FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

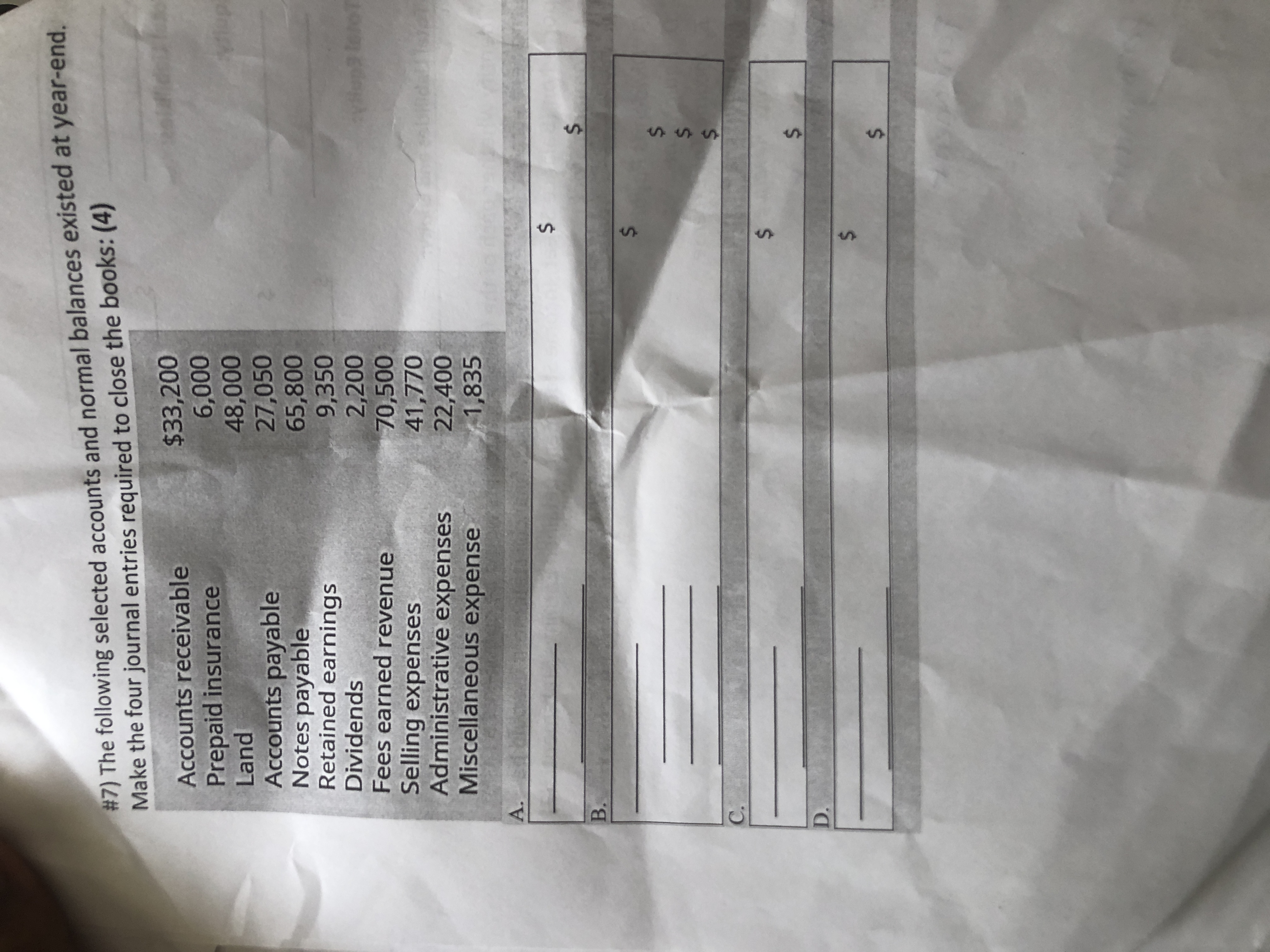

Transcribed Image Text:# 7) The following selected accounts and normal balances existed at year-end.

