FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

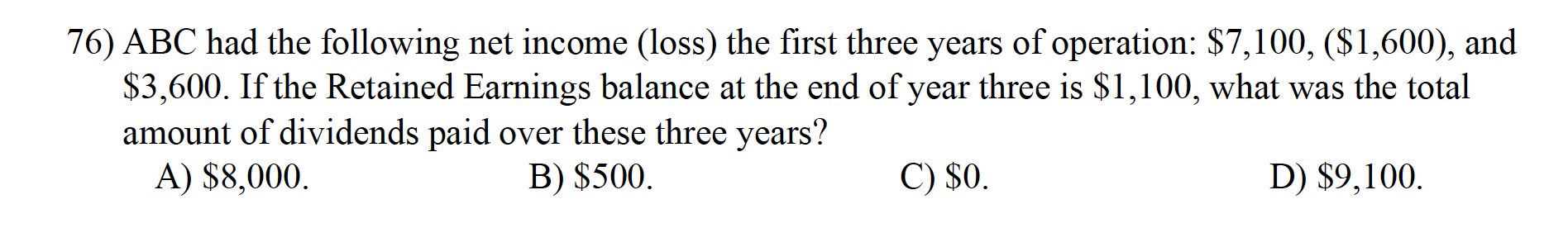

Transcribed Image Text:76) ABC had the following net income (loss) the first three years of operation: $7,100, ($1,600), and

$3,600. If the Retained Earnings balance at the end of year three is $1,100, what was the total

amount of dividends paid over these three years?

A) $8,000.

B) $500.

C) $0.

D) $9,100.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Similar questions

- Zero Corp's total common equity at the end of last year was $350,000 and its net income was $70,000. What was its ROE? a. 19.40% b.24.20% O c. 17.00% d. 17.40% e. 20.00%arrow_forwardam.104.arrow_forwardAssume the following information for both years: Net Profit Margin (NPM) was 4%. Interest on Long-term Debt 10% Times-Interest-earned was 5x All of the Net Income was retained and Market price for each share of common stock was as follows: January 1, 2008 - $1.253B December 31, 2008 - $1.14; January 1, 2007- $1.10; December 31, 2007 - $0.86 a. Use Altman Z-Score (for 2 years) to decide whether or not you would lend four million dollars to the above-mentioned company. Show all calculations supporting your conclusion.arrow_forward

- A company had the following selected data for two consecutive years of operation. Year 1 $12,000,000 6,000,000 Interest expense 300,000 Income tax expense 790,000 Profit 1,850,000 Using this data, determine the percentage change in the company's debt to total assets ratio from Year 1 to Year 2. Total assets Total liabilities O increase of 2% decrease of 8% no change O increase of 1% Year 2 $15,000,000 7,800,000 450,000 900,000 2,250,000arrow_forwardDuring the year, a merchandising company had the following transactions: Generated 300.000 TL revenue and incurred 225.000 TL expense. Issued new shares of 20.000 at a price of 1,2 TL (par value is 1 TL). Repurchased 10.000 of these new shares at a price of 1,1 TL. Sold these repurchased shares at a price of 0,5 TL. Revalued its headquarters building as well as its one of the rental properties. The increases in the relevant equity and income items have been found to be 15.000 TL and 20.000 TL. Suppose that the ending retained earnings balance in the Statement of Changes in Shareholders Equity is 105.000 TL. Then, what was the opening balance of the retained earnings at the beginning of the year? a) 10.000 TL b) 16.000 TL c) 20.000 TL d) 26.000 TLarrow_forwardFarmington Corporation began the year with a retained earnings balance of $20,000. The company paid a total of $3,000 in dividends and earned a net income of $60,000 this year. What is the ending retained earnings balance?arrow_forward

- Last year, net profits of a company were nine-elevenths of revenue. If the company declared a dividend of $14983 and two-seventeenths of the net profit was retained in the company, what was last year's revenue?arrow_forwardIvan's, Incorporated, paid $500 in dividends and $595 in interest this past year. Common stock increased by $205 and retained earnings decreased by $131. What is the net income for the year? a. $964 O b. $800 O c. $595 O d. $369 O e. $500arrow_forward10) During the current year, The Supply Co. Inc.'s total liabilities decreased by $26,700 and shareholder's equity increased by $4,150. By what amount and in what direction did Sue's total assets change during the same time period? A) $30,850 decrease. B) $30,850 increase. C) $22,550 decrease. D) $22,550 Increase.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education