ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

Please show equations used.

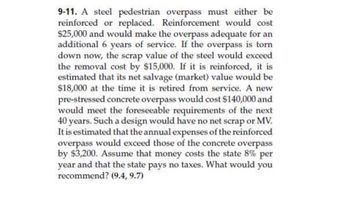

Transcribed Image Text:9-11. A steel pedestrian overpass must either be

reinforced or replaced. Reinforcement would cost

$25,000 and would make the overpass adequate for an

additional 6 years of service. If the overpass is torn

down now, the scrap value of the steel would exceed

the removal cost by $15,000. If it is reinforced, it is

estimated that its net salvage (market) value would be

$18,000 at the time it is retired from service. A new

pre-stressed concrete overpass would cost $140,000 and

would meet the foreseeable requirements of the next

40 years. Such a design would have no net scrap or MV.

It is estimated that the annual expenses of the reinforced

overpass would exceed those of the concrete overpass

by $3,200. Assume that money costs the state 8% per

year and that the state pays no taxes. What would you

recommend? (9.4, 9.7)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- Define the term Routine Annual Maintenance Costs?arrow_forwardI can not get 7.2, 7.8 or 8.3 when I do the calculations. How did you get them?arrow_forwardCan you help with the three questions on my worksheet that relate to the attached graph? Can you also advise if I have done my math correctly?arrow_forward

- Shane teaches guitar lessons. The graph below shows the comparison of his expenses and revenue for one month. r ($) L -1000 000 -600 200 Number of Lessons Expenses Revenue How many lessons must he teach to break even?arrow_forwardIn the late 1980s land prices in Japan surged upward in a speculative bubble. Land prices then fell for 11 straight years between 1990 and 2001. What can we safely assume happened to land rent in Japan over those 11 years? Use graphical analysis to illustrate your answer. graphical analysis is must, you have to draw graph. Do not provide handwritten solution. Maintain accuracy and quality in your answer. Take care of plagiarism. Answer completely. You will get up vote for sure.arrow_forwardTyped plz Please provide me a solution stp by step i want quality solution also tske care of plagiarism alsoarrow_forward

- Consider the following data on a firm: Number of Units Sold Total Revenue (£'s) 10 20 30 40 50 60 70 100 180 240 280 300 300 280 Fixed Costs are £100, Variable costs are constant at £3 per (i) Write a table showing the price and quantity sold. (ii) Calculate the profit maximising output of the firm (iii) What are the profits at the profit maximising output? (v) unit produced. (iv) What is the average variable cost at the profit maximising output? What is the arc price elasticity of demand between 40 and 50 units?arrow_forwardwhat is Operational definition Repeat Purchase for food customer?arrow_forwardCalculate the value of Average revenue for 4 units sold when the total revenue is $100arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education