FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

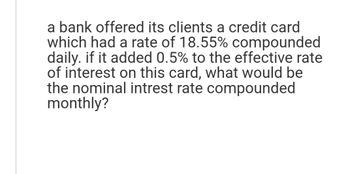

Transcribed Image Text:a bank offered its clients a credit card

which had a rate of 18.55% compounded

daily. if it added 0.5% to the effective rate

of interest on this card, what would be

the nominal intrest rate compounded

monthly?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 2 images

Knowledge Booster

Similar questions

- The annual interest rate on a credit card is 17.99%. If a payment of $400.00 is made each month, how many months will it take to pay off an unpaid balance of $2584.16? Assume that no new purchases are made with the credit card. (Don't Hand writing in solution) .arrow_forwardOne bank offers to loan you money at an interest rate of 12% compounded quarterly, and another bank offers to loan you money at 11.8% compounded continuously. Which loan would you prefer, and why?arrow_forwardWhat is the effective annual interest rate of a 8.4% bank loan compounded monthly?arrow_forward

- Today, you borrowed $5,400 on a credit card that charges an interest rate of 14.2 percent, compounded monthly. How long will it take you to pay off this debt assuming that you do not charge anything else and make regular monthly payments of $110?arrow_forwardYour credit card has a limit of $3,000. You have charged goods totaling that amount. Your yearly APR is 12%. What is the finance charge one month?arrow_forwardYour credit card carries an annual rate of 21.6% APR with a minimum payment due monthly. If you don’t pay the monthly minimum amount for a year, what is its EAR?arrow_forward

- A loan of $1500 is repaid with a check for $1575. If the annual simple interest rate was 15%, what was the time length of the loan in years? In months?arrow_forward. Calculating EAR First National Bank charges 11.4 percent compounded monthly on its business loans. First United Bank charges 11.6 percent compounded semiannually. As a potential borrower, to which bank would you go for a new loan ?arrow_forwardYour credit card company charges you 2.33 percent per month. What is the APR on your credit card? Enter your answer as a percentage rounded off to two decimal places. Do not enter % in the answer box.arrow_forward

- You are considering getting a new credit card from Imperial Credit Union. The credit union has quoted you a rate of 17.7 percent, compounded monthly. What is the actual rate of interest you will be paying?arrow_forwardIf a credit card has a 30-day billing period, a 20-day grace period, and charges an interest rate of 20%, compounded daily, how much interest will be charged on a $5000 average monthly balance which gets paid 40 days after the statement due date using the average daily balance method?arrow_forwardA bank offers a Certificate of Deposit (CD) at a rate of 6% compounded monthly. Another bank offers 5.90% compounded daily. Which rate is better for the investor?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education