FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

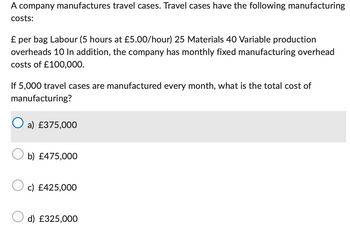

Transcribed Image Text:A company manufactures travel cases. Travel cases have the following manufacturing

costs:

£ per bag Labour (5 hours at £5.00/hour) 25 Materials 40 Variable production

overheads 10 In addition, the company has monthly fixed manufacturing overhead

costs of £100,000.

If 5,000 travel cases are manufactured every month, what is the total cost of

manufacturing?

a) £375,000

b) £475,000

c) £425,000

d) £325,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Similar questions

- Fantastic Plastics manufactures plastic bottles that are used by other companies for packaging. The have four operating machines in the factory that operate at 80% capacity. One machine can produce 10 000 plastic bottles per month at full capacity. There are four weeks in a month and all bottles are sold in the month of manufacture. Bottles are sold at R5 each. The following costs are incurred on a monthly basis in the manufacturing of plastic bottles. Plastic purchased per week. R8 000. Wages of machine operators R2 000 per week. There are four operators on duty at any time. Monthly salary of factory supervisor R20 000. Deprecation of machines R6 000 per machine per annum. Water and electricity of R12 000 per month. Must be apportioned according to floor space. (Factory takes up 80% of total floor space). Q1)Calculate the variable cost per unit manufactured and the fixed cost per month.arrow_forwardA manufacturing company has to produce and sell 229 items every month to break even. The company's fixed costs are $2,281.50 per month and variable costs are $12.00 per item. a. What is the total revenue at the break-even point? Round to the nearest cent b. What is the selling price per item? Round to the nearest centarrow_forwardMango Ltd produces several types of skin cream. You have been provided with the following expected average weekly information for June. £ £ Sales 33,000 Ingredients 6,050 Staff 11,550 Electricity 3,100 Factory rent 3,600 (24,300) Profit 8,700 The average skin cream sells for £6 per unit. All costs are variable costs except for electricity costs which are semi-variable with a fixed element of £2,000 per week and factory rent, which is fixed. In July, the average selling price per skin cream is expected to stay the same as June, but the sales volume is expected to be 15% higher than June. Contribution in July is expected to be £2.40 per skin cream and fixed costs are expected to total £5,700. In August, Mango Ltd considers selling some of the skin creams in smaller portions called mini-pots, in addition to the usual skin creams. It estimates that 1,200 mini-pots could be sold each week at £3 per mini-pot. The variable cost of each mini-pot would be £1.40. Incremental fixed costs per week…arrow_forward

- A company has monthly fixed costs of $36,000. The variable costs are $2.50 per unit. If the sales price of a unit is $12.00 and we produce and sell 8,000 units, the company's unit contribution margin will be $ 5.60 per unit. O $ 8.25 per unit. $ 9.50 per unit. O $7.00 per unit. O $ 2.50 per unit.Oarrow_forwardHead-First Company plans to sell 4,200 bicycle helmets at $67 each in the coming year. Product costs include: Direct materials per helmet $29 Direct labor per helmet 8.00 Variable factory overhead per helmet 5.00 Total fixed factory overhead 19,000 Variable selling expense is a commission of $4.00 per helmet, fixed selling and administrative expense totals $29,900. Required: 1. Calculate the total variable cost per unit 2. Calculate the total fixed expense for the year. 3. Prepare a contribution margin income statement for Head-First Company for the coming yeararrow_forwardXYZ Inc. needs 325 of a material per month. It costs OMR 100 to make and receive an orderand it takes 16 workdays to receive it. The annual holding cost is 35% of purchase price. The price OMR 2 per kg. The company is operating 6 days per weekWhat is the minimum annual total cost in OMR? Round up to the nearest integer : A. 8539 B. 9000 C. None is correct D. 8425 E. 8175arrow_forward

- Miller Company produces speakers for home stereo units. The speakers are sold to retail stores for £30. Variable costs per unit are: Direct materials £9.00; Direct labour 4.50; Distribution 1.50 and Variable Factory overhead 3.00. Fixed costs per month are: Factory overhead £120,000 and Selling and admin. 60,000. The variable distribution costs are for transportation to the retail stores. The current production and sales volume is 20,000 per year. Capacity is 25,000 units per year. An Atlanta wholesaler has proposed to place a special one-time order for 7,000 units at a special price of £25.20 per unit. The wholesaler would pay all distribution costs, but there would be additional fixed selling and administrative costs of £6,000. In addition, assume that overtime production is not possible and that allother information remains the same as the original data. The effect on profits if the special order is accepted is Select one: a. cannot be determined b. £30,900 decrease c. £50,100…arrow_forwardSimpkins Ltd is currently experiencing a shortage of skilled labour. In the coming quarter only 3,600 hours will be available for the production of the firm's three products for which details are shown below: Product X Y Selling price per unit Variable cost per unit Fixed cost per unit Skilled labour per unit £66 £100 £120 £42 £75 £90 £30 £34 £40 0.40 hours 0.50 hours 0.75 hours Maximum quarterly demand 5,000 5,000 2,000 The optimum production plan that will maximise profit for the quarter is: 0 X's (A) (В) (C) (D) 2,200 Y's and 5,000 X's 5,000 X's 3,200 Y's 9,000 X's 2,000 Z's 2,000 Z's 0 Z's 0 Z's 200 Y's and and O Y's andarrow_forwardSabre plc produces one product, the Delta. In one standard hour, 6 units of Delta should be made (i.e. one Delta every 10 minutes). Actual production for the period was 360 units. Actual hours worked to achieve this production amounted to 50 hours. The basic rate of pay is £14/hour. A bonus of 50% of the basic rate of pay is earned for every hour of production time saved. What is the labour cost for making 360 units of Delta? a) £840 b) £1,050 c) £770 d) £910arrow_forward

- 1.1 ) A steel bar manufacturer business can make 15000 bar a week. It is determined that to achieve this production, the company need to spend 90000 pesos weekly for materials, utilities and transportation. The manager also pays a fixed cost of 10000 pesos per week. HOW MUCH per steel bar should they sell to gain a profit of 40% of the total cost?arrow_forwardThe annual demand for a certain product is 11,340 units. The company informs you that every time an order is placed for this product the cost per order incurred is £100. You are also told that the cost of holding one unit fora year is £0.7. What is the economic order quantity of the product?arrow_forwardBang Inc has the following cost details: per kg. Material cost= 200 Direct labour= 40 Direct variable overhead= 20 Fixed production charges for the year on normal working capacity of 2 lakh kgs is 20 lakhs. 4,000 kgs of finished goods are in stock at the year end. Find Value of inventory per kg of finished goods.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education