Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

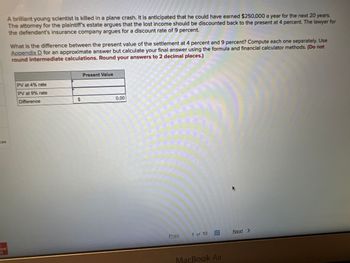

Transcribed Image Text:A brilliant young scientist is killed in a plane crash. It is anticipated that he could have earned $250,000 a year for the next 20 years.

The attorney for the plaintiff's estate argues that the lost income should be discounted back to the present at 4 percent. The lawyer for

the defendant's insurance company argues for a discount rate of 9 percent.

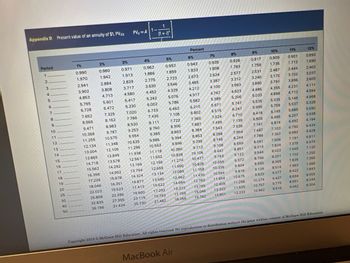

What is the difference between the present value of the settlement at 4 percent and 9 percent? Compute each one separately. Use

Appendix D for an approximate answer but calculate your final answer using the formula and financial calculator methods. (Do not

round intermediate calculations. Round your answers to 2 decimal places.)

PV at 4% rate

PV at 9% rate

Difference

$

Present Value

0.00

Prev

1 of 10

MacBook Air

Next >

Transcribed Image Text:A brilliant young scientist is killed in a plane crash. It is anticipated that he could have earned $250,000 a year for the next 20 years.

The attorney for the plaintiff's estate argues that the lost income should be discounted back to the present at 4 percent. The lawyer for

the defendant's insurance company argues for a discount rate of 9 percent.

What is the difference between the present value of the settlement at 4 percent and 9 percent? Compute each one separately. Use

Appendix D for an approximate answer but calculate your final answer using the formula and financial calculator methods. (Do not

round intermediate calculations. Round your answers to 2 decimal places.)

PV at 4% rate

PV at 9% rate

Difference

$

Present Value

0.00

Prev

1 of 10

MacBook Air

Next >

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- A wealthy graduate of a local university wants to establish a scholarship to cover the full cost of one student each year in perpetuity at her university. To adequately prepare for the administration of the scholarship, the university will begin awarding it starting in three years. The estimated full cost of one student this year is $38,000 and is expected to stay constant in real terms in the future. If the scholarship is invested to earn an annual real return of 5 percent, how much must the donor contribute today to fully fund the scholarship?arrow_forwardNonearrow_forwardBob buys a property that costs $1,000,000. The property is projected to generate NOI as follows: Year NOI 1 $100,000 2 $105,000 3 $110,000 Bob will own the property for two years. Bob will sell the property at the end of year 2 at a cap rate that is 250 basis points lower than the cap rate at which he bought the property. Assume Bob finances his purchase with a 50% LTV Fixed Rate IO loan at an annual rate of 5% with annual compounding and annual payments. What is Bob’s annualized IRR for the investment in question? A. 83.54% B. 52.38% C. 78.93% D. 79.71%arrow_forward

- Your employer asks you to consult on the better approach to a decision. What should the corporation pay for an asset that will return them $150,000 at the end of year 1, then zero in year 2, then $400,000 in years 3 & 4, then zero in year 5, then $200,000 in years 6-10, assuming their discount rate is 3% (ignoring taxes) ?arrow_forwardYour friend needs money today and can pay you $400 in one year, $800 in 3 years, $200 in 5 years and $1,000 every year starting at the beginning of year 7 and ending at the beginning of year 10. How much would you be willing to lend him today if you both agree that 9% interest is fair.arrow_forwardBeverly and Kyle currently insure their cars with separate companies, paying $500 and $510 a year. If they insured both cars with the same company, they would save 15 percent on the annual premiums. What would be the future value of the annual savings over 10 years based on an annual interest rate of 6 percent? Use Exhibit 1-B. (Do not round intermediate calculations. Round time value factor to 3 decimal places and final answer to 2 decimal places.) Future value of annual savingsarrow_forward

- Hank purchased a car for $20,500 two years ago using a 4-year loan with an interest rate of 6.0 percent. He has decided that he would sell the car now if he could get a price that would pay off the balance of his loan. What’s the minimum price Hank would need to receive for his car? Calculate his monthly payments, then use those payments and the remaining time left to compute the present value (called balance) of the remaining loan. (Do not round intermediate calculations and round your final answer to 2 decimal places.) Minimum Price = $_____.__arrow_forward4arrow_forward7. George, a financial planner, has determined that Dennis, his client, needs $2 million at age 66 to retire by using an annuity model based on a retirement income of $150,337.75 per year for 24 years to age 90. If the earnings rate was 10% and the inflation rate was 3%, what additional amount would be needed at age 66 to provide a capital preservation model solution?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education