Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

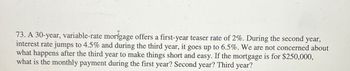

Transcribed Image Text:73. A 30-year, variable-rate mortgage offers a first-year teaser rate of 2%. During the second year,

interest rate jumps to 4.5% and during the third year, it goes up to 6.5%. We are not concerned about

what happens after the third year to make things short and easy. If the mortgage is for $250,000,

what is the monthly payment during the first year? Second year? Third year?

SAVE

AI-Generated Solution

info

AI-generated content may present inaccurate or offensive content that does not represent bartleby’s views.

Unlock instant AI solutions

Tap the button

to generate a solution

to generate a solution

Click the button to generate

a solution

a solution

Knowledge Booster

Similar questions

- 12. Amortized loans Mortgages and other amortized loans (meaning equal or blended payments) involve regular payments at fixed intervals. These are sometimes called reverse annuities, because you get a lump-sum amount as a loan in the beginning, and then you make the periodic payments (usually monthly or more frequently, depending on the agreement) to the lender. You've decided to buy a house that is valued at $1 million. You have $400,000 to use as a down payment on the house, and you take out a mortgage for the rest. Your bank has approved your mortgage for the balance amount of $600,000 and is offering you a 25-year mortgage with 12% fixed nominal interest rate (called the APR, or Annual Percentage Rate) compounded semiannually. According to this proposal, what will be your monthly mortgage payment? OOO $7,740 $6,192 $8,359 $9,598 Your friends suggest that you take a 15-year mortgage, because a 25-year mortgage is too long and you will lose a lot of money on interest. If your bank…arrow_forwardYou took out a $200,000 mortgage for 30 years. The contract rate is tied to the one-year U.S. treasury rate (index rate). The fixed risk premium for your mortgage is 9%. Your interest rate will be adjusted every year. For the first year, the index rate is 1.5%. What is the outstanding principal at the end of year 1? $95,758 $198,999 $197,769 $96,726arrow_forwardImagine you get a $450,000 closed floating rate mortgage (no CMHC needed) having a three-year term and amortized over 25 years. Although the interest rate on the mortgage would change, your monthly payments would remain fixed for the term. Monthly payments would be calculated based on APR of %4.8 compounded monthly and amortization period of 25 years. The actual amount of the interest accrued will be deducted from your fixed monthly payments and the rest would be used for principal repayment. Now, assume that the floating rate itself is 4.2% for the first 6 months, then suddenly jumps to 6% for the next 12 months, then drops to 3.6% for the next 6 months, and then declines to 3% for the final 12 months. Note that all rates are quoted as an APR and compounded monthly. Part A: How much money do you owe (i.e. what is the outstanding balance) after 18 months? Part B: How much interest did you pay over the term of the mortgage? How much was principal?arrow_forward

- -An❝interest-only" mortgage is made for $80,000 at 10 percent interest for 10 years. The lender and borrower agree that monthly payments will be constant and will require no loan amortization. a. What will the monthly payments be? b. What will be the loan balance after 5 years? c. If the loan is repaid after 5 years, what will be the yield to the lender?arrow_forwardIn a 5/1 hybrid adjustable-rate mortgage (ARM), the initial interest rate is fixed for 5 years, then is adjusted annually. (You usually pay points up front at closing in exchange for the rate lock for the first 5 years.) Suppose that you buy a house with a $ 260000, 30 year mortgage with a 5/1 ARM with initial rate of 4.5%; and suppose that five years later, the interest rate goes up to 7.1%. Use the Bankrate amortization schedule online to determine what your monthly payment was, originally, at 4.5%?Monthly Payment = What is your new payment? (Careful: the amount of the loan is no longer $ 260000 and you only have 25 years to pay it off.)New Monthly Payment =arrow_forwardA homeowner can obtain a $250,000, 30-year fixed-rate mortgage at a rate of 6.0% with zero points or at a rate of 5.5% with 2.25 points. If you will keep the mortgage for 30 years, what is the net present value of paying the points (to the nearest dollar)? A. $7,564 B. $7,222 C. $8,360 D. $9,475arrow_forward

- A Fixed Rate Mortgage (FRM) for $160,000 is made at a time when the market interest rate is 12%. The loan is partially amortizing, at the end of the maturity date there is a balloon payment of $25,000 to be able to pay off all the loan. The loan has a maturity of 30 years and payments will be made monthly. What will be the monthly payments? (Answer is rounded)arrow_forwardWhich of the following statements regarding a 30-year monthly payment amortized mortgage with a nominal interest rate of 8% is CORRECT? Exactly 8% of the first monthly payment represents interest. The monthly payments will decline over time. A smaller proportion of the last monthly payment will be interest, and a larger proportion will be principal, than for the first monthly payment. The total dollar amount of principal being paid off each month gets smaller as the loan approaches maturity. The amount representing interest in the first payment would be higherif the nominal interest rate were 6% rather than 8%.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education