Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

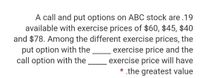

Transcribed Image Text:A call and put options on ABC stock are.19

available with exercise prices of $60, $45, $40

and $78. Among the different exercise prices, the

exercise price and the

exercise price will have

* .the greatest value

put option with the

call option with the

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Whats the profit of the "Bearish Put Spread" when stock price is $25, $30, $35, $40, $45, $50, $55, $60, and $65 respectively? Given: - Stock price = $45.00 - Current option price = 7.0 (put 35) - Current option price = 2.0 (put 45) - Exercise Price = $40.00arrow_forward4arrow_forwardSuppose you combine two option contracts as follows. You buy a call option on a stock with an exercise price of $65 for a premium of 9$. At the same time you sell a call option on the same stock with an exercise price of $75 for a premium of $4. Both calls expire at the same time. The stock sells currently at $72. Answer the following questions about this investment strategy: 1. Determinethevalueatexpiration(thepayoffs)andtheprofitunderthefollowingoutcomes: a. The price of the stock at expiration is $78b. The price of the stock at expiration is $69c. Thepriceofthestockatexpirationis$62 2. Determine the following:a. The maximum profit b. The maximum loss 3. Determinethebreakevenstockpriceatexpiration(thestockpriceforwhichyourstrategydeliversno profit and no loss). 4. Depictthepayoffandprofitdiagramsofyourinvestmentstrategy.arrow_forward

- Only typing. .... . A strip is a variation of a straddle involving two puts and one call. Construct a short strip using the August 170 options. The price of the call option is $8.10 and the price of the put option is $6.75. Hold the position until the options expire. Determine the profits and graph the results. Identify the breakeven stock prices at expiration and the minimum profit.arrow_forwardpls show full workingarrow_forward- You purchased 250 shares of common stock on margin for $28 per share. The initial margin is 70% and the stock pays no dividend but has a trading cost of $0.1 per share. Your rate of return would be if you sell the stock at $36 per share. Ignore interest on margin.arrow_forward

- Suppose you buy a stock at $70 together with a put option with a strike of $70 and a premium of $5. Your minimum payoff at expiration is $_----arrow_forwardYou see that three put options on a stock with strike prices of $55, $60, and $65 are $3, $5, and $8, respectively. You have the ability to use those options to create a butterfly spread.arrow_forwardData: S0 = 120; X = 126; 1 + r = 1.05. The two possibilities for ST are 150 and 102. Required: a-1. The range of S is 48 while that of C is 24 across the two states. What is the hedge ratio of the call? Note: Round your answer to 2 decimal places. a-2. Calculate the value of a call option on the stock with an exercise price of 126. (Do not use continuous compounding to calculate the present value of X in this example because we are using a two-state model here; the assumed 5% interest rate is an effective rate per period.) Note: Do not round intermediate calculations. Round your answer to 2 decimal places.arrow_forward

- A stock price is currently $23. A butterfly spread (ie. options are bought with strike prices of K₁ and K3, and two options with the middle strike price K₂ are sold) is created from call options with strike prices of $20, $25, and $30. Which of the following is TRUE? Select one alternative: O It is incorrect to assume that there is always a gain when the stock price is greater than $30 or less than $20. O The loss when the stock price is greater than $30 is the same as the loss when the stock price is less than $20. The gain when the stock price is greater than $30 is greater than the gain when the stock price is less than $20. O The gain when the stock price is greater than $30 is less than the gain when the stock price is less than $20.arrow_forwardYou bought (that is, you are “long”) both a put option and a call option on Strockfoot stock with the same expiration date. The exercise price of the call option is $40 and the exercise price of the put option is $30. Carefully graph the payoff of the combination of options at expiration.arrow_forwardConsider the following Options Kuala Lumpur Index (OKLI) traded at BMDB: Option Type Option Price 33 20 12 18 Call Call ii. Put Put Exercise Price 750 780 Required: Illustrate graphically with relevant labels and working for following synthetic strategies: i. Long straddle Long strangle 750 780 +arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education