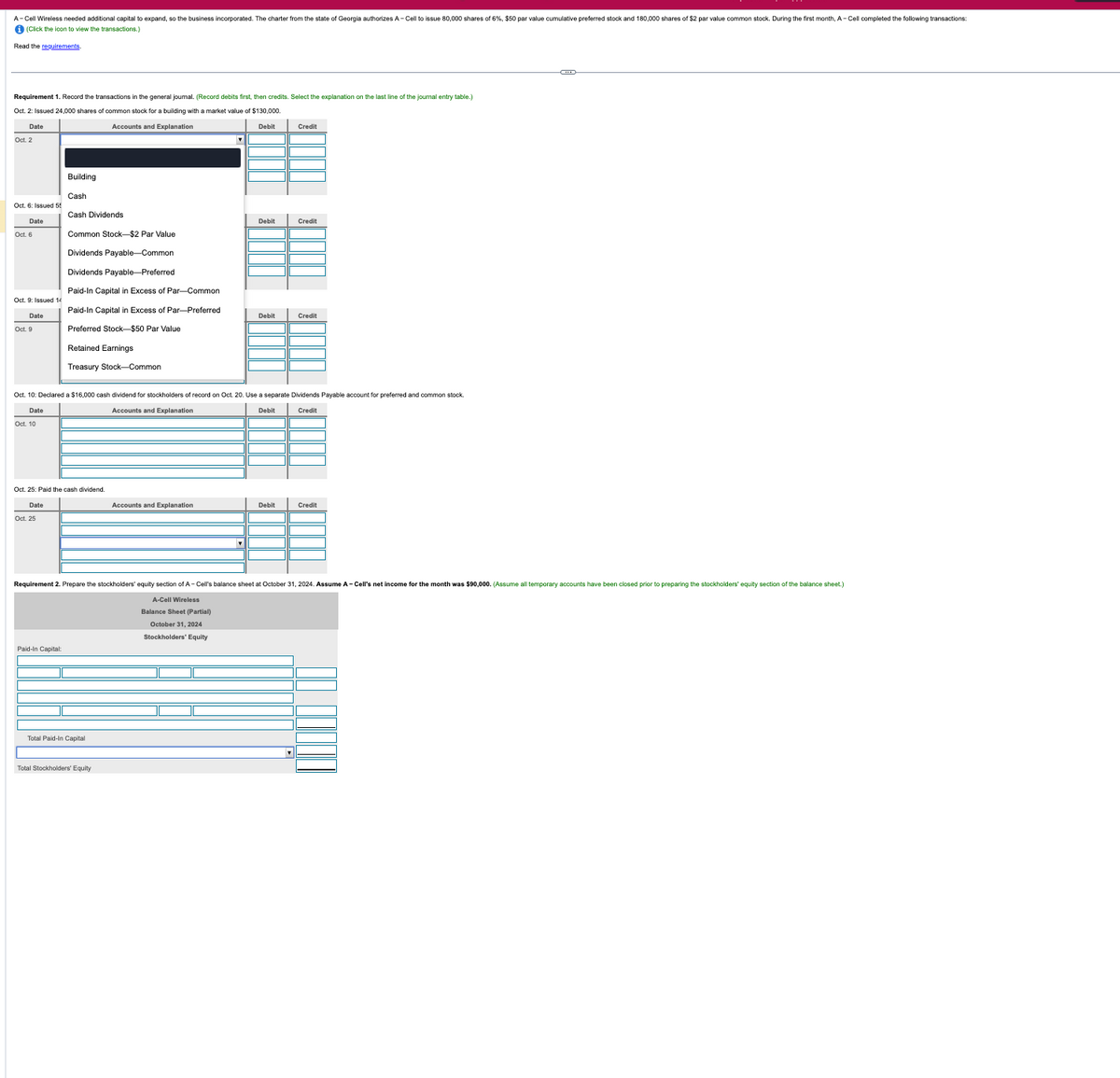

A-Cell Wireless needed additional capital to expand, so the business incorporated. The charter from the state of Georgia authorizes A-Cell to issue 80,000 shares of 6%, $50 par value cumulative preferred stock and 180,000 shares of $2 par value common stock. During the first month, A-Cell completed the following transactions: i (Click the icon to view the transactions.) Read the requirements. Requirement 1. Record the transactions in the general joumal. (Record debits first, then credits. Select the explanation on the last line of the journal entry table.) Oct. 2: Issued 24,000 shares of common stock for a building with a market value of $130,000. Date Oct. 2 Accounts and Explanation Debit Credit Building Cash Oct. 6: Issued 55 Cash Dividends Date Oct. 6 Debit Credit Common Stock-$2 Par Value Dividends Payable-Common Dividends Payable-Preferred Paid-In Capital Excess of Par-Common Oct. 9: Issued 14 Date Debit Credit Paid-In Capital in Excess of Par-Preferred Preferred Stock-$50 Par Value Retained Earnings Treasury Stock-Common Oct. 10: Declared a $16,000 cash dividend for stockholders of record on Oct. 20. Use a separate Dividends Payable account for preferred and common stock. Date Oct. 10 Oct. 25: Paid the cash dividend. Date Oct. 25 Accounts and Explanation Debit Credit Accounts and Explanation Debit Credit Requirement 2. Prepare the stockholders' equity section of A-Cell's balance sheet at October 31, 2024. Assume A-Cell's net income for the month was $90,000. (Assume all temporary accounts have been closed prior to preparing the stockholders' equity section of the balance sheet.) A-Cell Wireless Balance Sheet (Partial) October 31, 2024 Stockholders' Equity Paid-In Capital: Total Paid-In Capital Total Stockholders' Equity

