MATLAB: An Introduction with Applications

6th Edition

ISBN: 9781119256830

Author: Amos Gilat

Publisher: John Wiley & Sons Inc

expand_more

expand_more

format_list_bulleted

Question

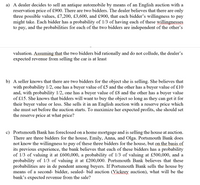

Transcribed Image Text:a) A dealer decides to sell an antique automobile by means of an English auction with a

reservation price of £900. There are two bidders. The dealer believes that there are only

three possible values, £7,200, £3,600, and £900, that each bidder's willingness to pay

might take. Each bidder has a probability of 1/3 of having each of these willingnesses

to pay, and the probabilities for each of the two bidders are independent of the other's

valuation. Assuming that the two bidders bid rationally and do not collude, the dealer's

expected revenue from selling the car is at least

b) A seller knows that there are two bidders for the object she is selling. She believes that

with probability 1/2, one has a buyer value of £5 and the other has a buyer value of £10

and, with probability 1/2, one has a buyer value of £8 and the other has a buyer value

of £15. She knows that bidders will want to buy the object so long as they can get it for

their buyer value or less. She sells it in an English auction with a reserve price which

she must set before the auction starts. To maximize her expected profits, she should set

the reserve price at what price?

c) Portsmouth Bank has foreclosed on a home mortgage and is selling the house at auction.

There are three bidders for the house, Emily, Anna, and Olga. Portsmouth Bank does

not know the willingness to pay of these three bidders for the house, but on

its previous experience, the bank believes that each of these bidders has a probability

of 1/3 of valuing it at £600,000, a probability of 1/3 of valuing at £500,000, and a

probability of 1/3 of valuing it at £200,000. Portsmouth Bank believes that these

probabilities are in de pendent among buyers. If Portsmouth Bank sells the house by

means of a second- bidder, sealed- bid auction (Vickrey auction), what will be the

bank's expected revenue from the sale?

the basis of

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Similar questions

- At a certain company, the mentoring program and the community outreach program meet at the same time, so it is impossible for an employee to do both. If the probability that an employee participates in the mentoring program is 0.43, and the probability that an employee participates in the outreach program is 0.32, what is the probability that an employee does the mentoring program or the community outreach program?arrow_forwardDan's Diner employs three dishwashers. Al washes 40% of the dishes and breaks only 2% of those he handles. Betty and Chuck each wash 30% of the dishes, and Betty breaks only 2% of hers, but Chuck breaks 4% of the dishes he washes. You go to Dan's for supper one night and hear a dish break at the sink. What's the probability that Chuck is on the job? The probability that Chuck is on the job is. (Round to three decimal places as needed.)arrow_forward3. A retailer sells two brands of batteries that experience indicates are equal in demand. If he stocks two of each brand (which means he has 4 batteries in his store), what is the probability that a customer seeking to purchase two batteries, purchases the same brand? 1/3 2/3 01/2 1/4arrow_forward

- Christine Wong has asked Dave and Mike to help her move into a new apartment on Sunday morning. She has asked them both, in case one of them does not show up. From past experience, Christine knows that there is a 36% chance that Dave will not show up and a 26% chance that Mike will not show up. Dave and Mike do not know each other and their decisions can be assumed to be independent. a. What is the probability that both Dave and Mike will show up? (Round your answer to 2 decimal places.) Probability b. What is the probability that at least one of them will show up? (Round your answer to 2 decimal places.) Probability c. What is the probability that neither Dave nor Mike will show up? (Round your answer to 2 decimal places.) Probabilityarrow_forwardSuppose that Trendy Inc. products a style of a seasonal business suit, Sit-T-Slicker, which has a cost of $500 per unit. The demand during the season for Sit-T-Slicker is generally unknown and could be either: 200, 500, 800, 1100, and 1500 units with equal probabilities. Trendy sells the Sit-T-Slicker suit for $900 per unit during its three-month season, and for $300 per unit when sold after that time. Given the above data, what is the optimal order quantity for the Sit-T-Slicker? What is expected profit? Suppose the probabilities in part a change to 0.05, 0.25, 0.40, 0.25, 0.05 for demand levels 200, 500, 800, 1100, 1500, respectively. What is the optimal order quantity and expected profit in this case? How would better information regarding the demand for the Sit-T-Slicker suit change the data provided in this problem? How would this information affect the answers to part a? Explain.arrow_forwardThe proprietor of Midland Construction Company has to decide between two projects. He estimates that the first project will yield a profit of $160,000 with a probability of 0.7 or a profit of $120,000 with a probability of 0.3; the second project will yield a profit of $220,000 with a probability of 0.6 or a profit of $70,000 with a probability of 0.4.Find the expected profit for each project. first project $ second project $ Which project should the proprietor choose if he wants to maximize his expected profit? first project second projectarrow_forward

