ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

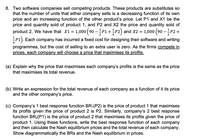

Transcribed Image Text:8. Two software companies sell competing products. These products are substitutes so

that the number of units that either company sells is a decreasing function of its own

price and an increasing function of the other product's price. Let P1 and X1 be the

price and quantity sold of product 1, and P2 and X2 the price and quantity sold of

product 2. We have that X1 = 1,000 (90 –P1 +P2) and X2 = 1,000 (90 –P2 +

P1). Each company has incurred a fixed cost for designing their software and writing

programmes, but the cost of selling to an extra user is zero. As the firms compete in

prices, each company will choose a price that maximises its profits.

(a) Explain why the price that maximises each company's profits is the same as the price

that maximises its total revenue.

(b) Write an expression for the total revenue of each company as a function of it its price

and the other company's price.

(c) Company's 1 best response function BR1(P2) is the price of product 1 that maximises

its profits given the price of product 2 is P2. Similarly, company's 2 best response

function BR2(P1) is the price of product 2 that maximises its profits given the price of

product 1. Using these functions, write the best response function of each company

and then calculate the Nash equilibrium prices and the total revenue of each company.

Show diagrammatically the BRs and the Nash equilibrium in prices.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- Your firm, Content Colleague, is similar to Happy Worker, a Canadian company that designs and manufactures toys and collectibles. Your research analyst has estimated the demand function for your stuffed toy animals is: If you set the price of a plush toy at $6, the number of toys that consumers will buy is [ million. Q=30 million - (4 million x P).arrow_forward7. Substitutes, complements, or unrelated? You work for a marketing firm that has just landed a contract with Run-of-the-Mills to help them promote three of their products: splishy splashers, raskels, and kipples. All of these products have been on the market for some time, but, to entice better sales, Run-of-the-Mills wants to try a new advertisement that will market two of the products that consumers will likely consume together. As a former economics student, you know that complements are typically consumed together while substitutes can take the place of other goods. Run-of-the-Mills provides your marketing firm with the following data: When the price of splishy splashers decreases by 8%, the quantity of raskels sold increases by 6% and the quantity of kipples sold decreases by 8%. Your job is to use the cross-price elasticity between splishy splashers and the other goods to determine which goods your marketing firm should advertise together. Complete the first column of the…arrow_forwardYou are the manager of a firm that receives revenues of $40,000 per year from product X and $80,000 per year from product Y. The own price elasticity of demand for product X is −1.5, and the cross-price elasticity of demand between product Y and X is −1.8.How much will your firm's total revenues (revenues from both products) change if you increase the price of good X by 1 percent?arrow_forward

- Q3. Refer to the diagram. Using the midpoint formula, calculate the price elasticity of demand between the prices of $15 and $12. Accordingly, state whether demand is elastic or inelastic between these two points. P$/unit 15 12 D 18 22 Q (units/week) Ep = Damand ie ... Q4. For each case below, answer the bolded questio Classification of the Case Calculations product(s) if requested to do so 1. Suppose that a 2% increase in income in the economy decreases the quantity of gadgets demanded by 1% ar every E,= Gadgets are possible price. Find the income elasticity of demand and dassify the product accordingly (state whether gadgets is a normal, necessity, luxury or an inferior product). 2. A firm finds that its price elasticity of demand is 4.0. Currently, the firm is selling 2000 units per month at $5 per unit. Price must be lowered by= If it wishes to increases its quantity sold by 10%, by how much it must lower its price? 1 Suppose legalization-and subseque nt regulation-of products Xand…arrow_forwardv Question Completion Status: 28 24 20 S2 16 S1 ND1 D2 01 0 4 4 8 12 16 20 24 Q 14. If this figure depicts the market for product X, and the demand for product X changed from D2 to D1 as a result of an increase in the price of a related product Y from $45 to $55, the cross price elasticity of demand for product X (calculated at Px = $18) is and the two products are O "1/6, substitutes" "6, substitutes" O "-6, complements "1/6, complements" QUESTION 15. Click Save and Submit to save and submit. Click Save All Answers to save all answers. Save All Answers 46 24 L AUG P 13 21 .... 284arrow_forward5.(a). Calculate the point advertising elasticity of demand for advertising expenditures (A) = $10000 also with PT = $10000 (which should make QT= 370). Other variables and their values are given at the top, before question #1. The formula is: (b). Does this elasticity indicate that demand for Toyotas is very responsive to changes in advertising expenditures (thus suggesting that advertising is a very important way to increase sales)? Explain why or why not.arrow_forward

