Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

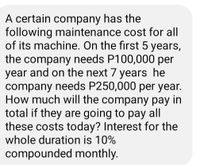

Transcribed Image Text:A certain company has the

following maintenance cost for all

of its machine. On the first 5 years,

the company needs P100,000 per

year and on the next 7 years he

company needs P250,000 per year.

How much will the company pay in

total if they are going to pay all

these costs today? Interest for the

whole duration is 10%

compounded monthly.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Charlie Corp. is purchasing new equipment with a cash cost of $100,000 for the assembly line. The manufacturer has offered to accept $22,960 payments at the end of each of the next six years. What is the interest rate that Charlie Corp. will be paying? a. 8%. b. 9%. c. 10%. d. 11%.arrow_forwardYou estimate your monthly gas and maintenance expenses for your delivery vehicles will be $1,500 a month for the next 7 years. Assuming an interest rate of 5%, what is the present value of these costs?arrow_forwardYou want to go on a holiday in 7 years. The cost of a similar holiday today is R70 000 and the cost of the holiday increases by 5% per annum. If you can earn 11% per annum on a savings account, how much must you save per month as from today to have the money ready in 7 years time? You will save at the beginning of each month. Rarrow_forward

- A machine can be leased for four years at $1000 per month payable at the beginning of each month. Alternatively, it can be purchased for $45,000 and sold for $5000 after four years. Should the machine be purchased or leased if the firm's cost of borrowing is: a. 6.6% compounded monthly? b. 9% compounded monthly? *arrow_forwardA company wants to deposit extra money to cover its increased maintenance costs for the next 13 years. How much should they deposit now if they expect costs to increase by $4,563 per year, starting from year 2, and their MARR is 9%?arrow_forwardThe total purchase price of a new home entertainment system is $14,260. If the down payment is $2300band the balance is to be financed over 72 months at 6% add-on intrest, what is the monthy payment?arrow_forward

- The rent on a building is 20,000 a month for 10 years with the first payment due today and the first of the month after that. If the APR is 9% compounded monthly, what is the value of those rent payments? Only type answer and give answer fastarrow_forwardCarla Vista Design has daily sales of $54,000. The financial management team has determined that a lockbox would reduce the collection time by 1.7 days. Assuming the company can earn 4.1 percent interest per year, what are the savings from the lockbox? (Round answer to 2 decimal places, e.g. 12.25.) what is the Savings from the lockbox per year?arrow_forwardA sailboat costs $26,652. You pay 15% down and amortize the rest with equal monthly payments over a 12-year period. If you must pay 8.1% compounded monthly, what is your monthly payment? How much interest will you pay?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education