Principles of Accounting Volume 1

19th Edition

ISBN: 9781947172685

Author: OpenStax

Publisher: OpenStax College

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

Account tutor help to solve this.

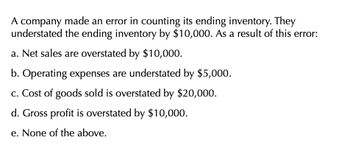

Transcribed Image Text:A company made an error in counting its ending inventory. They

understated the ending inventory by $10,000. As a result of this error:

a. Net sales are overstated by $10,000.

b. Operating expenses are understated by $5,000.

c. Cost of goods sold is overstated by $20,000.

d. Gross profit is overstated by $10,000.

e. None of the above.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Assuming a companys year-end inventory were overstated by $5,000, indicate the effect (overstated/understated/no effect) of the error on the following balance sheet and income statement accounts. A. Income Statement: Cost of Goods Sold B. Income Statement: Net Income C. Balance Sheet: Assets D. Balance Sheet: Liabilities E. Balance Sheet: Equityarrow_forwardIf Barcelona Companys ending inventory was actually $122,000, but the cost of consigned goods, with a cost value of $20,000 were accidentally included with the company assets, when making the year-end inventory adjustment, what would be the impact on the presentation of the balance sheet and income statement for the year that the error occurred, if any?arrow_forwardAssuming a companys year-end inventory were understated by $16,000, indicate the effect (overstated/understated/no effect) of the error on the following balance sheet and income statement accounts. A. Income Statement: Cost of Goods Sold B. Income Statement: Net Income C. Balance Sheet: Assets D. Balance Sheet: Liabilities E. Balance Sheet: Equityarrow_forward

- LO1 If the ending inventory is overstated by 10,000, indicate what, if anything, is incorrect about the following: Cost of goods sold___________ Gross profit___________ Net income___________ Ending owners capital___________arrow_forwardIf a group of inventory items costing $3,200 had been double counted during the year-end inventory count, what impact would the error have on the following inventory calculations? Indicate the effect (and amount) as either (a) none, (b) understated $______, or (c) overstated $______. Table 10.2arrow_forward(40) A company purchased inventory on account for $7,000. The inventory inspector at the company did not approve of the quality of the inventory and so returned it. What is the impact on the company's financial statements of the return of this inventory? Increase accounts payable by $7,000 O Decrease cost of goods sold by $7,000 Decrease inventory by $7,000 O Increase cost of goods sold by $7,000arrow_forward

- Ebbers Corporation overstated its ending inventory balance by $15,000 in the current year. What impact will this error have on cost of goods sold and gross profit in the current year and following year?arrow_forwardAssume that the ending inventory of a merchandising firm is overstated by $40,000. a. By how much and in what direction (overstated or understated) will the firms cost of goods be misstated? b. If this error is not corrected, what effect will it have on the subsequent period's operating income? c. If this error is not corrected, what effect will it have on the total operating income of the two periods (the period in which there is an error and the subsequent period) combined?arrow_forwardMerchandise inventory at the end of the year is overstated. Which of the following statements correctly states the effect of the error? Da. Gross profit is understated. Ob. Owner's equity is overstated. Oc. Net income is understated. Od. Cost of merchandise sold is overstated.arrow_forward

- Suppose Ajax Corporation overstates its ending inventory amount. What effect will this have on the reported amount of cost of goods sold in the year of the error? a. Overstate cost of goods sold.b. Understate cost of goods sold.c. Have no effect on cost of goods sold.d. Not possible to determine with information given.arrow_forwardIf ending inventory is understated by $25,000, what effect will this have on cost of goods sold and net income? a.Cost of goods sold is overstated by $25,000, and net income is understated by $25,000. b.Cost of goods sold is understated by $25,000, and net income is understated by $25,000. c.Cost of goods sold is understated by $25,000, and net income is overstated by $25,000. d.Cost of goods sold is overstated by $25,000, and net income is overstated by $25,000.arrow_forwardwhich of the three methods of costing-FIFO, LIFO, or average cost-will yield (a) cause an overstatement or an understatement of the gross profit for the year? (b) the highest inventory cost, (b) the lowest inventory cost, (c) the highest gross profit, 2. The inventory at the end of the year was understated by $12,750. (a) Did the error Which items on the balance sheet at the end of the year were overstated or understated Part One: Explanation and (d) the lowest gross profit? Show using example? as a result of the error? Show it numerically? 3. If ending inventory is misstated, it will not have an effect in the owners' equity of the following period. Why? 4. In periods of declining prices, which costing method are not preferable income tax purposes? Why? 5. Under what situation is the production method of depreciation appropriate? State and describe the drawback of the production method of depreciation? 6. Write the required data for preparing employee payroll?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

College Accounting, Chapters 1-27

Accounting

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:Cengage Learning,