Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

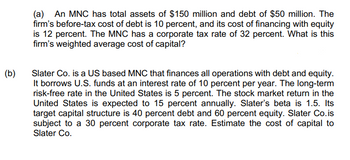

Transcribed Image Text:(a) An MNC has total assets of $150 million and debt of $50 million. The

firm's before-tax cost of debt is 10 percent, and its cost of financing with equity

is 12 percent. The MNC has a corporate tax rate of 32 percent. What is this

firm's weighted average cost of capital?

(b)

Slater Co. is a US based MNC that finances all operations with debt and equity.

It borrows U.S. funds at an interest rate of 10 percent per year. The long-term

risk-free rate in the United States is 5 percent. The stock market return in the

United States is expected to 15 percent annually. Slater's beta is 1.5. Its

target capital structure is 40 percent debt and 60 percent equity. Slater Co.is

subject to a 30 percent corporate tax rate. Estimate the cost of capital to

Slater Co.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Simple Tech Inc is an Australian company operating in a pure imputation tax system. It is currently financed entirely (100%) by equity and has a beta of 0.8. After examining its capital structure, Simple Tech finds that the optimal capital structure can be achieved at D/E ratio of 0.4. The before- tax cost of debt capital for Simple Tech at the optimal capital structure is 10% p.a. The risk-free rate and market risk premium are 5% p.a. and 7% p.a., respectively. If the statutory corporate tax rate is 30%, which of the following is closest to the cost of equity at the optimal capital structure (using the approach covered in the lecture)? O 12.03% p.a. 12.84% p.a. 11.69% p.a. 10.60% p.a. 12.17% p.a.arrow_forwardSuppose that MNINK industries' capital structure features 63 percent equity, 7 percent preferred stock, and 30 percent debt. If the before-tax component costs of equity, preferred stock, and debt are 11.60 percent, 9.5 percent, and 9 percent, respectively, what is MNINK's WACC if the firm faces an average tax rate of 21 percent and can make full use of the interest tax shield?arrow_forwardLafayette Group (U.S.). The Lafayette Group, a private equity firm headquartered in Boston, borrows £5,000,000 for one year at 7.375% interest. a. What is the dollar cost of this debt if the pound depreciates from $2.0260 = £1.00 to $1.9460 = £1.00 over the year? b. What is the dollar cost of this debt if the pound appreciates from $2.0260 = £1.00 to $2.1640 = £1.00 over the year? a. What is the dollar cost of this debt if the pound depreciates from $2.0260 = £1.00 to $1.9460 = £1.00 over the year? % (Round to two decimal places.) b. What is the dollar cost of this debt if the pound appreciates from $2.0260 = £1.00 to $2.1640 = £1.00 over the year? % (Round to two decimal places.)arrow_forward

- Barclay Corp is operating in a country K where the corporate tax is 40%, personal income tax on bond investment is 25% while the personal tax on stock is 29%. Assume the firm’s earnings before interest and taxes is $5,400,000 and cost of equity with zero debt is 9%. (Please Show Work) If Barclay current has $12 million total market value of debt financing, what would be the market value of the company of Barclay Corp in this country K?(Please Show Work) What is the proportion of debt (wd) and equity (ws) financing for Barclay Corp with financial leverage? (Please Show Work)arrow_forwardMM Model with Zero Taxes An unlevered firm has a value of $625 million. An otherwise identical but levered firm has $75 million in debt. Under the MM zero-tax model, what is the value of the levered firm? Enter your answer in millions. For example, an answer of $10,550,000 should be entered as 10.55. Round your answer to the nearest whole number. LA millionarrow_forwardAssuming that there is an unlevered firm and a levered firm. The basic information is given by the following table. Table1: Information of the firms Unlevered firm Levered firm EBIT 20000 20000 Interest Taxable income Tax (tax rate: 34%) Net income CFFA Assuming that: The size of the debt is 8000; cost of debt =8%; unlevered cost of capital =10%; systematic risk of the asset is 1.5 Fill in the blanks What is the present value of the tax shield? Calculate the following values:a) Calculate value of unlevered firm; b) value of the levered firm; c) equity value; d) Cost of equity; e) cost of capital; f) systematic risk of the equity Suppose that the firm changes its capital structure so that the debt-to-equity ratio is 1.6, then recalculate the systematic risk of the equity If the firm now has the following project: in year 0, the cashflow is 5000, in year 1, the cashflow is -5500. Based on the IRR rule,…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education