FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

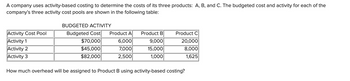

Transcribed Image Text:A company uses activity-based costing to determine the costs of its three products: A, B, and C. The budgeted cost and activity for each of the

company's three activity cost pools are shown in the following table:

BUDGETED ACTIVITY

Budgeted Cost Product A

$70,000

$45,000

$82,000

Activity Cost Pool

Activity 1

Activity 2

Activity 3

How much overhead will be assigned to Product B using activity-based costing?

Product B

9,000

15,000

1,000

6,000

7,000

2,500

Product C

20,000

8,000

1,625

Transcribed Image Text:Multiple Choice

$56,500

$78,000

$62,500

$197,000

$70,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- iiarrow_forwardThe following information is departmental cost allocation with two service departments and two production departments. Department Cost Percentage Service Provided to S1 S2 P1 P2 Service 1 (S1) $ 32,000 0% 25% 30% 45% Service 2 (S2) 23,000 20 0 20 60 Production 1 (P1) 130,000 Production 2 (P2) 180,000 What is the total cost in P1 and P2 and what is the amount of service department cost allocated to P1 and P2 using the step method with S1 going first? The following information relates to a joint production process for three products, with a total joint production cost of $165,000. There are no separable processing costs for any of the three products. Product Sales Value at Split-Off Units at Split-Off 1 $ 181,500 320 2 99,000 960 3 49,500 1,920 $ 330,000 3,200 What percentage of joint cost is allocated to each of the three products using the sales value at split-off method? Do not give answer in imagearrow_forwardAyala Inc. has conducted the following analysis related to its product lines, using a traditional costing system (volume-based) and an activity-based costing system. Both the traditional and the activity-based costing systems include direct materials and direct labor costs. Products Product 540X Product 137Y Product 2495 Sales Revenue $208,000 155,000 92.000 Total Costs Traditional $54,000 48,000 23.000 ABC $49,000 30,000 46,000arrow_forward

- The following information is departmental cost allocation with two service departments and two production departments. Percentage Service Provided to Department Cost S1 S2 P1 P2 Service 1 (S1) $ 40,000 0 % 40 % 30 % 30 % Service 2 (S2) 30,000 25 0 45 30 Production 1 (P1) 200,000 Production 2 (P2) 250,000 What is the total cost in P1 and P2 and what is the amount of service department cost allocated to P1 and P2 using the step method with S1 going first?arrow_forwardComparison of Methods of Allocation Duweynie Pottery, Inc., is divided into two operating divisions: Pottery and Retail. The company allocates Power and General Factory department costs to each operating division. Power costs are allocated on the basis of the number of machine hours and general factory costs on the basis of square footage. No effort is made to separate fixed and variable costs; however, only budgeted costs are allocated. Allocations for the coming year are based on the following data: Use the rounded values for subsequent calculations. Support Departments Operating Divisions Power General Factory Pottery Retail Overhead costs $140,400 $190,800 $96,000 $56,000 Machine hours 2,000 2,500 7,000 3,000 Square footage 2,500 1,700 4,000 6,000 Round all allocation ratios to four significant digits. Round all allocated amounts to the nearest dollar. Required: 3. Allocate the support service costs using the reciprocal method. Note: If…arrow_forwardA company has two products: A and B. It uses activity-based costing and has prepared the following analysis showing budgeted cost and activity for each of its three activity cost pools: Activity Cost Pool Activity 1 3,000 2,800 Activity 2 4,500 5,500 Activity 3 2,500 5,250 Annual production and sales level of Product A is 34,300 units, and the annual production and sales level of Product B is 69,550 units. What is the approximate overhead cost per unit of Product B under activity-based costing? O $10.28 O $3.00 $2.33 $2.00 O $15.00 Budgeted Activity Budgeted Cost $87,000 $62,000 $93,000 Product A Product Barrow_forward

