FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

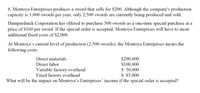

Transcribed Image Text:8. Montoya Enterprises produces a sword that sells for $200. Although the company's production

capacity is 3,000 swords per year, only 2,500 swords are currently being produced and sold.

Humperdinck Corporation has offered to purchase 500 swords as a one-time special purchase at a

price of $160 per sword. If the special order is accepted, Montoya Enterprises will have to incur

additional fixed costs of $2,000.

At Montoya's current level of production (2,500 swords), the Montoya Enterprises incurs the

following costs:

Direct materials

$200,000

$100,000

$ 50,000

$ 85,000

Direct labor

Variable factory overhead

Fixed factory overhead

What will be the impact on Montoya's Enterprises' income if the special order is accepted?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Sam's Auto Shop services and repairs a particular brand of foreign automobile. Sam uses oil filters throughout the year. The shop operates 52 weeks per year and weekly demand is 130 filters. Sam estimates that it costs $20 to place an order and his annual holding cost rate is $3 per oil filter. Currently, Sam orders in quantities of 650 filters. Calculate the total annual costs associated with Sam's current ordering policy. Total annual costs = $arrow_forwardRadar Company sells bikes for $490 each. The company currently sells 3.700 bikes per year and could make as many as 5,000 bikes per year. The bikes cost $275 each to make: $160 in variable costs per bike and $115 of fixed costs per bike. Radar received an offer from a potential customer who wants to buy 800 bikes for $440 each. Incremental fixed costs to make this order are $47,000. No other costs will change if this order is accepted. Compute Radar's additional income (ignore taxes) if it accepts this order. Contribution margin Incremental Amount per Unit Incremental Fixed Costs Incremental income (loss) from new business The company should Incremental Income from New Businessarrow_forwardAnderson Inc. uses packing machines to prepare their product for shipping. One machine costs $136,000 and lasts about 5 years before it needs to be replaced. The operating cost per machine is $6,500 a year. Ignoring taxes, what is the equivalent annual cost of one packing machine if the required rate of return is 11%? Multiple Choice $49,904 $51,036 $44,298 $43,298 $50,776arrow_forward

- Radar Company sells bikes for $500 each. The company currently sells 4,150 bikes per year and could make as many as 4,510 bikes per year. The bikes cost $300 each to make: $180 in variable costs per bike and $120 of fixed costs per bike. Radar receives an offer from a potential customer who wants to buy 360 bikes for $460 each. Incremental fixed costs to make this order are $70 per bike. No other costs will change if this order is accepted. (a) Compute the income for the special offer. (b) Should Radar accept this offer? (a) Special offer analysis Sales Variable costs Contribution margin Income (b) The company should $ Per Unit Total 460 $ 165,600 180 0arrow_forwardWant Answer of the following questionarrow_forwardRadar Company sells bikes for $520 each. The company currently sells 4,350 bikes per year and could make as many as 4,690 bikes per year. The bikes cost $270 each to make: $160 in variable costs per bike and $110 of fixed costs per bike. Radar receives an offer from a potential customer who wants to buy 340 bikes for $500 each. Incremental fixed costs to make this order are $70 per bike. No other costs will change if this order is accepted. (a) Compute the income for the special offer. (b) Should Radar accept this offer? (a) Special offer analysis Contribution margin Income: (b) The company should Per Unit 0 Totalarrow_forward

- Waterway Inc. manufactures snowsuits. Waterway is considering purchasing a new sewing machine at a cost of $2.45 million. Its existing machine was purchased five years ago at a price of $1.8 million; six months ago, Waterway spent $55,000 to keep it operational. The existing sewing machine can be sold today for $243,257. The new sewing machine would require a one-time, $85,000 training cost. Operating costs would decrease by the following amounts for years 1 to 7: Year 1 $390,900 2 399,900 3 410,400 4 425,200 5 432,600 435,300 7 437,700 The new sewing machine would be depreciated according to the declining-balance method at a rate of 20%. The salvage value is expected to be $379,700. This new equipment would require maintenance costs of $98,400 at the end of the fifth year. The cost of capital is 9%. Click here to view PV table. Use the net present value method to determine the following: (If net present value is negative then enter with negative sign preceding the number e.g. -45 or…arrow_forwardRadar Company sells bikes for $490 each. The company currently sells 4,150 bikes per year and could make as many as 4,490 bikes per year. The bikes cost $300 each to make: $175 in variable costs per bike and $125 of fixed costs per bike. Radar receives an offer from a potential customer who wants to buy 340 bikes for $470 each. Incremental fixed costs to make this order are $60 per bike. No other costs will change if this order is accepted. (a) Compute the income for the special offer. (b) Should Radar accept this offer? (a) Special offer analysis Per Unit Total Contribution margin Income (b) The company shouldarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education