FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

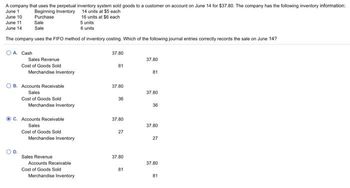

Question

Transcribed Image Text:A company that uses the perpetual inventory system sold goods to a customer on account on June 14 for $37.80. The company has the following inventory information:

June 1

14 units at $5 each

Beginning Inventory

June 10

Purchase

16 units at $6 each

5 units

June 11

June 14

Sale

Sale

6 units

The company uses the FIFO method of inventory costing. Which of the following journal entries correctly records the sale on June 14?

OA. Cash

Sales Revenue

Cost of Goods Sold

Merchandise Inventory

OB. Accounts Receivable

Sales

Cost of Goods Sold

Merchandise Inventory

C. Accounts Receivable

Sales

Cost of Goods Sold

Merchandise Inventory

Sales Revenue

Accounts Receivable

Cost of Goods Sold

Merchandise Inventory

37.80

81

37.80

36

37.80

27

37.80

81

37.80

81

37.80

36

37.80

27

37.80

81

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Salmone Company reported the following purchases and sales of its only product. Salmone uses a perpetual inventory system. Determine the cost assigned to cost of goods sold using FIFO. Date Activities Units Acquired at Cost Units Sold at Retail May 1 Beginning inventory 156 units @ $10 = $1,560 May 5 Purchase 226 units @$12 = $2,712 May 10 Sales 146 units @ $20 May 15 Purchase 106 units @$13 = $1,378 May 24 Sales 96 units @ $21arrow_forwardUsing the following data taken for a business with a periodic inventory system. Merchandise Inventory August 1 $ 96,990 Merchandise Inventory August 31 102,550 Purchases 267,010 Purchases Returns and Allowances 10,560 Purchases Discounts 6,300 Freight In 4,620 Determine the cost of merchandise sold for August.arrow_forwardJournalize the following transactions for Allen Company using the gross method of accounting for sales discounts. Assume a perpetual inventory system. Also, assume a constant gross profit ratio for all items sold. Make sure to enter the day for each separate transaction. September 5 September 11 September 15 Date Sold goods costing $3,720 to Walker Company on account, $6,200, terms 4/10, n/30. Walker Company was granted an allowance of $1,550 for returned merchandise that was previously purchased on account. The returned goods are in perfect condition. Received the amount due from Walker Company. Account Title Debit Creditarrow_forward

- Prepare journal entries to record each of the following sales transactions of a merchandising company. The company uses a perpetual inventory system and the gross method. Apr. 1 Sold merchandise for $6,000, with credit terms n/30; invoice dated April 1. The cost of the merchandise is $3,600. Apr. 4 The customer in the April 1 sale returned $680 of merchandise for full credit. The merchandise, which had cost $408, is returned to inventory. Apr. 8 Sold merchandise for $2,500, with credit terms of 1/10, n/30; invoice dated April 8. Cost of the merchandise is $1,750. Apr. 11 Received payment for the amount due from the April 1 sale less the return on April 4.arrow_forwardPlease help mearrow_forwardJournalize the following transactions assuming the company uses a perpetual inventory system: July 3. Sold merchandise on account for $3,750 terms n/eom. The cost of the goods sold was $2,000. 5. Issued a credit memo for $1,050 for merchandise returned from the sale on July 3. The cost of the merchandise returned was $610. 12. Received payment on account for the amount due on the sale of July 3, less the return of July 5. 17. Sold merchandise for $7,000 plus 6% sales tax to cash customers. The cost of the goods sold was $3,830.arrow_forward

