FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

thumb_up100%

Did I do this question correctly? If not please show where I went wrong and how to fix it.

A company is taking bids on four construction jobs. Three contractors have placed bids on the jobs. Their bids (in thousands of dollars) are given in the file P05_52.xlsx. (A blank indicates that the contractor did not bid on the given job.) Contractor 2 can do only one job, but contractors 1 and 3 can each do up to two jobs. Determine the minimum cost assignment of contractors to jobs

(Note that the data from P05_52.xlsx is already in the excel sheet (B5:E7).

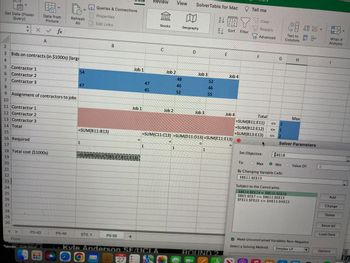

Transcribed Image Text:### Excel-Based Contractor and Job Assignment Solver

**Bids on Contracts (in $1000s)**

This section lists the bids from different contractors for four separate jobs. Each cell represents the bid amount a contractor would charge for a specific job.

| Contractor/Job | Job 1 | Job 2 | Job 3 | Job 4 |

|----------------|-------|-------|-------|-------|

| Contractor 1 | 54 | | 48 | 52 |

| Contractor 2 | 47 | | 46 | 55 |

| Contractor 3 | 47 | | 45 | |

**Assignment of Contractors to Jobs**

This allocation table uses binary values (1 and empty cells) to indicate whether a contractor is assigned to a particular job. A value of 1 means the contractor is assigned to the specified job.

| Contractor/Job | Job 1 | Job 2 | Job 3 | Job 4 | Total |

|----------------|-------|-------|-------|-------|-------|

| Contractor 1 | | | | | =SUM(B11:E11) |

| Contractor 2 | | | | | =SUM(B12:E12) |

| Contractor 3 | | | | | =SUM(B13:E13) |

**Constraints (Total Assignments)**

- Total contractors per job, as stipulated by "=SUM(B11:E11)"

- Constraint limit per contractor "=SUM(B11:E13)"

**Objective Function**

The total cost, defined by the formula:

```excel

=SUMPRODUCT(B5:E7, B11:E13)

```

This function multiplies each bid by its corresponding assignment and provides the total cost of assignments.

**Solver Parameters**

The Solver is set to minimize the total cost (`$B$18`) by adjusting the binary allocation matrix in `$B11:$E13`.

**Constraints:**

1. Contractors cannot be assigned more than twice (<= 2) as indicated in columns F and J.

2. Jobs must be assigned exactly once.

**Graphical and Visual Explanation**

- The blue-shaded cells indicate where bids are present and viable for consideration.

- The red-shaded area highlights the assignment matrix that the Solver will adjust to achieve the optimal cost solution.

By using Solver functionalities and correctly setting up the constraints and objective functions,

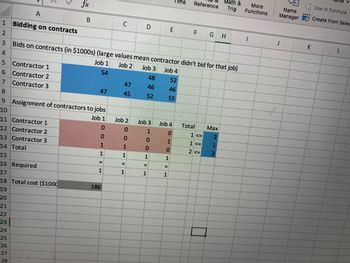

Transcribed Image Text:### Bidding on Contracts and Assignment of Contractors

#### Bids on Contracts (in $1000s)

- **Note:** Large values mean the contractor did not bid for that job.

| Contractor | Job 1 | Job 2 | Job 3 | Job 4 |

|--------------|-------|-------|-------|-------|

| Contractor 1 | 54 | 48 | 52 | |

| Contractor 2 | | 47 | 46 | |

| Contractor 3 | 47 | 45 | 52 | 55 |

#### Assignment of Contractors to Jobs

| Contractor | Job 1 | Job 2 | Job 3 | Job 4 | Total | Max |

|--------------|-------|-------|-------|-------|-------|-----|

| Contractor 1 | 0 | 0 | 1 | 0 | 1 | <= 2 |

| Contractor 2 | 0 | 1 | 0 | 0 | 1 | <= 1 |

| Contractor 3 | 1 | 0 | 0 | 1 | 2 | <= 2 |

#### Required Assignments

| | Job 1 | Job 2 | Job 3 | Job 4 |

|--------------|-------|-------|-------|-------|

| Required | 1 | 1 | 1 | 1 |

#### Total Cost ($1000s)

- **Total Cost:** 186

### Explanation of Graphs/Diagrams

This spreadsheet details the allocation of jobs to different contractors based on the bids they have placed.

1. **Bids on Contracts section (Rows 4-8):**

- It shows the bids of three contractors (Contractor 1, Contractor 2, and Contractor 3) for four jobs.

- For example, Contractor 1 bid $54,000 for Job 1, $48,000 for Job 2, $52,000 for Job 3, and did not place a bid for Job 4.

- If a contractor has not bid for a specific job, it is indicated by a large value or absence of a value.

2. **Assignment of Contractors to Jobs section (Rows 10-17):**

- This section shows

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Heidt Cleaning Services (HCS) is a local custodial service company serving both the residential and commercial markets. The owner is considering dropping the commercial clients because that business seems only marginally profitable. Twenty-five employees worked a total of 45,300 hours last year, 30,200 on commercial jobs and 15,100 on residential jobs. Wages were $20 per hour for all work done. Any materials used are included in overhead as supplies. All overhead is allocated on the basis of labor-hours worked, which is also the basis for customer charges. Given current economic conditions and competition, HCS bills residential clients $40 per hour and commercial clients $30 per hour. Required: If overhead for the year was $404,580, what were the profits of the residential and commercial services using labor-hours as the allocation base? Note: Do not round intermediate calculations. Round final answers to the nearest whole dollar. Overhead consists of costs of supervision,…arrow_forwardSmith Manufacturing Company allows employees to purchase materials, such as metal and limber, for personal use at a price equal to the company's cost. To purchase materials, an employee must complete a materials requisition form, which must then be approved by the employee's immediate supervisor. Brian, an assistant cost accountant, then charges the employee an amount based on Smith's net purchase cost. Brian is in the process of replacing a deck on his home and has requisitioned lumbar for personal use, which has been approved in accordance with company policy. In computing the cost of the lumber, Brian reviewed all the purchase invoices for the past year. He then used the lowest price to compute the amount due to the company for the lumber. The Institute of Management Accountants (IMA) is the professional organization for managerial accountants. The IMA has established four principles of ethical conduct for its members: Honesty Fairness Objectivity Responsibility These…arrow_forwardI need requirement A-C please.arrow_forward

- Harshman Company constructed a building for its own use. The company incurred costs of $45,000 for materials and supplies, $64,000 for direct labor, and $5,000 for a supervisor's overtime that was caused by the construction. Harshman uses a factory overhead rate of 50% of direct labor cost. Before construction, the company had received a bid of $159,000 from an outside contractor. 1. Assuming common practice is followed, at what value should Harshman capitalize the building? 2. The cost of the constructed asset will more closely approximate the cost of an equivalent purchased asset when the approach is used.arrow_forwardNeed help stuck on 2 questions.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education