ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

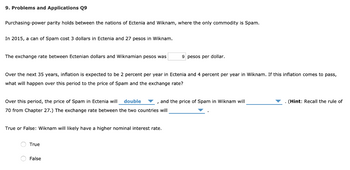

Transcribed Image Text:9. Problems and Applications Q9

Purchasing-power parity holds between the nations of Ectenia and Wiknam, where the only commodity is Spam.

In 2015, a can of Spam cost 3 dollars in Ectenia and 27 pesos in Wiknam.

The exchange rate between Ectenian dollars and Wiknamian pesos was

Over the next 35 years, inflation is expected to be 2 percent per year in Ectenia and 4 percent per year in Wiknam. If this inflation comes to pass,

what will happen over this period to the price of Spam and the exchange rate?

Over this period, the price of Spam in Ectenia will double , and the price of Spam in Wiknam will

70 from Chapter 27.) The exchange rate between the two countries will

True or False: Wiknam will likely have a higher nominal interest rate.

9 pesos per dollar.

True

False

(Hint: Recall the rule of

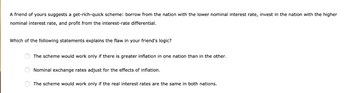

Transcribed Image Text:A friend of yours suggests a get-rich-quick scheme: borrow from the nation with the lower nominal interest rate, invest in the nation with the higher

nominal interest rate, and profit from the interest-rate differential.

Which of the following statements explains the flaw in your friend's logic?

The scheme would work only if there is greater inflation in one nation than in the other.

O Nominal exchange rates adjust for the effects of inflation.

The scheme would work only if the real interest rates are the same in both nations.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- a. What is purchasing power parity and how is it related to the law of one price?b. Is it reasonable to suppose that purchasing power parity holds in the long run but not in the short run?arrow_forwardWhy does purchasing-power parity theory NOT hold at all times? Select one: a. because prices are different across countries b. because wages are higher in some countries and lower in others c. because some goods and services cannot be traded d. because countries use different currenciesarrow_forward(a) Consider the exchange rate between US dollar and British pound. Let CPI be the consumer price index, or equivalently the average price level in a country. Assume the ratio CPIUK/CPIUS =0.75. According to the law of one price, what must be the exchange rate between US dollar and British pound (i.e. 1 pound equals to how many dollars)? Sunnese theore are three investment nroiects A. R. Rand Carrow_forward

- do fastarrow_forwardQuestion 2 of 25 In which situation is a country most likely to choose a flexible exchange rate for its currency? O A. A country believes that its currency will be in low demand in global markets. B. A country worries that the value of its currency could rise and fall unpredictably. C. A country has a reputation for having a strong and stable economy over time. O D. A country wants to make sure that its currency is stable in all economic situations.arrow_forward1. If Thalland wants to maintain a fixed exchange rate of 1 baht per euro, it should ___________ euros in the foreign exchange market. To be successful, this policy would have to ___________ euros by______ billion euros at any given exchange rate. 2. If investors believe the baht is going to be _________ as a result of the change in demand, a speculative attack may occur. 3. True or False: in the event of a successful speculative attack. Thai businesses tend to suffer because their foreign debt will now cost more to repay. True Falsearrow_forward

- Which of the following will most likely cause a nation's currency to appreciate on the foreign exchange market? a. A decrease in domestic interest rates O b. An increase in foreign interest rates c. Stable domestic prices while the nation's trading partners are experiencing 10 percent inflation O d. Domestic inflation of 10 percent while the nation's trading partners are experiencing stable pricesarrow_forwardA6 How long a country can sustain a surplus or deficit on its long-term capital account, are there any limits? Explain this. Should Americans worry about the size of the deficit in the current account of the US balance of payments? Also, Is there a limit to how long a country can sustain a surplus or deficit on its current account? elaborate it.arrow_forward36. When a country's goods and services are expensive relative to other countries', we say that its currency is ________ in terms of purchasing power parity. Question 36 options: a) irrational b) rational c) overvalued d) undervaluedarrow_forward

- I need help on this ASAP: The following questions are related to foreign exchange markets.(1) Explain the theory of Purchasing Power Parity (PPP) and give a real-world example(2) An investor in the UK purchased a 60-day T-bill for $875.65. At that time, theexchange rate was $1.5 per pound. At maturity, the exchange rate was $1.83 perpound . What was the investor's holding period return in pounds?arrow_forwardAdvanced Analysis: Refer to the following table, in which Qd is the quantity of loonies demanded, P is the dollar price of loonies, Qs is the quantity of loonies supplied in year 1, and Qs' is the quantity of loonies supplied in year 2. All quantities are in billions. Further, assume that the exchange rate is fixed at 110. Qd P Qs Qs' 10 125 30 20 15 120 25 15 20 115 20 10 25 110 15 5 Instructions: Enter your answers as whole numbers. a. In year 1, what would be the minimum initial size of the U.S. reserve of loonies such that it could maintain the peg throughout the year? billion loonies b. What about the minimum initial size that would be necessary at the start of year 2? billion loonies Next, consider only the data for year 1. c. What peg should the United States set if it wants the fixed exchange rate to increase the domestic money supply by $1.2 trillion? dollars per looniearrow_forwardSuppose the theory of purchasing power parity (PPP) is true. If inflation is higher in Eurozone than in Australia, which of the following is TRUE? a.The nominal exchange rate, expressed in euros per Australian dollar, increases b.The nominal exchange rate, expressed in euros per Australian dollar, decreases c.The nominal exchange rate, expressed in euros per Australian dollar, does not change d.None of the other optionsarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education