- Q. Wilpen Company, a price-setting firm, produces nearly 80 percent of all tennis balls purchased in the United States. Wilpen estimates the U.S. demand for its tennis balls by using the following linear specification: Q = a + bP + cM + dPR. Where Q is the number of cans of tennis balls sold quarterly, P is the wholesale price Wilpen charges for a can of tennis balls, M is the consumers’ average household income, and PR is the average price of tennis rackets. The regression results are as follows: a- Discuss the statistical significance of the parameter estimates a^, b^, c^, and d^ using the p-values. Are the signs of b^, c^, and d^ consistent with the theory of demand? Wilpen plans to charge a wholesale price of $1.65 per can. The average price of a tennis racket is $110, and consumers’ average household income is $24,600. b. What is the estimated number of cans of tennis balls demanded? c) At the values of P, M, and Pr given, what are the estimated values of the price (E^), income…arrow_forwardJim's Camera shop sells two high-end cameras, the Sky Eagle and Horizon. The demand for these two cameras are as follows (DS = demand for the Sky Eagle, Ps is the selling price of the Sky Eagle, DH is the demand for the Horizon and PH is the selling price of the Horizon): Ds = 230 - 0.5 Ps + 0.38 PH DH = 260 + 0.1 Ps - 0.62 PH The store wishes to determine the selling price that maximizes revenue for these two products. Select the revenue function for these two models. Choose the correct answer below. (i) Ps Ds + PHDH = PH(260 - 0.1 Ps - 0.62 PH) + Ps(230 - 0.5 Ps + 0.38 PH) (ii) Ps Ds - PH DH = Ps(230 - 0.5 Ps + 0.38 PH) - PH(260 - 0.1 Ps - 0.62 PH) (iii) Ps Ds + PH DH = Ps(230 - 0.5 Ps + 0.38 PH) + PH(260 + 0.1 Ps - 0.62 PH) (iv) Ps Ds - PH DH = Ps(230 + 0.5 Ps + 0.38 PH) - PH(260 - 0.1 Ps - 0.62 PH) Answer: Option 3 Find the prices that maximize revenue. Do not round intermediate calculations. If required, round your answers to two decimal places. Optimal Solution:…arrow_forwardGr8 Ideaz Inc. has determined that the demand function for their heated socks is given by: 5 7P². a. Find E(p), the Elasticity of Demand as a function of price, p. E(p) = b. Find the Elasticity of Demand when heated socks are selling at a price of $10. Give result accurate to at least 3 decimal places. E(10) = c. At this price ($10): We would say the demand for heated socks is: Select an answer Based on this, in order to increase revenue we should: Select an answer d. Use the Elasticity model to determine the price that maximizes revenue. (Round result to 2 decimal places.) D(p) = = 345- p=arrow_forward

- The following table shows worldwide sales of a certain type of cell phone and their average selling prices in 2012 and 2013. Year 2012 2013 Selling Price ($) Sales (millions) 928 1,144 375 335 (a) Use the data to obtain a linear demand function for this type of cell phone. (Let p be the price, and let q be the demand). q(p): -5.4p + 3185 X Use your demand equation to predict sales if the price is lowered to $255. 1808 x million phones (b) Fill in the blank. For every $1 increase in price, sales of this type of cell phone decrease by 5.4 million units.arrow_forwardQUESTION 2 Replicas of popular mid-century furniture and homeware can be highly sought after by interior designers. Suppose a company sold 1000 replica Eames chairs for a price of $600 each. However, when they set the price at $750, they only sold 750. Which of the following statements are true: The point price elasticity of demand for replica Eames chairs at a price of $600 is unit elastic. At a price of $600 per chair, a 1% increase in the price of replica Eames chairs would lead to a 1% decrease in the quantity of chairs sold. The point price elasticity of demand for replica Eames chairs at a price of $600 is 0.0239 (to four decimal places). The point price elasticity of demand for replica Eames chairs at a price of $600 is 0.02 (to two decimal places).arrow_forward8. Substitutes, complements, or unrelated? You work for a marketing firm that has just landed a contract with Run-of-the-Mills to help them promote three of their products: penguin patties, raskels, and kipples. All of these products have been on the market for some time, but, to entice better sales, Run-of-the-Mills wants to try a new advertisement that will market two of the products that consumers will likely consume together. As a former economics student, you know that complements are typically consumed together while substitutes can take the place of other goods. Run-of-the-Mills provides your marketing firm with the following data: When the price of penguin patties decreases by 1%, the quantity of raskels sold decreases by 18% and the quantity of kipples sold increases by 3%. Your job is to use the cross-price elasticity between penguin patties and the other goods to determine which goods your marketing firm should advertise together. Complete the first column of the following…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education