Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

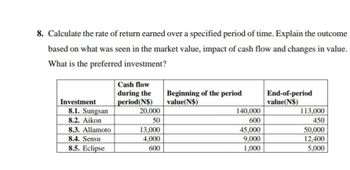

Transcribed Image Text:8. Calculate the rate of return earned over a specified period of time. Explain the outcome

based on what was seen in the market value, impact of cash flow and changes in value.

What is the preferred investment?

Investment

8.1. Sungsan

8.2. Aikon

8.3. Allamoto

8.4. Sensu

8.5. Eclipse

Cash flow

during the

period(N$)

20,000

50

13,000

4,000

600

Beginning of the period

value(N$)

140,000

600

45,000

9,000

1,000

End-of-period

value(N$)

113,000

450

50,000

12,400

5,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 4 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Consider an investment where the cash flows are: – $946.21 at time t = 0 (negative since this is your initial investment) $377 at time t = 1 in years $204 at time t = 2 in years $499 at time t = 3 in years (a) Use Excel's "Solver" to find the internal rate of return (IRR) of this investment. Take a screen shot showing Solver open with your entries for the function clearly visible. Paste the screen shot into an application (like Paint), and save it as a (.png) file. Upload your screenshot below. (b) What is the value of IRR found by Solver?arrow_forwardS Year 0 1 2 3 Cash Flow -$ 9,900 2,300 2,900 5,200 a. What is the profitability index for the cash flows if the relevant discount rate is 6 percent? Profitability index 0.949 0.967 0.875 0.893 0.921 b. What is the profitability index for the cash flows if the relevant discount rate is 16 percent? Profitability index c. What is the profitability index for the cash flows if the relevant discount rate is 23 percent?arrow_forwardConsider the following cash flow year cash flow -1000 TL 2 +300 TL 3 +300 TL 4 +300 TL +300 TL Calculate the rate of return for an investment of 1000 TLarrow_forward

- es Consider the following cash flows: Year Cash Flow 0 -$ 29,900 1 13,800 2 3 15,100 11,500 a. What is the profitability index for the cash flows if the relevant discount rate is 8 percent? Note: Do not round intermediate calculations and round your answer to 3 decimal places, e.g., 32.161. b. What is the profitability index if the discount rate is 13 percent? Note: Do not round intermediate calculations and round your answer to 3 decimal places, e.g., 32.161. c. What is the profitability index if the discount rate is 20 percent? Note: Do not round intermediate calculations and round your answer to 3 decimal places, e.g., 32.161. a. Profitability index b. Profitability index c. Profitability index Tarrow_forwardCan I get some help with this practice questionarrow_forwardDetermine the rate of return for the cash flows shown in the diagram. Use trial and error (start with two trials with 5% and 10% interest rates) and then use interpolation (or more trials) to approximate the result. Roh?? S7000 1- ? Year 590 s90 s90 sz00 sz00 sz00 $3000arrow_forward

- What is the yield on the following set of cashflows? Time Cashflow (£) t = 0 t=1 H 400 t=2 t = 3 -100 -120 t = 4 -140 t = 5 -160arrow_forwardCalculate the APR of the following investment, entered as a percentage (Example: if your answer is 14.5%, enter 14.5 and not 0.145) Year Number Cashflow 0 -11000 1 3000 2 3500 3 2900 4 2800arrow_forward1. Discounted Payback (DCPB) and IRR analysis. Use the cash flow situation (table below) to answer. a. Determine the DCPB based on a MARR rate of 8.0% b. Determine the IRR Year Cash Flow (in $1000's) 0 1 -5500 +1500 2 +1800 3 +1500 4 +1800 5 6 +1500 +1800 7 +1500arrow_forward

- ) Assuming a 9% cost of capital, find the modified internal rate of return for the following cash flows: a. 19.78% b. 6.95% c. 13.64% d. 7.86% Year Cash Flow 0 1 2 3 -$175 $167 $240 -$120arrow_forwardConsider the following cash flows: Year Cash Flow 0 −$ 29,000 1 14,700 2 14,200 3 10,600 What is the profitability index for the cash flows if the relevant discount rate is 10 percent? Note: Do not round intermediate calculations and round your answer to 3 decimal places, e.g., 32.161. What is the profitability index if the discount rate is 15 percent? Note: Do not round intermediate calculations and round your answer to 3 decimal places, e.g., 32.161. What is the profitability index if the discount rate is 22 percent? Note: Do not round intermediate calculations and round your answer to 3 decimal places, e.g., 32.161.arrow_forwardPlease do not give solution in image format thankuarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education