A-Cell Wireless needed additional capital to expand, so the business incorporated. The charter from the state of Georgia authorizes A-Cell to issue 80,000 shares of 6%, $50 par value cumulative preferred stock and 180,000 shares of $2 par value common stock. During the first month, A-Cell completed the following transactions: i (Click the icon to view the transactions.) Read the requirements. Requirement 1. Record the transactions in the general joumal. (Record debits first, then credits. Select the explanation on the last line of the journal entry table.) Oct. 2: Issued 24,000 shares of common stock for a building with a market value of $130,000. Date Oct. 2 Accounts and Explanation Debit Credit Building Cash Oct. 6: Issued 55 Cash Dividends Date Oct. 6 Debit Credit Common Stock-$2 Par Value Dividends Payable-Common Dividends Payable-Preferred Paid-In Capital Excess of Par-Common Oct. 9: Issued 14 Date Debit Credit Paid-In Capital in Excess of Par-Preferred Preferred Stock-$50 Par Value Retained Earnings Treasury Stock-Common Oct. 10: Declared a $16,000 cash dividend for stockholders of record on Oct. 20. Use a separate Dividends Payable account for preferred and common stock. Date Oct. 10 Oct. 25: Paid the cash dividend. Date Oct. 25 Accounts and Explanation Debit Credit Accounts and Explanation Debit Credit Requirement 2. Prepare the stockholders' equity section of A-Cell's balance sheet at October 31, 2024. Assume A-Cell's net income for the month was $90,000. (Assume all temporary accounts have been closed prior to preparing the stockholders' equity section of the balance sheet.) A-Cell Wireless Balance Sheet (Partial) October 31, 2024 Stockholders' Equity Paid-In Capital: Total Paid-In Capital Total Stockholders' Equity

Chapter14: Corporation Accounting

Section: Chapter Questions

Problem 8PB: Tent Tarp Corporation is a manufacturer of outdoor camping equipment. The company was incorporated...

Related questions

Question

plz help

Transcribed Image Text:A-Cell Wireless needed additional capital to expand, so the business incorporated. The charter from the state of Georgia authorizes A-Cell to issue 80,000 shares of 6%, $50 par value cumulative preferred stock and 180,000 shares of $2 par value common stock. During the first month, A-Cell completed the following transactions:

i (Click the icon to view the transactions.)

Read the requirements.

Requirement 1. Record the transactions in the general joumal. (Record debits first, then credits. Select the explanation on the last line of the journal entry table.)

Oct. 2: Issued 24,000 shares of common stock for a building with a market value of $130,000.

Date

Oct. 2

Accounts and Explanation

Debit

Credit

Building

Cash

Oct. 6: Issued 55

Cash Dividends

Date

Oct. 6

Debit

Credit

Common Stock-$2 Par Value

Dividends Payable-Common

Dividends Payable-Preferred

Paid-In Capital

Excess of Par-Common

Oct. 9: Issued 14

Date

Debit

Credit

Paid-In Capital in Excess of Par-Preferred

Preferred Stock-$50 Par Value

Retained Earnings

Treasury Stock-Common

Oct. 10: Declared a $16,000 cash dividend for stockholders of record on Oct. 20. Use a separate Dividends Payable account for preferred and common stock.

Date

Oct. 10

Oct. 25: Paid the cash dividend.

Date

Oct. 25

Accounts and Explanation

Debit

Credit

Accounts and Explanation

Debit

Credit

Requirement 2. Prepare the stockholders' equity section of A-Cell's balance sheet at October 31, 2024. Assume A-Cell's net income for the month was $90,000. (Assume all temporary accounts have been closed prior to preparing the stockholders' equity section of the balance sheet.)

A-Cell Wireless

Balance Sheet (Partial)

October 31, 2024

Stockholders' Equity

Paid-In Capital:

Total Paid-In Capital

Total Stockholders' Equity

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Auditing: A Risk Based-Approach (MindTap Course L…

Accounting

ISBN:

9781337619455

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning