FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

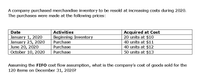

Transcribed Image Text:A company purchased merchandise inventory to be resold at increasing costs during 2020.

The purchases were made at the following prices:

Acquired at Cost

20 units at $10

40 units at $11

40 units at $12

50 units at $13

Date

Activities

January 1, 2020

January 25, 2020

June 20, 2020

October 10, 2020

Beginning Inventory

Purchase

Purchase

Purchase

Assuming the FIFO cost flow assumption, what is the company's cost of goods sold for the

120 items on December 31, 2020?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- On January 1, 2024, HGC Camera Store adopted the dollar-value LIFO retail inventory method. Inventory transactions at both cost and retail, and cost indexes for 2024 and 2025 are as follows: Beginning inventory Net purchases Freight-in Net markups Net markdowns Net sales to customers Sales to employees (net of 20% discount) Price Index: January 1, 2024 December 31, 2024 December 31, 2025 Estimated ending inventory at retail Estimated ending inventory at cost Estimated cost of goods sold 2024 2024 Cost $ 48,000 103,040 3,200 Retail $ 64,000 120,000 2025 16,000 3,200 117,850 3,800 Cost 2025 $ 115,150 3,700 Retail Required: Estimate the 2024 and 2025 ending inventory and cost of goods sold using the dollar-value LIFO retail inventory method. Note: Do not round other intermediate calculations. Round your cost-to-retail percentage calculation to 2 decimal places and final answers to the nearest whole dollar. $ 133,000 10,400 3,400 119,440 5,920 1.00 1.06 1.12arrow_forwardUMET's Stores had the following inventory transactions in 2020: Transaction Units Cost per unit 1/1 Balance 50 $6 2/14 Sale 25 5/23 Purchase 100 8 8/21 Sale 50 11/5 Purchase 25 12 11/18 Sale 95 Required: Compute tge cost of goods sold and the ending inventory using the periodic inventory system for each of the following cost flow assumptions: a. FIFO b. LIFO c. Weighted averagearrow_forwardOn January 1, 2024, HGC Camera Store adopted the dollar-value LIFO retail inventory method. Inventory transactions at both cost and retail, and cost indexes for 2024 and 2025 are as follows: Beginning inventory Net purchases Freight-in Net markups Net markdowns Net sales to customers Sales to employees (net of 20 % discount) Price Index: January 1, 2024 December 31, 2024 December 31, 2025 Estimated ending inventory at retail Estimated ending inventory at cost Estimated cost of goods sold 2024 2024 Cost $ 56,000 104,000 4,000 Retail $ 80,000 128,000 2025 20,000 4,000 129,465 2,700 Cost 2025 $ 109,695 4,500 Required: Estimate the 2024 and 2025 ending inventory and cost of goods sold using the dollar-value LIFO retail inventory method. Note: Do not round other intermediate calculations. Round your cost-to-retail percentage calculation to 2 decimal places and final answers to the nearest whole dollar. Retail $ 134,200 12,000 4,200 121,260 4,400 1.00 1.06 1.12arrow_forward

- Manjiarrow_forwardView Policies Current Attempt in Progress Whispering Inc. uses LIFO inventory costing. At January 1, 2025, inventory was $211,879 at both cost and market value. At Decembe 31, 2025, the inventory was $287,291 at cost and $270,300 at market value. Prepare the necessary December 31 entry under (a) the cost-of-goods-sold method and (b) the loss method. (List all debit entries before credit entries. Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No entry" for the account titles and enter O for the amounts.) No. Account Titles and Explanation (a) (b) List of Accounts Save for Later O Search Debit co DELL Attempts: 0 of 15 used M Credit 1 Submit Answerarrow_forwardAL LUSE AL RELdi Beginning inventory Net purchases $127, 600 231,240 $256, 800 393, 600 Assume that in addition to estimating its ending Inventory by the retall method, Harmony Co. also took a physical Iinventory at the marked selling prices of the Inventory Items at the end of 2020. Assume further that the total of this physical Inventory at marked selling prices was $109,200. a. Determine the amount of this Inventory at cost. (Round your intermedlete calculatlons and final answer to 2 decimal places.) Inventory at cost b. Determine Harmony's 2020 Inventory shrinkage from breakage, theft, or other causes at retall and at cost. (Round your Intermedlate calculatlons and final answers to 2 decimal places.) At Cost At Retail Estimated inventory that should have been on hand Physical inventory Inventory shrinkagearrow_forward

- The following inventory transactions took place for Sunland Ltd. for the year ended December 31, 2023: Date Jan 1 Jan 5 Feb 15 Mar 10 May 20 Aug 22 Sep 12 Nov 24 Dec 5 beginning inventory sale purchase purchase sale Event purchase sale purchase sale Ending inventory Unit cost of the last item sold $ CA $ Quantity 24,300 LA 6,200 32,200 9,200 40,900 14,800 20,350 9,800 17,300 Cost/ Selling Price $47.00 77.00 38.25 45.00 Calculate the ending inventory balance for Sunland Ltd., assuming the company uses a perpetual inventory system and the first-in, first-out cost formula. Also calculate the per-unit cost of the last item sold. (Round unit costs to 2 decimal places, e.g. 52.75 and ending inventory to O decimal places, e.g. 5,276.) 77.00 42.50 77.00 57.00 77.00arrow_forwardHansabenarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education