FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

Transcribed Image Text:nment i

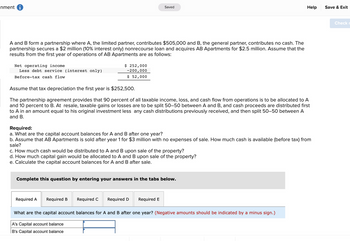

A and B form a partnership where A, the limited partner, contributes $505,000 and B, the general partner, contributes no cash. The

partnership secures a $2 million (10% interest only) nonrecourse loan and acquires AB Apartments for $2.5 million. Assume that the

results from the first year of operations of AB Apartments are as follows:

Net operating income

Less debt service (interest only)

Before-tax cash flow

$ 252,000

-200,000

$ 52,000

Assume that tax depreciation the first year is $252,500.

The partnership agreement provides that 90 percent of all taxable income, loss, and cash flow from operations is to be allocated to A

and 10 percent to B. At resale, taxable gains or losses are to be split 50-50 between A and B, and cash proceeds are distributed first

to A in an amount equal to his original investment less any cash distributions previously received, and then split 50-50 between A

and B.

Saved

Required:

a. What are the capital account balances for A and B after one year?

b. Assume that AB Apartments is sold after year 1 for $3 million with no expenses of sale. How much cash is available (before tax) from

sale?

c. How much cash would be distributed to A and B upon sale of the property?

d. How much capital gain would be allocated to A and B upon sale of the property?

e. Calculate the capital account balances for A and B after sale.

Required A

Complete this question by entering your answers in the tabs below.

Required B

Required C Required D

Required E

Help

What are the capital account balances for A and B after one year? (Negative amounts should be indicated by a minus sign.)

A's Capital account balance

B's Capital account balance

Save & Exit

Check

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step 1: Meaning of limited & general partner and working note of before tax cash flow

VIEW Step 2: Calculate Taxable Income:

VIEW Step 3: Calculation Of Capital Account Balance

VIEW Step 4: b. Cash available from sale:

VIEW Step 5: c. Cash that would be distributed on the sale of property A and B

VIEW Solution

VIEW Step by stepSolved in 6 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education