Question

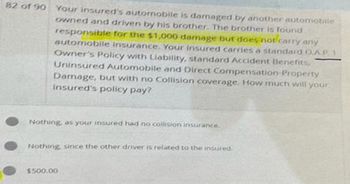

Transcribed Image Text:82 of 90 Your insured's autornobile is damaged by another automobile

owned and driven by his brother. The brother is found

responsible for the $1,000 damage but does not carry any

automobile insurance. Your insured carries a standard O.A.P

Owner's Policy with Liability, standard Accident Benefits,

Uninsured Automobile and Direct Compensation Property

Damage, but with no Collision coverage. How much will your

insured's policy pay?

Nothing, as your insured had no collision insurance.

Nothing, since the other driver is related to the insured.

$500.00

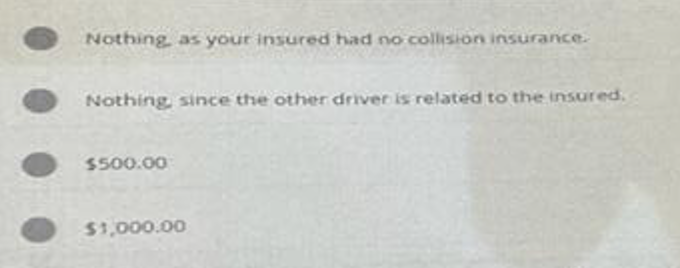

Transcribed Image Text:Nothing, as your insured had no collision insurance.

Nothing, since the other driver is related to the insured.

$500.00

$1,000.00

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Similar questions

- Zach had surgery, which was his third claim of the year. He had a bill of $5000.Considering the prior visits, what is Zach’s portion of this bill and what is theresponsibility of the insurance carrier?arrow_forwardBuyer Bert can't believe that Seller Sam has had a last-second change of heart about entering into an agreement to sell his home to Bert. Sam has offered to refund Bert's earnest money and even pay him something in acknowledgment of Bert's inconvenience and disappointment, but Bert's not having it. He wants Sam's house. Choose the remedy for breach of trust that Bert will most likely take. demand specific performance initiate rescission accept compensatory damages settle for liquidated damagesarrow_forwardAn individual who has liability, medical payments, uninsured motorist, other than collision, collision, crashed into a flower shop. Damage to the shop would be paid under which coverage? A- collision coverage B- uninsured motorist C- medical payments D- liabilityarrow_forward

- Calculator The Coinsurance cause in an individual Medical Expense policy refers to the OA insured's rights to have another person, such as a spose or dinned on the same poky OB. company cay esse corage op insurance company's right to join with and insurance company's right to share OC in ce with another c Insurance company's right to the hosto de detale percentage of the cost of com OD.arrow_forwardYour insureds occupy a single family detached dwelling. For economic reasons, they are considering renting the finished basement to a tenant. What affect will this have on their Homeowners Policy? O A) None at all. Renting part of a dwelling is not considered a commercial activity. O B) They will have to install a smoke detector in the basement and the policy will then be in full force. O C) The policy will have to be cancelled and re-issued on a Secondary Dwelling form. O D) The policy must be endorsed to declare it is no longer a single family, owner- occupied dwelling."arrow_forwardShould FedEx be liable for the alleged loss of valuable rare coins when FedEx did not know what the package contained. Rykard v. FedEx Ground Package System.arrow_forward

- S insured his appliance store under an owner, landlords, and tenant’s policy that included products liability coverage. While he was demonstrating a microwave oven the door came open and injured a customer. Which of the following would protect S? The oven manufacture’s products liability policy The premises-operation section on S’s policy The products Liability section on S’s policy The incidental contracts section of S’s policyarrow_forward13) Garrett works as an electrician, going into people's homes and offices to set up and repair 13) electrical systems. When he sees a dangerous condition, he reports it to the home or business owner immediately and begins working to fix the situation. He wears safety goggles and gloves while he is working, and he has a comprehensive insurance plan with income protection in the event that he becomes unable to work. Garrett's actions are most related to Maslow's needs. A) social B) physiological C) esteem D) self-actualization E) securityarrow_forward13. Sam Fraser, 24 years of age and single, possesses a two-year-old vehicle which he drives to work (a distance of 7(1/2) miles, full circle). He keeps the vehicle in 03 region, and has had one auto crash during the previous three years. What amount would Sam save money on a mix of $100-deductible impact and thorough inclusion on the off chance that he drove a vehicle delegated image 1 instead of as image 5? We don't know whether Sam has had driver preparing.arrow_forward

- Scenario B (Australian Taxation Law): – Taxpayers at retirement age Inder Muller, aged 58, recently retired from his employment as chief accountant of Moon Light Pty Ltd, after 17 years and 4 months of service. Inder’s wife Belinda, aged 59, is currently running a small newsagency. Inder and Belinda visited you to seek advice on various retirement planning options specified below. Inder and Belinda both are covered by private health insurance. 2) Regarding Inder’s Termination payment & Superannuation Inder currently has superannuation valued at $582,000 with the Suncorp (complying Super fund). The total amount includes the following elements; > Tax free component $25,000 > Element untaxed in the fund $207,000 > Element taxed in the fund $350,000LAW6001 Required Advise Inder what would be the tax consequences of withdrawing his super prior to his retirement age, including all options available to him.arrow_forwardUnder a Commercial General Liability policy, which of the following actions is an obligation of the insurer? OA. To inspect the insured premises for safety OB. To renew the policy period from the date of loss OC. To pay claims only when there has been a judgment against the insured To pay a daim for which the insured has been found legally responsible ODarrow_forwardWhich of the following sections of an insurance contract limits coverage? A Waiver of Premian OB OC OD. Conditions Exclusions Declarationsarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios