Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

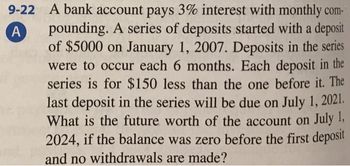

Transcribed Image Text:9-22

A

A bank account pays 3% interest with monthly com-

pounding. A series of deposits started with a deposit

of $5000 on January 1, 2007. Deposits in the series

were to occur each 6 months. Each deposit in the

series is for $150 less than the one before it. The

last deposit in the series will be due on July 1, 2021.

What is the future worth of the account on July 1,

2024, if the balance was zero before the first deposit

and no withdrawals are made?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 4 steps with 5 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- The Schitt Company borrowed $900 on January 1, 2020 at an annual rate of interest of eight percent. The loan has a three-year term and the company will not make any payments until the end of the term. What amount of interest expense will the company record on December 31, 2022? Round your final answer to the nearest whole dollar and enter as a positive number.arrow_forwardIt is the first day of the year and you plan to make a total of 5 deposits of $ 4, 000 each, one every 6 months with the first payment being made today. The bank pays a nominal interest rate of 15% but uses semiannual compounding. How much your account with the bank be if you leave the money in the bank to be withdrawn all in 12 years from today? Round to the nearest $0.01 but do not use the $ sign. DO NOT USE commas to separate thousands. For example if you obtain $1, 432.728 then enter 1433.73; if you obtain $432 then enter 432.00arrow_forwardDineshbhaiarrow_forward

- Please do it by hand. If not please do not respond. Write cleararrow_forwardYou deposit $1,500 at the end of the year (k = 0) into an account that pays interest at a rate of 7% compounded annually. A year after your deposit, the savings account interest rate changes to 12% nominal interest compounded monthly. Six years after your deposit, the savings account again changes its interest rate; this time the interest rate becomes 8% nominal interest compounded quarterly. Eight years after your deposit, the saving account changes its rate once more to 6% compounded annually. a. How much money should be in the savings account 18 years after the initial deposit, assuming no further changes in the account's interest rate? b. What interest rate, compounded annually, is equivalent to the interest pattern of the saving account in Part (a) over the entire 18 year period? a. $ should be in the savings account 18years after the initial deposit. (Round to the nearest dollar.) b. The interest rate equivalent to the interest pattern of the saving account in Part (a) over the…arrow_forwardYou decide to make monthly $2000 deposits into an account that pays 4% compounded monthly. If your first deposit was on January 1, 2019, then how much is in the account immediately after the deposit on January 1, 2025?arrow_forward

- You deposit $ 7,812 in your account today. You make another deposit at t = 1 of $ 6,946 . How much will there be in your account at the end of year 1 if the interest rate is 11.9 percent p.a.? (Record your answer without a dollar sign, without commas and round your answer to 2 decimal places; that is, record $3,245.847 as 3245.85). Your Answer:arrow_forwardYou invest $ 4,060 in an account today. You make no additional deposits into the account. One year from today there is $ 5,140 in the account. What is the nominal interest rate that you earned on your money? (Record your answer as a percent rounded to 1 decimal place; for example, record .527945 = 52.8% as 52.8). Your Answer:arrow_forwardYou deposit $2,000 at the end of the year (k = 0) into an account that pays interest at a rate of 6% compounded annually. A year after your deposit, the savings account interest rate changes to 12% nominal interest compounded monthly. Five years after your deposit, the savings account again changes its interest rate; this time the interest rate becomes 8% nominal interest compounded quarterly. Nine years after your deposit, the saving account changes its rate once more to 5% compounded annually. a. How much money should be in the savings account 17 years after the initial deposit, assuming no further changes in the account's interest rate? b. What interest rate, compounded annually, is equivalent to the interest pattern of the saving account in Part (a) over the entire 17 year period?arrow_forward

- The McAllister Company borrowed $40,000 from a bank on January 1, 2021 at an interest rate of 4 percent; the loan will be repaid in full at the end of the two-year term. What amount of interest expense will the company record in its financial statements for the year 2022? As needed, round your final answer (but not intermediate steps) to the nearest whole dollar and enter as a positive number.arrow_forwardK Mahadeus opened an RRSP deposit account on December 1, 2008, with a deposit of $2300. He added $2300 on April 1, 2010, and $2300 on January 1, 2012. How much is in his account on October 1, 2016. if the deposit earns 6.7% pa compounded monthly? (3) The amount in the account is $ (Round the final answer to the nearest cent as needed. Round all intermediate values to six decimal places as needed) Clear allarrow_forwardYou wish to deposit $500 dollars per year. The first deposit will be on April 1, 2017, and your last deposit will be on April 1, 2026. How much will be in the account on April 1, 2050 if the bank pays 4% annually?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education