FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

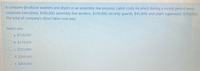

Transcribed Image Text:A company produces washers and dryers in an assembly-line process. Labor costs incurred during a recent period were:

corporate executives, $500,000; assembly-line workers, $209,000; security guards, $45,000; and plant supervisor, $110,000.

The total of company's direct labor cost was:

Select one:

O a. $754,000

O b. $319,000

O c. $203,000

O d. $209,000

O e. $864,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- A company used $35,000 of direct materials, incurred $73,000 in direct labor cost, and had $114,000 in factory overhead costs during the period. If beginning and ending work in process inventories were $28,000 and $32,000, respectively, the cost of goods manufactured was a.$226,000 b.$218,000 c.$222,000 d.$190,000arrow_forwardSelected data for Lemon Grass, Inc. for the year are provided below: Factory Utilities $2,100 Indirect Materials Used 32,500 Direct Materials Used 309,000 Property Taxes on Factory Building 5,400 Sales Commissions 83,000 Indirect Labor Incurred 20,000 Direct Labor Incurred 145,000 Depreciation on Factory Equipment 6,800 What is the total manufacturing overhead? A. $52,500 B. $14,300 C. $454,000 D.arrow_forwardBell Corporation manufactures computers. Assume that Bell: • allocates manufacturing overhead based on machine hours • estimated 8,000 machine hours and $86,000 of manufacturing overhead costs actually used 16,000 machine hours and incurred the following actual costs: (Click the icon to view the actual costs.) What is Bellredetermined overhead allocation rate? ● O A. $5.31/ machine hour B. $5.38/ machine hour C. $10.75/ machine hour O D. $10.63/ machine hour Data table Indirect labor Depreciation on plant Machinery repair Direct labor Plant supplies Plant utilities Advertising Sales commissions $ 12,000 49,000 12,000 71,000 3,000 9,000 34,000 27,000arrow_forward

- Gell Corporation manufactures computers. Assume that Gell: • allocates manufacturing overhead based on machine hours • estimated 12,000 machine hours and $93,000 of manufacturing overhead costs • actually used 16,000 machine hours and incurred the following actual costs: What is Gell’s actual manufacturing overhead cost? a. $158,000 b. $83,000 c. $145,000 d. $220,000arrow_forwardA-6arrow_forward3arrow_forward

- Presented below are certain operating data for the four departments of Tally Manufacturing Company. Service Production 1 2 1 2 Total manufacturing overhead costs either identifiable with or allocated to each department $72,000 $86,400 $108,000 $117,600 Square feet of factory floor space 48,000 96,000 Number of factory workers 110 70 Planned direct labor hours for the year 24,000 36,000 Allocate, to the two production departments, the costs of service departments 1 and 2, using factory floor space and number of workers, respectively, as bases. Do not round bases when calculating reallocations of service departments. Production 1 2 Identifiable and allocated overhead Answer Answer Reallocation of service departments: Dept. 1 Factory floor space Answer Answer Dept. 2 Number of factory workers Answer Answer Total manufacturing overhead Answer Answer What is the apparent…arrow_forwardABC Co. produces washers and dryers in an assembly-line process. Labor costs incurred during a recent period were: corporate executives, $500,000; assembly-line workers, $180,000; security guards, $45,000; and plant supervisor, $110,000. The total of ABC’s direct labor cost was: a. $235,000 b. $110,000 c. $155,000 d. $180,000arrow_forwardBell Corporation manufactures computers. Assume that Bell: • allocates manufacturing overhead based on machine hours. • estimated 12,000 machine hours and $93,000 of manufacturing overhead costs. The predetermined overhead rate is $7.75 per machine hour. • actually used 15,000 machine hours and incurred the following actual costs: Indirect labor $14,000 Depreciation on plant 49,000 Machinery repair 17,000 Direct labor 75,000 Plant supplies 5,000 Plant utilities 10,000 Advertising 33,000 Sales commissions 23,000 How much manufacturing overhead would Bell allocate?arrow_forward

- Zap Construction manufactures extension ladders. Information for the year related to the company appears below. The company allocates overhead based on machine hours. Based on the information below, how much overhead was applied to products during the year? Total manufacturing overhead cost Machine hours O $550,000 $720.000 O $490,000 O $480,000 Estimated Actual $500,000 $480,000 100,000 110,000arrow_forwardWilmington Company has two manufacturing departments--Assembly and Fabrication. It considers all of its manufacturing overhead costs to be fixed costs. The first set of data that is shown below is based on estimates from the beginning of the year. The second set of data relates to one particular job completed during the year-Job Bravo. Estimated Data Manufacturing overhead costs Direct labor-hours Machine-hours Job Bravo Direct labor-hours Machine-hours Assembly $1,400,000 70,000 28,000 Assembly Fabrication 15 7 7 10 Fabrication Total $1,680,000 $3,080,000 Total 22 17 42,000 140,000 112,000 168,000 Required: 1. If Wilmington used a plantwide predetermined overhead rate based on direct labor-hours, how much manufacturing overhead would be applied to Job Bravo? 2. If Wilmington uses departmental predetermined overhead rates with direct labor-hours as the allocation base in Assembly and machine-hours as the allocation base in Fabrication, how much manufacturing overhead would be applied…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education