FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

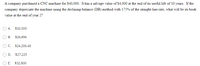

Transcribed Image Text:A company purchased a CNC machine for $40,000. It has a salvage value of $4,000 at the end of its useful life of 10 years. If the

company depreciate the machine using the declining-balance (DB) method with 175% of the straight-line rate, what will be its book

value at the end of year 2?

A.

$32,333

B. $26,896

O C. $24,206.40

D.

$27,225

E.

$32,800

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- A certain office equipment has a first cost of P 20,000 and a salvage value of P 1,000 at the end of 10 years. Determine its book value at the end of 6 years using Straight-line Method. 8,600.00 3,311.00 1,657.38 9,280.00 11,400.00 1,000.00arrow_forwardSpeedbag, Incorporated purchased equipment at a cost of $60,000 on July 1, 2023. The expected useful life is 4 years and the asset is expected to have salvage value of $10,000. Speedbag depreciates its assets using the straight-line method. What is the accumulated depreciation for this asset on December 31, 2024? Multiple Choice $30,000 $12,500 $25,000 $18,750arrow_forwardChandler Company purchased a factory machinery on May 1, 2030 for $133,500 with an estimated 5- year life. It is estimated that the machinery will have a $22,000 salvage value. What is the amount of depreciation expense at December 31, 2030 using the straight-line method of depreciation? O $26,700 O $20,733 O $22,300 O $14,867 O $17,800arrow_forward

- A man bought an equipment which cost P524.000.00. Freight and installation expenses cost him P31,000.00. If the life of the equipment is 15 years with an estimated salvage value of P 120,000.00, find its book value after 8 years. Ans. P323,000.00.Show the step by step solution and explanation.arrow_forwardMango Company purchased equipment for $100,000 and assigned it an estimated salvage value of $10,000 and a useful life of 10 years. After two years of using the double-declining balance method for depreciation, the company decided to switch to the straight-line method. The company also revised the equipment's remaining useful life to 6 years. What is the depreciation expense for the equipment for the third year? Answer a. $12,000 b. $9,000 c. $11,500 d. $13,500arrow_forwardAn asset was purchased three years ago at a cost of P5,000. It was estimated to have a useful life of 8 years with a salvage value of P250 at the end of the time. It is now of no future use and can be sold for only P720. a. Straight-line method b. Sum-of-the-Years'-Digits (SYD) Methodarrow_forward

- Mohr Company purchases a machine at the beginning of the year at a cost of $31,000. The machine is depreciated using the straight-line method. The machine's useful life is estimated to be 5 years with a $4,000 salvage value. The book value of the machine at the end of year 2 is: Multiple Choice $5,400. $10,800. $16,200. $20,200.arrow_forwardXYZ bought an asset that cost $200,000 at the beginning of the year. It has a salvage value of $30,000. The useful life of the asset is 10 years. How much will the company's total depreciation expense be over the asset's 10 year life? Group of answer choices $200,000 $170,000 $30,000 $20,000arrow_forwardEquipment costing $80000 with a salvage value of $11000 and an estimated life of 8 years has been depreciated using the straight-line method for 2 years. Assuming a revised estimated total life of 5 years and no change in the salvage value, the depreciation expense for year 3 would be O $20917. O $17250. O $10350. O $14450.arrow_forward

- An equipment was bought at 600,000 JD. The life time of the equipment is 10 years at the end of which its salvage value is 10,000 JD. The depreciation rate using the straight line method is A. 10,000 JD B. 59,000 JD/year C. 59,000 JD D. 60,000 JD/yeararrow_forward2arrow_forwardAn asset cost $200,000. It has a salvage value of $40,000. It has a 10 year life. What is its depreciation expense if the company uses straight-line depreciation? Group of answer choices $200,000 $160,000 $20,000 $16,000arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education