- Montoure Company uses a periodic inventory system. It entered into the following calendar-year purchases and sales transactions. Units Sold at Retail Units Acquired at Cost @$45 per unit $42 per unit @ $27 per unit Date January 1 February 10 March 13 March 15 August 21 Septeber 5 September 10 Activities Beginning inventory Purchase Purchase Sales Purchase Purchase Sales Totals Cost of goods available for sale Number of units available for sale Ending inventory Required: 1. Compute cost of goods available for sale and the number of units available for sale. (a) FIFO (b) LIFO (c) Weighted average (d) Specific identification 2. Compute the number of units in ending inventory. $ Sales Less: Cost of goods sold Gross profit 1,400 units Ending Inventory $ $ S O Weighted Average O Specific Identification O LIFO O FIFO 600 units 400 units 200 units 100 units 500 units 9,800 7,600 1,800 units 3. Compute the cost assigned to ending inventory using (a) FIFO, (b) LIFO, (c) weighted average, and (d)…arrow_forwardThe accounting records of Kingbird Electronics show the following data. Beginning inventory Purchases Sales 3,060 units at $7 7,140 units at $9. 8,590 units at $12 Determine cost of goods sold during the period under a periodic inventory system using (a) the FIFO method, (b) the LIFO method, and (c) the average-cost method. Cost of goods sold FIFO SA $ LIFO $ Average-cost $arrow_forwardThe following data has been provided by Lee Company regarding its inventory purchases and sales throughout the year. Transaction Units Cost per Unit January 1 Balance 185 $86 March 14 Sale 54 May 23 Purchase 136 90 August 21 Sale 100 November 5 Purchase 171 91 November 18 Sale 100 November 30 Sale 100 December 5 Sale 100 December 10 Purchase 25 95 Required: Compute the cost of goods sold and ending inventory using the perpetual inventory system for the LIFO cost flow assumption. Ending inventory Cost of goods soldarrow_forward

- Prepare journal entries to record each of the following transactions. The company records purchases using the gross method and a perpetual inventory system. August 1 Purchased merchandise with an invoice price of $117,000 and credit terms of 3/10, n/30. August 11 Paid supplier the amount owed from the August 1 purchase. View transaction list Journal entry worksheet 1 2 Purchased merchandise with an invoice price of $117,000 and credit terms of 3/10, n/30. Note: Enter debits before credits. Date General Journal Debit Credit Aug 01 Record entry Clear entry View generaarrow_forwardSome of the transactions of Torres Company during August are listed below. Torres uses the periodic inventory method. August 10 Purchased merchandise on account, $12,000, terms 2/10, n/30. 13 Returned part of the purchase of August 10, $1,200, and received credit on account. 15 Purchased merchandise on account, $16,000, terms 1/10, n/60. 25 Purchased merchandise on account, $20,000, terms 2/10, n/30. 28 Paid invoice of August 15 in full. Instructions a. Assuming that purchases are recorded at gross amounts and that discounts are to be recorded when taken: 1. Prepare general journal entries to record the transactions. 2. Describe how the various items would be shown in the financial statements. b. Assuming that purchases are recorded at net amounts and that discounts lost are treated as financial expenses: 1. Prepare general journal entries to enter the transactions. 2. Prepare the adjusting entry necessary on August 31 if financial statements…arrow_forwardLaker Company reported the following January purchases and sales data for its only product. The Company uses a perpetual inventory system. Required: 2. Determine the cost assigned to ending inventory and to cost of goods sold using weighted average. Date Activities Units Acquired at Cost Units Cost per unit Total cost Units Units Sold at Retail Selling price per Total Sales January 01 Beginning inventory 205 $13.00 $2,665.00 January 10 January 20 January 25 Sales Purchase Sales 165 $22 $3,630.00 140 $12.00 $1,680.00 145 $22 $3,190.00 January 30 310 $11.50 655 Purchase Totals Notice that cost of goods sold, $3,917.22, plus ending inventory, $3,992.78, equals cost of goods available for sale, $7,910.00. Weighted Average Cost of Goods Sold $3,565.00 $7,910.00 310 $6,820.00 Inventory Balance Units Date Activities Cost per unit Cost of goods sold Units Cost per Total Cost January 01 Beginning inventory 205 unit $13.00 $2,665.00 January 10 Sales 165 $13.000 $2,145.00 40 $13.00 $520.00…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education