FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

A-3

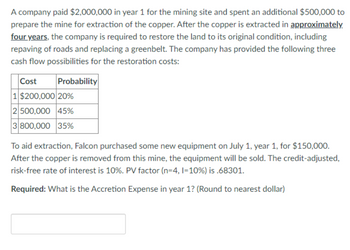

Transcribed Image Text:A company paid $2,000,000 in year 1 for the mining site and spent an additional $500,000 to

prepare the mine for extraction of the copper. After the copper is extracted in approximately

four years, the company is required to restore the land to its original condition, including

repaving of roads and replacing a greenbelt. The company has provided the following three

cash flow possibilities for the restoration costs:

Cost Probability

1 $200,000 20%

2 500,000 45%

3 800,000 35%

To aid extraction, Falcon purchased some new equipment on July 1, year 1, for $150,000.

After the copper is removed from this mine, the equipment will be sold. The credit-adjusted,

risk-free rate of interest is 10%. PV factor (n=4, 1=10%) is .68301.

Required: What is the Accretion Expense in year 1? (Round to nearest dollar)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- A7 please help[.....arrow_forward102. Four capacitors C1-1uF, C2=2uF, C3=3uF and C4-4uF are connected as given in figure. The potential of junction O is A. 16.5 V B. 18 V C. 15.5 V D. 18.5 V 10 V 5V C₁ # H C3+ CA 20 V 30 Varrow_forward18 pts Multiple Functions 88 MULTIPLE CHOICE Question 2 ◄ Listen When f(x)=-3x-6 and g(x) = x²-x-6, what is ? A B C f 54 g = 3 fg = -3 x-3x=3 f 51 g = -2x+2; x=1arrow_forward

- Question 4 Listen Which of the following points are on the unit circle? Select all that apply. A (--) B (33.3) C 12 (1/13. 31/3)arrow_forwardUse the following information to solve for both the levered and unleved NPV & IRR.. Please note: mortgage and income numbers are to be annual numbers, not monthly. Potential Investment Purchase Price: $700,000.00 Years: 30 LTV: 80.0% Rate: 7.0% PAID ANNUALLY Origination Expenses: 3.0% of the loan amount NOI $75,000.00 Per Year Required Return Levered: Required Return Un-Levered: Expected Price Appreciation: Selling expenses: 13.0% 10.0% 4.0% Years 5.0% of the sale price Expected holding period: 2 Years Workspace:arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education