ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

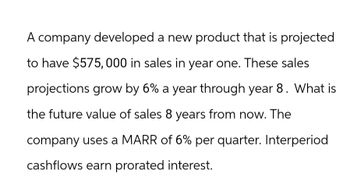

Transcribed Image Text:A company developed a new product that is projected

to have $575,000 in sales in year one. These sales

projections grow by 6% a year through year 8. What is

the future value of sales 8 years from now. The

company uses a MARR of 6% per quarter. Interperiod

cashflows earn prorated interest.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- A material supplier won a 7-year contract to supply a construction company with all their building materials needs. The contract is expected to generate a first-year profit of $12,000. This annual profit is expected to increase by $7,000 each successive year for the rest of the contract period. The profits will be invested in an account earning an interest rate of 12% per year. (a) Assuming that the profits are deposited in the account at the end of each year, how much money will be in the account immediately after the last deposit is made? (b) What is the equivalent uniform annual deposit? (a) The amount in the account immediately after the last deposit is $121068 (to the nearest dollar). (b) The equivalent uniform annual deposit is $12000 (to the nearest dollar)arrow_forwardWhat is the present worth of a $30000 bond that has an interest of 20% per year payable semiannually? The bond matures in 5 years. The interest rate in the marketplace is 9.64547563378% per year, compounded quarterly.arrow_forwardA series of 10 end of year deposits is made that begins with $6500 at the end of year 1 and decreases by $300 per year with 12% interest.what amount could be withdrawn at t=10?arrow_forward

- Find the future value of a $6500 investment for 275 days at 4.24% simple annual interest.arrow_forward1. Dave Grohl wants to buy drums and guitars. Drums are sold in an unusual way. There is only one supplier, and the more drums you buy from him, the higher the price you have to pay per unit. In fact, y units of drums will cost Dave y² dollars. Guitars are sold in the usual way at a price of 2 dollars per unit. Dave's income is 20 dollars, and his utility function is U (x,y) = x+2y, where x is his consumption of guitars and y is his consumption of drums. A. Sketch Dave's budget set and shade its in. B. Sketch some of his indifference curves and label the point that he chooses. C. Calculate the number of drums and guitars that Dave demands at these prices and this income.arrow_forwardConsider the following schedule of cash flows. If interest is 4% per year, compounded continuously, the equivalent value at year 5 is closest to . Cash Flows 1 $300 2 $280 3 $260 4 $240 5 $220arrow_forward

- A certain sum of money will be deposited in a savings account that pays interest at the rate of 6% per year, compounded annually. If all of the money is allowed to accumulate, how much must be deposited initially so that $5,000 will have accumulated after 10 yearsarrow_forwardQ1. Find the present worth in year o for the cash flows shown. Let -10 of per year.arrow_forwardWhat is the present value of $8000 paid at the end of each of the next 16 years if the interest nate is 9% per year?arrow_forward

- You plan to deposit $100 per week into a fund that pays interest of 6% per year, compounded quarterly. Identify the interest period, compounding period, and number of times interest is com-pounded per interest period. Additionally, include the cash flow diagram. Could I please get help with question without the use of excel.arrow_forwardCalculate the future value if present value (PV) = $1548, interest rate (r) = 9.0% and number of years (t) = 18arrow_forwardHi, what is the answer and how you got it? A recently hired chief executive officer wants to reduce future production costs to improve the company’s earnings, thereby increasing the value of the company’s stock. The plan is to invest $82,000 now and $52,000 in each of the next 4 years to improve productivity. By how much must annual costs decrease in years 5 through 15 to recover the investment plus a return of 12% per year? The annual cost decreases by $?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education