MATLAB: An Introduction with Applications

6th Edition

ISBN: 9781119256830

Author: Amos Gilat

Publisher: John Wiley & Sons Inc

expand_more

expand_more

format_list_bulleted

Question

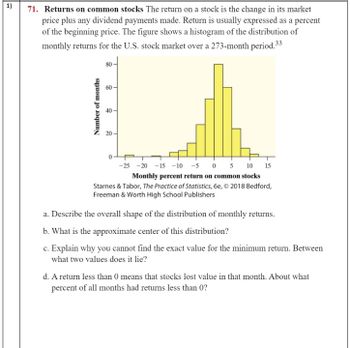

The return on a stock is the change in its market price plus any dividend payments made. Return is usually expressed as a percent of the beginning price. The figure shows a histogram of the distribution of monthly returns for the U.S. stock market over a 273-month period. a. Describe the overall shape of the distribution of monthly returns. b. What is the approximate center of this distribution? c. Explain why you cannot find the exact value for the minimum return. Between what two values does it lie? d. A return less than 0 means that the stocks lost value in that month. About what percent of all months had returns less than 0?

Transcribed Image Text:1)

71. Returns on common stocks The return on a stock is the change in its market

price plus any dividend payments made. Return is usually expressed as a percent

of the beginning price. The figure shows a histogram of the distribution of

monthly returns for the U.S. stock market over a 273-month period.33

Number of months

80

60

40-

20-

-25 -20 -15 -10 -5 0 5 10 15

Monthly percent return on common stocks

Starnes & Tabor, The Practice of Statistics, 6e, © 2018 Bedford,

Freeman & Worth High School Publishers

a. Describe the overall shape of the distribution of monthly returns.

b. What is the approximate center of this distribution?

c. Explain why you cannot find the exact value for the minimum return. Between

what two values does it lie?

d. A return less than 0 means that stocks lost value in that month. About what

percent of all months had returns less than 0?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Refer to the picture for the question and show alll work in full detailarrow_forwardCompute the specified quantity. Source: Financial Industry Regulatory Authority (www.finra.org) A 5 year bond costs $10,000 and will pay a total of $4,800 in interest over its lifetime. What is its annual interest rate r (as a percent)? (Round your answer to three decimal places.) % r =arrow_forwardThe rate of return for the last 19 years of a certain segment of the stock market is given in the table. (The data is also provided below the table as a comma-separated list to make it easier to copy.) Market Segment Rate of Return, 2002-2020 Year Rate of Return (%) 2020 3.23 2019 6.14 2018 11.39 2017 15.99 2016 3.24 2015 -3.86 2014 -1.04 2013 8.49 2012 5.93 2011 6.96 2010 1.98 2009 3.13 2008 -6.55 2007 7.27 2006 3.02 2005 -1.34 2004 7.28 2003 6.27 2002 -0.76 Rate of Return (%): 3.23, 6.14, 11.39, 15.99, 3.24, -3.86, -1.04, 8.49, 5.93, 6.96, 1.98, 3.13, -6.55, 7.27, 3.02, -1.34, 7.28, 6.27, -0.76 Find the 34th percentile of the data. 6.46arrow_forward

- Follow up question about the Plot. What Pattern do you see in the residual plot? is it A.The points are fairly evenly distributed in a rectangular pattern along the zero line. B.The points form a slight U shape around the zero line. C.Substantially more points are concentrated below the zero line than above it. D.The points spread in a fan shape left to right around the zero line.arrow_forwardFill in the blanks in the following table. Round your answers to 2 decimal places.arrow_forwardCalculate the missing values and express your answers rounded to two decimal places. Cost Amount of Markup Selling Price Rate of Markup Rate of Markup on Cost on Selling Price a. $330.00 25.00% % b. $66.00 % 24.00%arrow_forward

- - The percent increase in enrollment at a junior college for the last 5 years were 9.8%, 14.8%, 12.7%, 10.9% and 18.7%. Determine the geometric mean percent increase over the last 5 years.arrow_forwardComplete the following table and draw a graph showing how bond price for each bond changes over time as they move towards their maturity dates. Describe the relationship between bond prices and time remaining for maturity. Using the table below show all the calculations for every bond prices calculated Years remaining to maturity BOND A Coupon rate = 8% p.a. Market interest rate = 6% p.a. BOND B Coupon rate = 6% p.a. Market interest rate = 6% p.a. BOND C Coupon rate = 4% p.a. Market interest rate = 6% p.a. 10 9 8 7 6 5 4 3 2 1 0arrow_forwardSuppose that a firm's sales were $3,750,000 five years ago and are $5,250,000 today. What was the geometric mean growth rate in sales over the past five years?arrow_forward

