FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

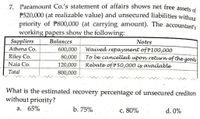

Transcribed Image Text:7. Paramount Co.'s statement of affairs shows net free assets of

P520,000 (at realizable value) and unsecured liabilities without

priority of P800,000 (at carrying amount). The accountants

working papers show the following:

Suppliers

Balances

Notes

600,000

Waived repayment of P100,000

To be cancelled upon return of the goods

Rebate of P50,000 is available

Athena Co.

Riley Co.

Naia Co.

80,000

120,000

800,000

Total

What is the estimated recovery percentage of unsecured creditors

without priority?

а. 65%

b. 75%

с. 80%

d. 0%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Marin Corporation purchased a truck by issuing an $113,600, 4-year, zero-interest-bearing note to Equinox Inc. The market rate of interest for obligations of this nature is 9%. Prepare the journal entry to record the purchase of this truck. (Round present value factor calculations to 5 decimal places, e.g. 1.25124 and final answers to O decimal places, e.g. 5,275. Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts.) Account Titles and Explanation Debit Creditarrow_forwardPearl plc purchased a truck by issuing an £76,800, 4-year, zero-interest-bearing note to Equinox Inc. The market rate of interest for obligations of this nature is 6%. Prepare the journal entry to record the purchase of this truck. (Round present value factor calculations to 5 decimal places, e.g. 1.25124 and final answers to O decimal places, e.g. 5,275. Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts.) Account Titles and Explanation Debit Creditarrow_forwardOn January 1, Windsor, Inc. sold used equipment with a cost of $17,000 and a carrying amount of $2,300 to Swifty Corporation in exchange for a $5,100, three-year non-interest-bearing note receivable. Although no interest was specified, the market rate for a loan of that risk would be 7%. Assume that Windsor follows IFRS. Click here to view the factor table PRESENT VALUE OF 1. Click here to view the factor table PRESENT VALUE OF AN ANNUITY OF 1. (a) Prepare the entry to record the sale of Windsor's equipment and receipt of the note. (Round answers to O decimal places, e.g. 5,275. Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts.) Account Titles and Explanation Debit Credit Notes Receivable Accumulated Depreciation - Equipment Equipment 1700 Gain on Disposal of Equipmentarrow_forward

- Sheridan Corporation purchased a truck by issuing an $91,200, 4-year, zero-interest-bearing note to Equinox Inc. The market rate of interest for obligations of this nature is 10%. Prepare the journal entry to record the purchase of this truck. (Round present value factor calculations to 5 decimal places, e.g. 1.25124 and final answers to O decimal places, e.g. 5,275. Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts. List all debit entries before credit entries.) Account Titles and Explanation Debit Creditarrow_forwardRequired information [The following information applies to the questions displayed below.] Tyrell Co. entered into the following transactions involving short-term liabilities. Year 1 Apr. 20 Purchased $36,000 of merchandise on credit from Locust, terms n/30. May 19 Replaced the April 20 account payable to Locust with a 90-day, 8%, $35,000 note payable along with paying $1,000 in cash. July 8 Borrowed $57,000 cash from NBR Bank by signing a 120-day, 11%, $57,000 note payable. note to Locust at the maturity date. Paid the amount due on the Paid the amount due on the note to NBR Bank at the maturity date. Nov. 28 Borrowed $33,000 cash fro Fargo Bank by signing a 60-day, 7%, $33,000 note payable. Dec. 31 Recorded an adjusting entry for accrued interest on the note to Fargo Bank. Year 2 _____?_ Paid the amount due on the note to Fargo Bank at the maturity date. Required: 1. Determine the maturity date for each of the three notes described. Maturity date Locust NBR Bank Fargo Bankarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education