FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

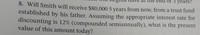

Transcribed Image Text:3 years?

8. Will Smith will receive $80.000 5 years from now, from a trust fund

established by his father. Assuming the appropriate interest rate for

discounting is 12% (compounded semiannually), what is the present

value of this amount today?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Katie is planning to receive an annuity of $7,545 per year for the next 38 years as part of her retirement plan. The interest rate is 0.06 per annum compounded annually. Calculate the present value (PV) of this annuity $6,191.79 $1,484.60 $4,920.36 $5,190,960.00 $112,013.21arrow_forwardHow much would you accept in a lump sum today, in place of a lottery payment of $35,000 at the end of the next 20 years ($700,000 in total), assuming you could invest it at a 6 percent rate?arrow_forwardTo accumulate $100,000 for your child's 18th birthday, you need to invest a certain amount annually, excluding the 5th birthday deposit. The first deposit is made the day your child is born. To find this amount (X), considering a 8% annual rate of return:arrow_forward

- To save for her newborn son's college education, Lea Wilson will invest P1,000 at the beginning of each year for the next 18 years. The interest rate is 12 percent. What is the future value? * 55,750. O 7,690 34,931. O 63,440. O 62,440.arrow_forwardConsider an inheritance that pays the beneficiary an annuity of $500 that begins immediately (an annuity due) and then annually in year 1 through year 17 (for a total of 18 years) with one exception - the payment in year 12, and only 12, is not $500 but $0. Using an interest rate of 3%, determine the present value of this cash flow stream.arrow_forwardThe Good Fairy has offered to give you $1,000,000 in 20 years. She has volunteered to deposit the present value of the $1,000,000 in a trust managed by a bank or insurance company of your choice. How much must the Good Fairy deposit if the investment earns annual compounding interest of 5 percent?arrow_forward

- Mary is going to receive a 31-year annuity of $8,600 per year. Nancy is going to receive a perpetuity of $8,600 per year. If the appropriate interest rate is 9 percent, how much more is Nancy’s cash flow worth?arrow_forwardAssume that Dorothy Williams desires to accumulate $926,000 in 15 years using her money market fund balance of $254,222. At what interest rate must Dorothy’s investment compound annually?arrow_forwardQ3) Mr. Clifton Chen, aged 39, recently purchased an endowment plan from an insurer that requires him to set aside $25,000 per year for the next 23 years till he retires at age 62. The first premium payment occurs at the beginning of the period. Assuming an inflation rate of 2% and an estimated rate of return of 3.2% from the endowment plan, what is the estimated future value of Clifton’s regular savings at age 62?arrow_forward

- Your grandparents would ilke to establish a trust fund that will pay you and your heirs $125,000 per year forever with the first payment 10 years from today. If the trust fund earns an annual return of 2.4 percent, how much must your grandparents deposit today?arrow_forwardToday is January 1, 2022. Roy will use a single premium to purchase an annuity today. This annuity pays $10,000 at the end of each year while Roy is alive. The estimated probability of Roy surviving for the next 4 years is stated in following table. The yield rate is assumed to be j₁ = 4.5% p.a. Calculate the premium value. Round your answer to three decimal places. Year 1 2 3 4 Probability of surviving from start of year to end of year a. $17490.442 b. $19100.000 c. $14729.264 d. $17651.074 0.83 0.62 0.46 0 Today is 1 July, 2022, Georg plans to purchase a corporate bond with a coupon rate of j2 = 3.15% p.a. and a face value of $100. This corporate bond matures at par. Its maturity date is 1 January, 2025. The yield rate is assumed to be j₂ = 4.7% p.a. Assume that this corporate bond has a 9% chance of default in any six-month period during its term. Assume, also, that, if default occurs, Georg will receive no further payments at all. Calculate Georg's purchase price. Round your answer…arrow_forwardGary is planning for his retirement this year. One option that has been presented to him is the purchase of an annuity that would provide a $31, 000 payment each year for the next 18 years. Factor Table Appendix 9.1 Present value of $1 received in n periods = 0.1799 Appendix 9.2 Present value of an annuity of $1 per period= 8.2014 Calculate how much Gary should be willing to pay for the annuity if he can invest his funds at 10% ( For calculation purposes, use 4 decimal places as displayed in the factor table provided and round the final answer to 0 decimal places, e.g. 58,971)arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education