- The following table shows the balance in a savings account, in dollars, in terms of time, measured as the number of years since the initial deposit was made. Explain in terms of interest rates how the account grew. (Round the ratios to three decimal places.) The yearly interest rate was % for the first 3 years, then Need Help? Submit Answer Time 0 1 2 3 Balance 250.00 262.50 275.63 289.41 Read It Time 4 5 6 Watch It Balance 300.98 313.02 325.54 % after that.arrow_forward1. Find the geometric mean rate of return. 1yr: 10 percent 2yr: 20 percent 3yr: 30 percent 4yr: -40 percentarrow_forwardThe rent for tenants in a building in 1940 was $30 per month. The landlord changes the rent based on the CPI-U. Use the CPI-U chart below to calculate the current rent in 2019. Round to the nearest dollar. Year CPI-U 1940 14.0 1949 23.8 1983 99.6 2000 172.2 2005 195.3 2009 214.5 2014 236.0 2017 245.1 2019 255.7 2020 258.8arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

MATLAB: An Introduction with ApplicationsStatisticsISBN:9781119256830Author:Amos GilatPublisher:John Wiley & Sons Inc

MATLAB: An Introduction with ApplicationsStatisticsISBN:9781119256830Author:Amos GilatPublisher:John Wiley & Sons Inc Probability and Statistics for Engineering and th...StatisticsISBN:9781305251809Author:Jay L. DevorePublisher:Cengage Learning

Probability and Statistics for Engineering and th...StatisticsISBN:9781305251809Author:Jay L. DevorePublisher:Cengage Learning Statistics for The Behavioral Sciences (MindTap C...StatisticsISBN:9781305504912Author:Frederick J Gravetter, Larry B. WallnauPublisher:Cengage Learning

Statistics for The Behavioral Sciences (MindTap C...StatisticsISBN:9781305504912Author:Frederick J Gravetter, Larry B. WallnauPublisher:Cengage Learning Elementary Statistics: Picturing the World (7th E...StatisticsISBN:9780134683416Author:Ron Larson, Betsy FarberPublisher:PEARSON

Elementary Statistics: Picturing the World (7th E...StatisticsISBN:9780134683416Author:Ron Larson, Betsy FarberPublisher:PEARSON The Basic Practice of StatisticsStatisticsISBN:9781319042578Author:David S. Moore, William I. Notz, Michael A. FlignerPublisher:W. H. Freeman

The Basic Practice of StatisticsStatisticsISBN:9781319042578Author:David S. Moore, William I. Notz, Michael A. FlignerPublisher:W. H. Freeman Introduction to the Practice of StatisticsStatisticsISBN:9781319013387Author:David S. Moore, George P. McCabe, Bruce A. CraigPublisher:W. H. Freeman

Introduction to the Practice of StatisticsStatisticsISBN:9781319013387Author:David S. Moore, George P. McCabe, Bruce A. CraigPublisher:W. H. Freeman

MATLAB: An Introduction with Applications

Statistics

ISBN:9781119256830

Author:Amos Gilat

Publisher:John Wiley & Sons Inc

Probability and Statistics for Engineering and th...

Statistics

ISBN:9781305251809

Author:Jay L. Devore

Publisher:Cengage Learning

Statistics for The Behavioral Sciences (MindTap C...

Statistics

ISBN:9781305504912

Author:Frederick J Gravetter, Larry B. Wallnau

Publisher:Cengage Learning

Elementary Statistics: Picturing the World (7th E...

Statistics

ISBN:9780134683416

Author:Ron Larson, Betsy Farber

Publisher:PEARSON

The Basic Practice of Statistics

Statistics

ISBN:9781319042578

Author:David S. Moore, William I. Notz, Michael A. Fligner

Publisher:W. H. Freeman

Introduction to the Practice of Statistics

Statistics

ISBN:9781319013387

Author:David S. Moore, George P. McCabe, Bruce A. Craig

Publisher:W. H. Freeman