ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

Please provide full and authentic solution. Please ensure the working out eases the eyes. Please dont make mistakes. Please double check when done. Greatly Appreciated!!

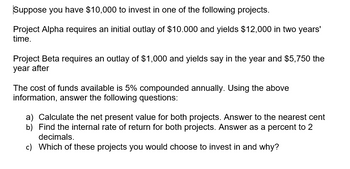

Transcribed Image Text:Suppose you have $10,000 to invest in one of the following projects.

Project Alpha requires an initial outlay of $10.000 and yields $12,000 in two years'

time.

Project Beta requires an outlay of $1,000 and yields say in the year and $5,750 the

year after

The cost of funds available is 5% compounded annually. Using the above

information, answer the following questions:

a) Calculate the net present value for both projects. Answer to the nearest cent

b) Find the internal rate of return for both projects. Answer as a percent to

decimals.

c) Which of these projects you would choose to invest in and why?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 24 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- p (a) MC ATC MR P* (b) MC ATC MR (c) MC ATC MRarrow_forwardWrite the formula of Annual Effective Yields?arrow_forwardS LO 20 # 3 PRICE (Dollars per hot dog) 5. History Bookmarks People Tab Window Help 令) 71% Mind Tap - Cengage Learning /index.html?deploymentld%359828119415547787292595253&elSBN=9780357133606&id%3D1069413986&snapshotid%-D2211990& * CENGAGE MINDTAP Q Search this course Homework (Ch 15) 5. Monopoly outcome versus competition outcome Consider the daily market for hot dogs in a small city. Suppose that this market is in long-run competitive equilibrium with many hot dog stands in the city, each one selling the same kind of hot dogs. Therefore, each vendor is a price taker and possesses no market power. The following graph shows the demand (D) and supply (S = MC) curves in the market for hot dogs. %3D Place the black point (plus symbol) on the graph to indicate the market price and quantity that will result from competition. Competitive Market +. 4.5 PC Outcome 3.5 3.0 2.5 S=MC 1.5 0.5 D. 120 140 160 180 09 QUANTITY (Hot dogs) 40 PI MacBook Air DA DD F8 F6 F5 F4 F2 %24 6. 7. 8. 9- 4. 2.arrow_forward

- AutoSave File Document! Word Chris Navo Home Insert Draw Design Layout References Mailings Review View MathType Help Acrobat Graphs Format Cobb and Douglas used economic data published by the government to obtain Table 2. Year P Year 1899 100 100 DOL 1911 148 216 1900 101 105 107 1912 155 1901 112 110 114 1912 1902 122 117 122 1014 169 152 244 1903 124 122 131 1915 109 156 266 1904 122 121 138 1916 225 183 1905 143 125 149 1917 227 1905 152 124 163 1915 223 201 1907 151 140 170 1919 218 19.08 126 123 485 1920 231 104 407 19.09 155 143 198 1921 179 146 417 1910 159 208 1922 240 161 431 Table 2 Swords et Predictions. The Cobb Douglass formula is P(L, K) = bLa K¹-a Determine monetary value of all the goods produced in 1 year or simply the production level in 1920 for a=.20 and b=1.01. Round to one decimal place.arrow_forwardPlease don't use excel and show equations used.arrow_forwardDefine the term Present-Worth Factor?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education