ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

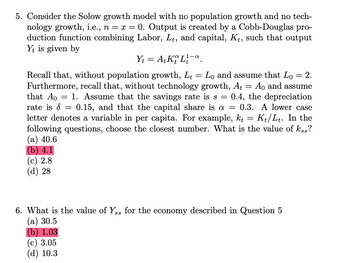

Transcribed Image Text:5. Consider the Solow growth model with no population growth and no tech-

nology growth, i.e., n = x = 0. Output is created by a Cobb-Douglas pro-

duction function combining Labor, Lt, and capital, Kt, such that output

Yt is given by

Y₁ = At Ko La

=

=

=

2.

Ao and assume

Recall that, without population growth, L₁ = Lo and assume that Lo

Furthermore, recall that, without technology growth, At

that Ao = 1. Assume that the savings rate is s

rate is 8: 0.15, and that the capital share is a =

letter denotes a variable in per capita. For example, kt

=

0.4, the depreciation

0.3. A lower case

=

Kt/Lt. In the

following questions, choose the closest number. What is the value of kss?

(a) 40.6

(b) 4.1

(c) 2.8

(d) 28

6. What is the value of Ys for the economy described in Question 5

(a) 30.5

(b) 1.03

(c) 3.05

(d) 10.3

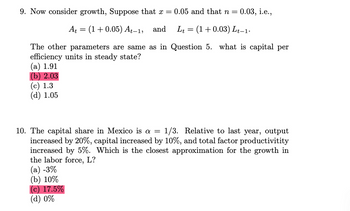

Transcribed Image Text:9. Now consider growth, Suppose that x =

0.05 and that n =

0.03, i.e.,

A₁ = (1+0.05) At−1, and L₁ = (1 + 0.03) Lt−1·

The other parameters are same as in Question 5. what is capital per

efficiency units in steady state?

(a) 1.91

(b) 2.03

(c) 1.3

(d) 1.05

10. The capital share in Mexico is a = 1/3. Relative to last year, output

increased by 20%, capital increased by 10%, and total factor productivitity

increased by 5%. Which is the closest approximation for the growth in

the labor force, L?

(a) -3%

(b) 10%

c) 17.5%

(d) 0%

SAVE

AI-Generated Solution

info

AI-generated content may present inaccurate or offensive content that does not represent bartleby’s views.

Unlock instant AI solutions

Tap the button

to generate a solution

to generate a solution

Click the button to generate

a solution

a solution

Knowledge Booster

Similar questions

- Question Please provide justified answer asap to get a upvotearrow_forwardWhat is the mechanism in the Solow model that generates growth? Why isthis an appealing mechanism? Why does it fail to deliver economic growth inthe long run?arrow_forward5. When was the Solow growth model developed and what was significant about that period? What did it predict that was significant at the time? When was the endogenous growth model developed? What did researchers observe the world that led to its development? What is the main feature that differentiates the two?arrow_forward

- The basic Solow growth model was initially used to help governments of very low income nations measure what source of real GDP growth? O a) Growth due to factor accumulation. b) Growth due to technological progress. Oc) Growth due to efficiency gains. d) All of the abovearrow_forwardConsider the Solow growth model with no population growth and no tech- nology growth, i.e., n = x = 0. Output is created by a Cobb-Douglas pro- duction function combining Labor, Lt, and capital, Kt, such that output Yt is given by Y₁ = A+ KL-a = = 2. Recall that, without population growth, Lt = Lo and assume that Lo Furthermore, recall that, without technology growth, At Ao and assume that A0 = 1. Assume that the savings rate is s = 0.4, the depreciation rate is = 0.15, and that the capital share is a = 0.3. A lower case letter denotes a variable in per capita. For example, kt = K₁/Lt. In the following questions, choose the closest number. What is the value of kss? (a) 40.6 (b) 4.1 c) 2.8 (d) 28arrow_forwardConsider the Solow growth model with no population growth and no tech- nology growth, i.e., n = x = 0. Output is created by a Cobb-Douglas pro- duction function combining Labor, Lt, and capital, Kt, such that output Yt is given by Y₁ = A+ KL₁-a = = Ao and Recall that, without population growth, Lt Lo and assume that Lo = 10. Furthermore, recall that, without technology growth, At assume that A0 = 2. Assume that the savings rate is s = 0.2, the depre- ciation rate is 8 = 0.1, and that the capital share is a = 0.3. A lower case letter denotes a variable in per capita. For example, kt= Kt/Lt. In the following questions, choose the closest number. What is the value of kss? (a) 72 (b) 27 (c) 7.2 (d) 2.7 What is the value of Yss for the Economy described in Question 7 (a) 36 (b) 3.6 (c) 2.7 (d) 27 Suppose that the economy described in Question 7 economy starts with Ко = 10. Choose the correct one for the change in capital over time. (a) fall (b) grow (c) Once dropped, it grows (d) unchange…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education