FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

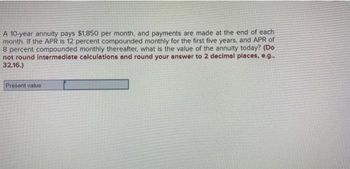

Transcribed Image Text:A 10-year annuity pays $1,850 per month, and payments are made at the end of each

month. If the APR is 12 percent compounded monthly for the first five years, and APR of

8 percent compounded monthly thereafter, what is the value of the annuity today? (Do

not round intermediate calculations and round your answer to 2 decimal places, e.g...

32.16.)

Present value

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Determine the amount of the ordinary annuity at the end of the given period. (Round your final answer to two decimal places.) $600 deposited quarterly at 6.8% for 10 years.arrow_forwardAn annuity has payments at the beginning of every three months starting today. The first payment is $100 and payments increase by 1% every three months for the first four years, making the 16th payment $116.10 to the nearest cent. After this, payments increase by $1 every three months for 32 additional payments, making 48 payments in total. If d (5) = 5.5%, find the present value of this annuity.arrow_forwardA 20-year annuity was purchased with $180,000 that had accumulated in an RRSP. The annuity provides a semiannually compounded rate of return of 5% and makes equal month-end payments. What will be the principal portion of Payment 134?arrow_forward

- An ordinary annuity pays 8.28% compounded monthly. (A) A person deposits $100 monthly for 30 years and then makes equal monthly withdrawals for the next 15 years, reducing the balance to zero. What are the monthly withdrawals? How much interest is earned during the entire 45-year process? (B) If the person wants to make withdrawals of 1,500 per month for the last 15 years, how much must be deposited monthly for the first 30 years? (A) The monthly withdrawals are $ (Round to the nearest cent as needed.)arrow_forwardA 15-year annuity pays $1,750 per month, and payments are made at the end of each month. If the APR is 9 percent compounded monthly for the first seven years, and APR of 6 percent compounded monthly thereafter, what is the value of the annuity today? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) Present valuearrow_forwardThe compounding periods and the payment periods are the same for an annuity and for an amortization. Determine the present value of the annuity that will pay the given periodic payments. (Round your final answer to two decimal places.) Periodic payments of $2400 annually for 13 years. The interest is 4% compounded annually.arrow_forward

- If you have a 13-year annuity paying $305 quarterly in 5 years when interest is 3.25% compounded semi-annually, what is the number of missed payments? Treat the deferred annuity as an ordinary annuity with the first annuity payment at the 5-year mark.arrow_forwardAn annuity-due makes payments of $15 every other year, with the first payment beginning immediately. The annuity-due makes ten payments. The nominal annual interest rate compounded semiannually is 5%. Calculate the present value of the annuity due. a. 100.0958 O b. 93.2775 O c. 66.7310 d. 124.3700 O e. 133.4620arrow_forwardMonthly payments of $75 are paid into an annuity beginning on January 31, with a yearly interest rate of 9%, compounded monthly. Add the future values of each payment to calculate the total value of the annuity on September 1. On September 1, the value of the annuity will be $_____________?arrow_forward

- An annuity is paid half-yearly in arrears at a rate of 9000 per annum, for 11 years. The rate of interest is 3% per quarter-year effective. Calculate the accumulation of the annuity at the end of 11 years. Give your answer to two decimal places.arrow_forwardA 13-year annuity pays $1,400 per month, and payments are made at the end of each month. The interest rate is 7 percent compounded monthly for the first six years and 5 percent compounded monthly thereafter. What is the present value of the annuity?arrow_forwardAssuming a 12% annual interest rate, determine the present value of a five-period annual annuity of $6,500 under each of the following situations: Note: Use tables, Excel, or a financial calculator. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) 1. The payments are received at the end of each of the five years and interest is compounded annually. 2. The payments are received at the beginning of each of the five years and interest is compounded annually. 3. The payments are received at the end of each of the five years and interest is compounded quarterly. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Deposit Date The payments are received at the end of each of the five years and interest is compour Note: Round your final answers to nearest whole dollar amount. First payment Second payment Third payment Fourth payment Fifth payment j= 3% 3% 3% 3% 3% Required 3 X Answer is complete but not entirely corre n= 4 ✓ $ 8 12 16 ✓…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education