FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

E 18-2B

Transcribed Image Text:720

PART 4

Specialized Accounting Procedures for Merchandising Businesses and Partnerships

$102,000

5,000

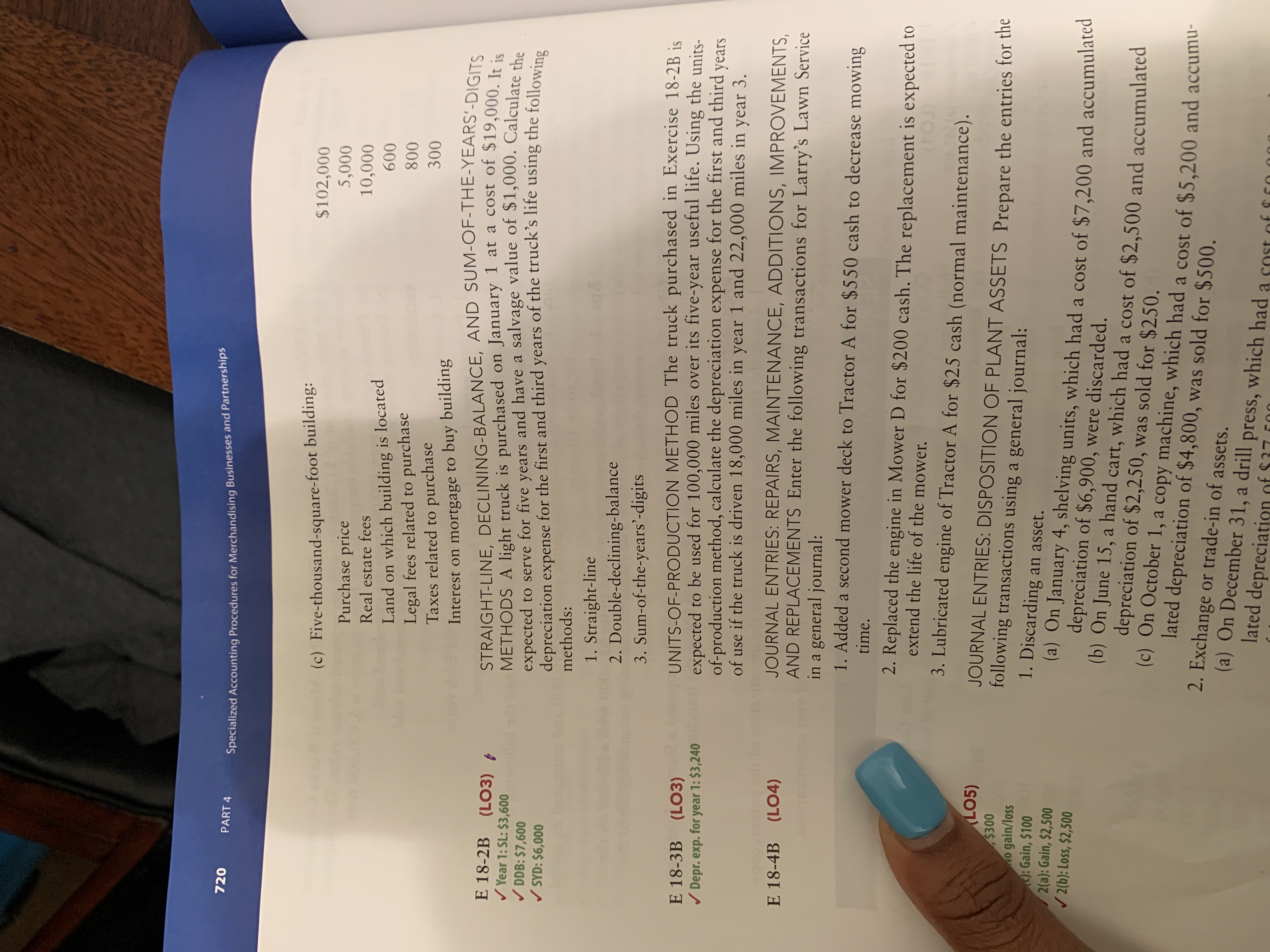

(c) Five-thousand-square-foot building:

Purchase price

10,000

Real estate fees

Land on which building is located

Legal fees related to purchase

Taxes related to purchase

Interest on mortgage to buy building

STRAIGHT-LINE, DECLINING-BALANCE, AND SUM-OF-THE-YEARS'-DIGITS

METHODS A light truck is purchased on January 1 at a cost of $19,000. Ir in

expected to serve for five years and have a salvage value of $1,000. Calculate s

depreciation expense for the first and third years of the truck's life using the following

600

ble

800

300

E 18-2B

/ Year 1: SL: $3,600

/ DDB: $7,600

/ SYD: $6,000

(LO3) ,

methods:

1. Straight-line

2. Double-declining-balance

3. Sum-of-the-years'-digits

UNITS-OF-PRODUCTION METHOD The truck purchased in Exercise 18-2B is

expected to be used for 100,000 miles over its five-year useful life. Using the units-

of-production method, calculate the depreciation expense for the first and third years

of use if the truck is driven 18,000 miles in year 1 and 22,000 miles in year 3.

E 18-3B (LO3)

/ Depr. exp. for year 1: $3,240

JOURNAL ENTRIES: REPAIRS, MAINTENANCE, ADDITIONS, IMPROVEMENTS,

AND REPLACEMENTS Enter the following transactions for Larry's Lawn Service

in a general journal:

1. Added a second mower deck to Tractor A for $550 cash to decrease mowing

E 18-4B (L04)

time.

2. Replaced the engine in Mower D for $200 cash. The replacement is expected to

extend the life of the mower.

3. Lubricated engine of Tractor A for $25 cash (normal maintenance).

LO5)

$300

o gain/loss

: Gain, $100

2(a): Gain, $2,500

/ 2(b): Loss, $2,500

JOURNAL ENTRIES: DISPOSITION OF PLANT ASSETS Prepare the entries for the

following transactions using a general journal:

1. Discarding an asset.

(a) On January 4, shelving units, which had a cost of $7,200 and accumulated

depreciation of $6,900, were discarded.

(b) On June 15, a hand cart, which had a cost of $2,500 and accumulated

depreciation of $2,250, was sold for $250.

(c) On October 1, a copy machine, which had a cost of $5,200 and accumu-

lated depreciation of $4,800, was sold for $500.

2. Exchange or trade-in of assets.

(a) On December 31, a drill press, which had a sost of

lated depreciation of $37 c00

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps with 7 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- 48. Which of the following is not an issue associated with liabilities?a. Reportingb. Identificationc. Valuation and Measurementd. Assessmentarrow_forwardQuestion 3: When is an employer NOT required to file a quarterly Form 941? Answer: А. O When annual tax liability for federal income, Social Security, and Medicare tax is less than $1,000 В. O When annual tax liability for federal income, Social Security, and Medicare tax is less than $1,500 С. O When annual tax liability for federal income, Social Security, and Medicare tax is less than $2,500 D. When annual tax liability for federal income, Social Security, and Medicare tax is less than $100,000arrow_forwardThe requirements of a 'provision' or a 'contingent liability in compliance with MFRS137arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education