- Brian, a landscape architect, submitted a bid on each of three home landscaping projects. He estimates that the probabilities of winning the bid on Project A, Project B, and Project C are 0.7, 0.5, and 0.2, respectively. Assume that the probability of winning a bid on one of the three projects is independent of winning or losing the bids on the other two projects. Find the probability that Brian will experience the following. (a) Win all three of the bids (b) Win exactly two of the bids (c) Win exactly one bidarrow_forwardIn a certain community, eight percent of all adults over age 50 have diabetes. If a health service in this community correctly diagnosis 95% of all persons with diabetes as having the disease and incorrectly diagnoses ten percent of all persons without diabetes as having the disease, find the probabilities that: The health service will diagnose an adult over age 50 as having diabetes. A person over 50 diagnosed by the health service as having diabetes actually has the disease.arrow_forwardA student takes a multiple-choice quiz with 5 questions, each with four possible answers and only oneof them is correct. A passing grade is 60% or better (i.e., answering at least 3 of 5 questions correctly).Suppose that the student was unable to find time to study for the exam and just guesses at eachquestion. Find the probabilities for the two events below.i. the student gets exactly 3 questions correct.ii. the student passes the examarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

MATLAB: An Introduction with ApplicationsStatisticsISBN:9781119256830Author:Amos GilatPublisher:John Wiley & Sons Inc

MATLAB: An Introduction with ApplicationsStatisticsISBN:9781119256830Author:Amos GilatPublisher:John Wiley & Sons Inc Probability and Statistics for Engineering and th...StatisticsISBN:9781305251809Author:Jay L. DevorePublisher:Cengage Learning

Probability and Statistics for Engineering and th...StatisticsISBN:9781305251809Author:Jay L. DevorePublisher:Cengage Learning Statistics for The Behavioral Sciences (MindTap C...StatisticsISBN:9781305504912Author:Frederick J Gravetter, Larry B. WallnauPublisher:Cengage Learning

Statistics for The Behavioral Sciences (MindTap C...StatisticsISBN:9781305504912Author:Frederick J Gravetter, Larry B. WallnauPublisher:Cengage Learning Elementary Statistics: Picturing the World (7th E...StatisticsISBN:9780134683416Author:Ron Larson, Betsy FarberPublisher:PEARSON

Elementary Statistics: Picturing the World (7th E...StatisticsISBN:9780134683416Author:Ron Larson, Betsy FarberPublisher:PEARSON The Basic Practice of StatisticsStatisticsISBN:9781319042578Author:David S. Moore, William I. Notz, Michael A. FlignerPublisher:W. H. Freeman

The Basic Practice of StatisticsStatisticsISBN:9781319042578Author:David S. Moore, William I. Notz, Michael A. FlignerPublisher:W. H. Freeman Introduction to the Practice of StatisticsStatisticsISBN:9781319013387Author:David S. Moore, George P. McCabe, Bruce A. CraigPublisher:W. H. Freeman

Introduction to the Practice of StatisticsStatisticsISBN:9781319013387Author:David S. Moore, George P. McCabe, Bruce A. CraigPublisher:W. H. Freeman

MATLAB: An Introduction with Applications

Statistics

ISBN:9781119256830

Author:Amos Gilat

Publisher:John Wiley & Sons Inc

Probability and Statistics for Engineering and th...

Statistics

ISBN:9781305251809

Author:Jay L. Devore

Publisher:Cengage Learning

Statistics for The Behavioral Sciences (MindTap C...

Statistics

ISBN:9781305504912

Author:Frederick J Gravetter, Larry B. Wallnau

Publisher:Cengage Learning

Elementary Statistics: Picturing the World (7th E...

Statistics

ISBN:9780134683416

Author:Ron Larson, Betsy Farber

Publisher:PEARSON

The Basic Practice of Statistics

Statistics

ISBN:9781319042578

Author:David S. Moore, William I. Notz, Michael A. Fligner

Publisher:W. H. Freeman

Introduction to the Practice of Statistics

Statistics

ISBN:9781319013387

Author:David S. Moore, George P. McCabe, Bruce A. Craig

Publisher:W. H. Freeman