Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

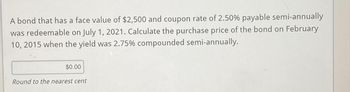

Transcribed Image Text:A bond that has a face value of $2,500 and coupon rate of 2.50% payable semi-annually

was redeemable on July 1, 2021. Calculate the purchase price of the bond on February

10, 2015 when the yield was 2.75% compounded semi-annually.

$0.00

Round to the nearest cent

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- A bond with par value of 1,000 has payment dates of April 15 and October 15. The nominal coupon rate convertible semiannually is 8%. The bond matures on October 15, 2012. On April 15, 2010, a coupon payment of 40 was made. The bond is sold 80 days later on the settlement date of July 4, 2010 to yield 6% convertible semiannually. There are 183 days between April 15, 2010 and October 15, 2010. Find the market price on July 4, 2010 if compound interest is used in finding the purchase price but simple interest is used in computing the accrued coupon.arrow_forwardA bond that has a face value of $1,500 and coupon rate of 3.20% payable semi-annually was redeemable on July 1, 2021. Calculate the purchase price of the bond on February 10, 2015 when the yield was 3.70% compounded semi-annually. $0.00arrow_forwardConsider a zero-coupon bond issued on 1st of March 2017 with maturity in two years and face value £100 (a) Compute the price on the 1st of March 2017 if the gross yield is 4% p.a. effective. (b) If the bond is issued at a price of £90 and pays capital gains tax at 25%, find the net redemption yield.arrow_forward

- Crazy Racoon Fur Trading Company issued a 20-year bond on May 15, 2018 with a 6.00% coupon. The bond pays interest semi-annually (5/15 and 11/15) with no special covenants (puts, calls, etc.). The bond will pay off at par (100.00%) or face value at maturity. You decide to purchase the bond and the trade is going to settle on August 30, 2020. On that date.... a. What is the price of the bond if the yield to maturity is 6.00%? b. What is the price of the bond if the yield to maturity increases to 7.00%? c. What is the price of the bond if the yield to maturity falls to 5.00%? Settlement date 08/30/20 Maturity date 05/15/22 Annual coupon rate 6.000% Yield to maturity 6.000% Redemption value as % of par valu 100.00 Number of coupons per year 2 BOND PRICE CALCULATOR $1,000.00 $1,000.00 CORRECT! $981.19 $962.89arrow_forwardOn February 9, 2015, Hunter-Gratzner, Inc. issued a 10 year bond (with a typical $1000 face value) that had an annual coupon value of $42. We will assume that the 2022 coupon has just been redeemed. Initially (in 2015), the bond was sold at the premium price of $1,037. On February 9, 2022, this bond was selling for $972. The market rate of interest for a riskless corporate bond, of this maturity (i.e., a U.S. Treasury security), was 1.75% on February 9, 2015, which reflected market expectations about future rates of inflation. The market rate of interest for a riskless corporate bond, of this maturity (i.e., a U.S. Treasury security), was 2.05% on February 9, 2022, which reflects market expectations about future rates of inflation. Question: What was the yield to maturity for this bond on February 9, 2015? [To 2 decimal places.]arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education