Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

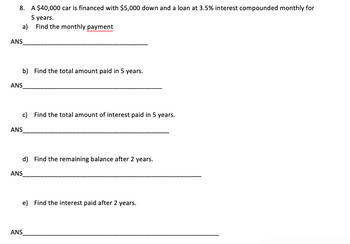

Transcribed Image Text:8. A $40,000 car is financed with $5,000 down and a loan at 3.5% interest compounded monthly for

5 years.

Find the monthly payment

a)

ANS

ANS

ANS

b) Find the total amount paid in 5 years.

c) Find the total amount of interest paid in 5 years.

d) Find the remaining balance after 2 years.

ANS

ANS

e) Find the interest paid after 2 years.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 5 steps with 5 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Assuming a 5% (0.05) interest rate, $500 invested today in a savings account today will be worth $525 in one year. What will that amount be in 2 and 3 years, and what is the total interest you will earn at the end of three years. Refer to the video in the information page for assistance in calculating simple interest. Year 2: $445.78 Year 3: $335.29 Total Interest: $98.75 Year 2: $551.25 Year 3: $578.81 Total Interest: $78.31 Year 2: $114.49 Year 3: $122.50 Total Interest: $22.50 Year 2: $222.70arrow_forward2. Now consider: 4.05% APR on 5 years for $23,000 car a. Estimate the monthly payment (using the average balance method) b. How much would you pay in total for interest?arrow_forwardYou deposited $250 in the bank for 5 years at 12%. If interest is added at the end of the year, how much will you have in the bank after one year? Calculate the compounded amount you will have in the bank at the end of year two and continue to calculate all the way to the end of the fifth year. Year Year Beginning Balance Interest Year End Balance 1 $250.00 2 3 4 5 PLEASE NOTE #1: All dollar amounts will be with "$" and commas as needed and rounded to two decimal places (i.e. $12,345.67). Present Value (PV) PV FV Factor Future Value (FV) PLEASE NOTE #2: All factors from the PV FV Tables are rounded to three decimal places (i.e. 1.234).arrow_forward

- You have taken out a loan of $23,000 for 4 years with an interest rate of 4% compounded annually. The loan will be repaid by end of year payments. Fill in all the boxes below, and round all entries to the nearest cent. Enter only positive values for ALL ANSWERS. Annual payment: $ Payment Number 0) 1) 2) 3) 4) Total Amount Paid $ 6,336,30 x same as above same as above $ Interest Paid SA SA A +A +A Principal Repaid SA SA +A Outstanding Balance $23,000 SA GA SAarrow_forwarda. Use the appropriate formula to determine the periodic deposit. b. How much of the financial goal comes from deposits and how much comes from interest? Periodic Deposit $? at the end of each year iClick the icon to view some finance formulas. Rate 3% compounded annually Time 16 years Financial Goal $120,000arrow_forward3. You deposited $250 in the bank for 5 years at 12%. If interest is added at the end of the year, how much will you have in the bank after one year? Calculate the compounded amount you will have in the bank at the end of year two and continue to calculate all the way to the end of the fifth year. Year Year Beginning Balance Interest Year End Balance 1 $250.00 ? ? 2 ? ? ? 3 ? ? ? 4 ? ? ? 5 ? ? ? PLEASE NOTE #1: All dollar amounts will be with "$" and commas as needed and rounded to two decimal places (i.e. $12,345.67). Use the future value of $1 table in the Appendix B PV FV Tables Appendix B PV FV Tablesand verify that your answer above is correct. Present Value (PV) PV FV Factor Future Value (FV) ? ? ? PLEASE NOTE #2: All factors from the PV FV Tables are rounded to three decimal places (i.e. 1.234).arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education