FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

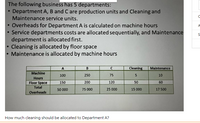

Transcribed Image Text:The following business has 5 departments:

Department A, B and C are production units and Cleaning and

Maintenance service units.

• Overheads for Department A is calculated on machine hours

• Service departments costs are allocated sequentially, and Maintenance

department is allocated first.

Cleaning is allocated by floor space

• Maintenance is allocated by machine hours

A

A

Cleaning

Malntenance

Machine

100

250

75

5

10

Hours

Floor Space

200

50

60

150

120

Total

50 000

75 000

25 000

15 000

17 500

Overheads

How much cleaning should be allocated to Department A?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Similar questions

- CengageNOWv2 | Online teachin x + A v2.cengagenow.com/ilrn/takeAssignment/takeAssignmentMain.do?invoker=&takeAssignmentSession. E * Ch 20.2 Cost of Units Transferred Out and Ending Work in Process The costs per equivalent unit of direct materials and conversion in the Filling Department of Ivy Cosmetics Company are $1.75 and $1.85, respectively. The equivalent units to be assigned costs are as follows: Equivalent Units Direct Materials Conversion Inventory in process, beginning of period 2,800 Started and completed during the period 46,000 46,000 Transferred out of Filling (completed) 46,000 48,800 Inventory in process, end of period 3,000 1,500 Total units to be assigned costs 49,000 50,300 The beginning work in process inventory had a cost of $1,570. Determine the cost of completed and transferred-out production and the ending work in process inventory. If required, round to the nearest dollar. Completed and transferred out of production Inventory in process, ending 8,025 Feedback V…arrow_forwardA ezto.mheducation.com Homework: Cost Management and Allocation Assignment Question 5 - Homework: Cost Management and Allocatic :Cost Management and Allocation Assignm... 6 Saved Help Caro Manufacturing has two production departments, Machining and Assembly, and two service departments, Maintenance and Cafeteria. Direct costs for each department and the proportion of service costs used by the various departments for the month of August follow: Proportion of Services Used by Direct Costs Department Machining Assembly Maintenance Cafeteria Maintenance Cafeteria Machining Assembly $120,000 76,000 54,000 37,000 0.2 0.6 0.2 0.7 0.2 0.1 Required: Use the step method to allocate the service costs, using the following: a. The order of allocation starts with Maintenance. b. The allocations are made in the reverse order (starting with Cafeteria). Complete this question by entering your answers in the tabs below. Required A Required B The order of allocation starts with Maintenance. (Negative…arrow_forwardQuestion 6.4 Krum Lawn Equipment has five departments, of which Casting and Finishing are producing departments. Maintenance, Product Movement, and Inspection are service departments. The distribution of the service departments is as follows: Service Costs Services provided to: Maint. Prod. Move. Insp. Cast. Finish. Maintenance $84,000 5% 25% 50% 20% Product movement 160,000 10% 5 45 40 Inspection 38,000 15 5 20 60 Required Use the direct method to allocate the service departments' costs. Prepare a schedule showing the total costs allocated to each…arrow_forward

- Please don't give solution in image format..arrow_forwardIdentify the following costs whether they are included in production costs or non-production costs or period costsarrow_forwardX 8 FILE Paste Clipboard C16 4 1. Assign indirect costs to products or services using activity based costing. & 14 HOME Calibri A Activity Cost Pool 5 Material Handling ▶ L= BIU INSERT ⠀ READY Attomatle) 3/2 6 Machine Set-Ups 7 Engineering Support 8 Power and Space 9 Total overhead cost $ 10 15 Activity Cost Pool 16 Material Handling 17 Machine Set-Ups 18 Engineering Support 19 Power and Space 20 Total Overhead Cost 21 22 DO Font Sheet1 11 PAGE LAYOUT B A A A. Overhead Cost $ 300,000 $ 210,000 fxx 710,000 + E Economy FORMULAS C Assigning indirect costs to products or services using activity based costing - Excel DATA REVIEW VIEW Wrap Text *Merge & Center - Alignment Deluxe D Overhead Assigned Using Activity Rates Activity Cost Driver 5,000 Material moves Set-ups Engineering hours $ 20,000 square feet. 11 Use formulas to assign overhead to each product using both activity rates and activity proportions (%). 12 Create if/then statements to verify that the two methods produce the same…arrow_forward

- Please do not give solution in image format thankuarrow_forwardYPLUS Kimmel, Accounting, 7e Help | System Announcements CALCULATOR PRINTER VERSION 1 BACK NEXT National Corporation needs to set a target price for its newly designed product M14-M16. The following data relate to this new product. RESOURCES OMEWORK --05 -07 -09 -11 a-b Per Unit Total Direct materials $21 -16 Direct labor $41 --01A -02A -03A Variable manufacturing overhead Fixed manufacturing overhead $14 $1,264,000 Variable selling and administrative expenses $ 4 Fixed selling and administrative expenses $ 1,106,000 Its by Study These costs are based on a budgeted volume of 79,000 units produced and sold each year. National uses cost-plus pricing methods to set its target selling price. The markup percentage on total unit cost is 40%. Compute the total variable cost per unit, otal fixed cost per unit, and total cost per unit for M14-M16. Variable cost per unit 2$ Fixed cost per unit Total cost per unit 24 MacBookarrow_forwardPlease do not give solution in image format thankuarrow_forward

- Please do not give solution in image format thankuarrow_forwardO MyPath Home Content O Managerial Accounting, Fifteenth x My Questions | bartleby х O File | C:/Users/pse/Documents/managerial-accounting-15th-edition.pdf Managerial Accounting, Fifteenth Edition 204 / 795 Required: 1. Compute the cost per equivalent unit for materials, for labor, and for overhead. 2. Compute the total cost per equivalent whole unit. EXERCISE 4-4 Applying Costs to Units-Weighted-Average Method [LO4–4] Data concerning a recent period's activity in the Prep Department, the first processing department in a company that uses process costing, appear below: Materials Conversion Equivalent units of production in ending work in process Cost per equivalent unit 2,000 $13.86 800 $4.43 A total of 20,100 units were completed and transferred to the next processing department during the period. Required: Compute the cost of the units transferred to the next department during the period and the cost of ending work in process inventory. EXERCISE 4-5 Cost Reconciliation…arrow_forward5.04 Cost of Normal Spoilage additional rework required direct materials costing $1,000 and direct labor costing $700. Assume that the spoilage was due to carelessness by a Frieling worker and it is considered to be normal spoilage. Required: Calculate the cost of the Tramel job. $ Feedback Check My Work Make any needed journal entry to the overhead control account. If an amount box does not require an entry, leave it blank. V Check My Work See Cornerstone 5.4. What if the additional rework required $1,400 of direct labor? What would be the effect on the cost of the Tramel job?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education