ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

Do step by step. No excel pls

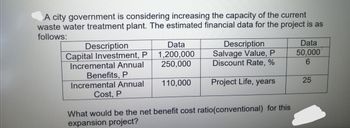

Transcribed Image Text:A city government is considering increasing the capacity of the current

waste water treatment plant. The estimated financial data for the project is as

follows:

Description

Data

Capital Investment, P

Data

1,200,000

250,000

Description

Salvage Value, P

Discount Rate, %

50,000

6

Incremental Annual

Benefits, P

Incremental Annual

110,000

Project Life, years

25

Cost, P

What would be the net benefit cost ratio(conventional) for this

expansion project?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- Vinnie’s Painting Company specializes in painting houses. Their cost schedule is as follows: 1. Show to calculate for the table below Output TFC TVC TC AFC AVC ATC MC 0 1000 1 100 2 100 3 400 4 450 5 1600 6 3200 7 6400 a) Given the partial data available, finish the table and calculate all the costs. b) What is the minimum efficient scale of Vinnie’s company? c) What is the marginal cost of 6 houses? d) If Vinnie charges $825 per house, how many houses he should paint to maximize profits?arrow_forward2b statements is true or false and explain If marginal cost is larger than average cost, average cost will fall as output increases.arrow_forwardf production, C be the total cost, MC be the marginal cost, AFC, the average fixed cost, AVC, the aver ecimal places.) Output (q) VC C MC AFC AVC AC 1 $100 $64 112 $164 $64 48 $100.00 $64.00 $164.00 50.00 56 00 106.00 2 100 212 3. 100 144 244 32 33.33 48.00 4. 100 160 16 25.00 40.00 65.00 100 192 292 -32 20.00 58 40 9. 100 340 48 16.67 40.00 56.67 7. 100 -304 404 14.29 4343 57.71 100 -384 484 80 48.00 60.50 53.33 59.20 9. 100 480 580 96 11.11 64.44 10 100 592 112 10.00 F.arrow_forward

- Describe the unit-of-production method?arrow_forwardWhat is the difference between economic profit and accounting profit? What is a normal rate of return and how does normal, less than normal, greater than normal inform resource allocation?arrow_forwardIAN GE Student Resources - Faculty Resources - Academic Resources - Ime grupiI Delow IIUIUUES two piunt Sizes us musuuteu uy ACr UnU ACZ. AC1 AC2 AC1 AC2 LRAC Q1 02 Output per time period Refer to the graph above to answer this question. Which of the following statements is correct if a firm is operating at point a on AC1? Select one: O a. The firm is achieving MES. O b. Building a larger plant would result in lower long-run average cost. O c. Building a larger plant would not result in lower long-run average cost. od. The firm has achieved capacity output. O e. An increase in the output would not lower costs. Clear my choice Staut o gaoarrow_forward

- Read the question and given information carefully. Show all necessary steps and reasoning that lead to the answers. You nead to draw graphs. a-Define diseconomies of scale and draw the long run average cost curve of a company that demonstrates diseconomies of scale b-List 2 reasons of diseconomies of scale and (in no more than 50 words for each reason) explain how each reason can contribute to diseconomies of scalearrow_forwardThe behavior of long run average cost determines what is known economies of scale, constant return to scale and diseconomies of scale. Discuss and explain that providing real world examples. give me new answer not from internetarrow_forwardChris The use of fixed cost items to magnify the firm's results Correct! What are some uses for break-even analysis? Select all that apply, then click Submit below To see how much the changes in cost affect variable costs. To see how much the changes in volume affect cost and profit. To determine the magnitude of operations necessary to avoid loss. To figure out the most efficient level of fixed costs for the firm. To figure out the most inefficient way to make profit. To figure out the operating leverage. Submitarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education