FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

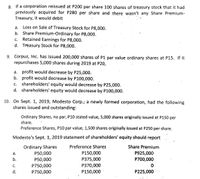

Transcribed Image Text:8. If a corporation reissued at P200 per share 100 shares of treasury stock that it had

previously acquired for P280 per share and there wasn't any Share Premium-

Treasury, it would debit

a. Loss on Sale of Treasury Stock for P8,000.

b. Share Premium-Ordinary for P8,000.

Retained Earnings for P8,000.

d. Treasury Stock for P8,000.

а.

С.

9. Corpuz, Inc. has issued 200,000 shares of P1 par value ordinary shares at P15. If it

repurchases 5,000 shares during 2019 at P20,

a. profit would decrease by P25,000.

b. profit would decrease by P100,000.

c. shareholders' equity would decrease by P25,000.

d. shareholders' equity would decrease by P100,000.

С.

10. On Sept. 1, 2019, Modesto Corp.; a newly formed corporation, had the following

shares issued and outstanding:

Ordinary Shares, no par, P10 stated value, 5,000 shares originally issued at P150 per

share.

Preference Shares, P10 par value, 1,500 shares originally issued at P250 per share.

Modesto's Sept. 1, 2019 statement of shareholders' equity should report

Ordinary Shares

Р50,000

Preference Shares

Share Premium

P150,000

P375,000

P370,000

P925,000

P700,000

а.

b.

P50,000

P750,000

P750,000

C.

d.

P150,000

P225,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- MC Qu. 11-74 Anthem Inc. issues... Anthem Inc. issues 200,000 shares of stock with a par value of $0.11 for $160 per share. Three years later, it repurchases these shares for $90 per share. Anthem records the repurchase in which of the following ways? Multiple Choice Debit Common Stock for $22,000, debit Additional Paid-in Capital for $31,978,000 and credit Cash for $32.00 million. Debit Treasury Stock for $18.00 million and credit Cash for $18.00 million. Debit Common Stock for $22,000, debit Additional Paid-in Capital for $17,978,000 and credit Cash for $18.00 million. Debit Stockholders' Equity for $32.00 million, credit Additional Paid-in Capital for $18.00 million and credit Cash for $18.00 million.arrow_forwardBefore Riverbed Ltd. engages in the treasury share transactions listed below, its general ledger reflects, among others, the following account balances (par value is £30 per share). Share Premium-Ordinary Share Capital-Ordinary £91,700 £269,400 Retained Earnings (a) Bought 390 treasury shares at £39 per share. (b) Bought 300 treasury shares at £45 per share. (c) Sold 350 treasury shares at £41 per share. (d) Sold 100 treasury shares at £37 per share. £81,900 Record the treasury share transactions (given below) under the cost method of handling treasury shares; use the FIFO method for purchase-sale purposes. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts.)arrow_forward

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education