- Zachary Manufacturing Company established the following standard price and cost data. Sales price $ 8.60 per unit Variable manufacturing cost 4.00 per unit Fixed manufacturing cost 2,900 total Fixed selling and administrative cost 800 total Zachary planned to produce and sell 2,100 units. Actual production and sales amounted to 2,300 units. Required Prepare the pro forma income statement in contribution format that would appear in a master budget. Prepare the pro forma income statement in contribution format that would appear in a flexible budget. Prepare the pro forma income statement in contribution format that would appear in a master budget. ZACHARY MANUFACTURING COMPANY Pro Forma Income Statement Master Budget 0 $0 Prepare the pro forma income statement in contribution format that would appear in a flexible budget.…arrow_forwardRequired information Dierich Company uses an activity-based costing system with three activity cost pools. The company has provided the following data concerning its costs and its activity-based costing system: Costs: Manufacturing overhead Selling and administrative expenses Total Distribution of Resource Consumption: Manufacturing overhead Selling and administrative expenses Order Size 15% 60% Activity Cost Pools Other Customer Support 75% 20% 10% 20% $600,000 220.000 $820,000 Total 100% 100% D The "Other" activity cost pool consists of the costs of idle capacity and organization-sustaining costs. You have been asked to complete the first-stage allocation of costs to the activity cost pools.arrow_forwardSwanson Manufacturing uses activity-based management to analyze the cost of non-value-added activities across its value chain. The company's annual budgeted costs in its Human Resources Department (HR) total $5 million. This amount is allocated to 3 cost pools, as follows: (1) 20% to Hiring & Recruiting; (2) 50% to Payroll; and (3) 30% to Employee Benefits. There are 3 activity cost drivers associated with HR's 3 cost pools: (1) travel; (2) information processing; and (3) professional development. These activities drive each of HR's cost pool amounts as follows: Hiring & Recruiting Cost Pool Drivers -- 70% travel activities -- 12% information processing activities -- 18% professional development activities Payroll Cost Pool Drivers -- 10% travel activities -- 65% information processing activities -- 25% professional development activities Employee Benefits Cost Pool Drivers -- 10% travel activities -- 30% information processing activities -- 60% professional development…arrow_forward

- manufacturer of industrial equipment has a standard costing system based on standard direct labor-hours (DLHs) as the measure of activity. Data from the company's flexible budget for manufacturin overhead are given below: Level of activity Overhead costs at the denominator activity level: Variable overhead cost Fixed overhead cost The following data pertain to operations for the most recent period: Actual hours Standard hours allowed for the actual output Actual total variable manufacturing overhead cost Actual total fixed manufacturing overhead cost 2,550 DLHs $ 8,600 $ 35,125 2,700 DLHs 2,597 DLHs $ 9,200 $ 35,525 How much overhead was applied to products during the period to the nearest dollar? Note: Do not round Intermediate calculations. Multiple Cholce $44.125 $43.725 $44.725 $44.531 $44.725arrow_forwardBanks Corporation has the following information for direct materials for the latest period. BANKS CORPORATION INFORMATION FOR DIRECT MATERIALS FOR THE LATEST PERIOD Standard price per unit of direct materials Actual price per unit of direct materials Budgeted units of output Standard quantity of direct materials allowed per unit of output Actual units of direct materials used Actual units of direct materials purchased Actual units of output produced SA SA 15.00 $ 16.50 45,000 3 units 40,000 50,000 14,000 The company calculates its price variance based on quantity purchased. What is the direct materials price variance? $60,000 favorable. $60,000 unfavorable.arrow_forwardBanks Corporation has the following information for direct materials for the latest period. BANKS CORPORATION INFORMATION FOR DIRECT MATERIALS FOR THE LATEST PERIOD Standard price per unit of direct materials Actual price per unit of direct materials Budgeted units of output Standard quantity of direct materials allowed per unit of output Actual units of direct materials used Actual units of direct materials purchased Actual units of output produced SA SA $ 15.00 $ 16.50 45,000 3 units 40,000 50,000 14,000 The company calculates its price variance based on quantity purchased. What was the total quantity of direct materials allowed based on the standards? 45,000. 50,000.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education