ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

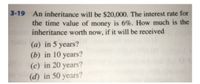

Transcribed Image Text:An inheritance will be $20,000. The interest rate for

the time value of money is 6%. How much is the

inheritance worth now, if it will be received

3-19

(a) in 5 years?

(b) in 10 years?

(c) in 20 years?

(d) in 50 years?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- Year Cash Flow S100,000 $30.000 $35.000 $5,000 S30.000 $40.000 3 4. Annual Interest rate - 5.5% a) Calculate the Present worth b) Calculate the equivalent annuity for these cash flowsarrow_forwardIt’s time to get a new laptop that is $2500. If you finance it, you will be charged 8% annual interest and it will take you two years to pay it off, paying each month. (A)How much will you pay each month for this laptop? (B)What are your total acquisition costs of financing the laptop?arrow_forwardA mom would like to open a savings account for her new born son's university education. Her plan is to deposit $5,000 at the end of each year for 18 years. From her job, she is expecting a promotion bonus of $4,000 at the end of 8 years that she can deposit directly to her son's university fund. However, she needs to get a new car 5 years from now with a down payment, so she realizes she cannot save any money for her son's university fund during that year. If the underlying savings account pays 8% interest compounded annually, how much money would her son have in this account at the end of 18 years? Please show all steps!!arrow_forward

- What is the equivalent present amount to an accumulation of $375,000 17 years from now at 9% interest? (a). $78,443 (b). $86,652 (c). $90,776 (d). $80,423arrow_forwardYou owe P30,000 due at the end of 3 years without interest. After 2 years, you want to pay the loan, how much should your creditor be willing to accept at the least? Money is worth 8%. 5.arrow_forward8-23 Three mutually exclusive projects are being considered:arrow_forward

- Some laboratory equipment sells for $75,000. The manufacturer offers financing at 8% with annual payments for 4 years for up to $50,000 of the cost. The salesman is willing to cut the price by 10% if you pay cash. What is the interest rate you would pay by financingarrow_forwardThe incomes for a business for 5 years are as follows: $8250, $12,600, $9,750, $11,400, and $14,500. If the value of money is 8%, what is the equivalent uniform annual benefit for the 5-year period?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education