Make the four journal entries required to close the books: (4)

$33,200

6,000

48,000

27,050

65,800

9,350

2,200

70,500

41,770

22,400

1,835

Accounts receivable

Prepaid insurance

Land

Accounts payable

Notes payable

Retained earnings

Dividends

Fees earned revenue

Selling expenses

Administrative expenses

Miscellaneous expense

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Year-end balance sheets follow. At December 31 Assets Cash Accounts receivable, net Inventory Prepaid rent Current Year 1 Year Ago 2 Years Ago $ 26,725 77,457 $ 31,858 95,459 8,436 240,403 30,967 41,290 43,529 52,503 73,671 8,200 220,389 3,372 193,642 $ 312,800 $ 42,115 69,129 162,500 Machinery, net Total assets $ 448,480 $ 386,621 Liabilities and Equity Accounts payable $ 110,555 Long-term notes payable 83,471 $ 65,992 88,034 Common stock 162,500 Retained earnings 91,954 162,500 70,095 39,056 Total liabilities and equity $ 448,480 $ 386,621 $ 312,800 Complete this question by entering your answers in the tabs below. Required 3A Required 3B Compute times interest earned for the current year and one year ago. Current Year 1 Year Ago Times Interest Earned Choose Numerator: / Choose Denominator: I II 11 Times interest earned times timesarrow_forwardThe following data are taken from the financial statements of Rise and Shine Company. Terms of all sales are 2/10, n/30. Year 3 Year 2 Year 1 Accounts receivable, end of year $113,600 $120,000 $128,200 Sales 700,800 682,550 a. For Years 2 and 3, determine (1) the accounts receivable turnover and (2) the number of days' sales in receivables. Assume there are 365 days in the year. Round intermediate calculations to the nearest whole dollar and final answers to one decimal place. Year 3 Year 2 1. Accounts receivable turnover fill in the blank 1 fill in the blank 2 2. Number of days' sales in receivables fill in the blank 3 days fill in the blank 4 days b. What conclusion can be drawn from these data concerning accounts receivable and credit policies?The collection of accounts receivable has . This can be seen in the in accounts receivable turnover and the in the collection period. The company either became aggressive in…arrow_forwardBelow are amounts (in millions) from three companies' annual reports. Beginning Accounts Receivable Ending Accounts Receivable Net Sales WalCo TarMart $1,815 $2,762 $322,427 6,166 6,694 67,878 CostGet 629 665 68,963 Required: 1. Calculate the receivables turnover ratio and the average collection period for WalCo, TarMart and CostGet. 2. Which company appears most efficient in collecting cash from sales? Complete this question by entering your answers in the tabs below. Required 1 Required 2 Calculate the receivables turnover ratio and the average collection period for WalCo, TarMart and CostGet. (Enter your rounded to 1 decimal place.) WalCo TarMart CostGet Choose Numerator Receivables Turnover Ratio Choose Denominator Average Collection Period Choose Numerator Choose Denominator = Receivables turnover ratio times times times = Average collection periodarrow_forward

- no handwrittten please thankuarrow_forwardJournal Entries for Accounts and Notes ReceivablePittsburgh, Inc., began business on January 1. Certain transactions for the year follow: Jun.8 Received a $33,000, 60 day, eight percent note on account from J. Albert. Aug.7 Received payment from J. Albert on her note (principal plus interest). Sep.1 Received an $39,000, 120 day, nine percent note from R.T. Matthews Company on account. Dec.16 Received a $31,800, 45 day, ten percent note from D. Leroy on account. Dec.30 R.T. Matthews Company failed to pay its note. Dec.31 Wrote off R.T. Matthews account as uncollectible. Pittsburgh, Inc. uses the allowance method of providing for credit losses. Dec.31 Recorded expected credit losses for the year by an adjusting entry. Accounts written off during this first year have created a debit balance in the Allowance for Doubtful Accounts of $48,200. An analysis of aged receivables indicates that the desired balance of the allowance account should be $43,000.…arrow_forwardshow the balance shet presentation of the receivable accounts at july 31.arrow_forward

- Below are amounts (in millions) from three companies' annual reports. Beginning Accounts Ending Accounts Receivable $2,722 6,494 625 WalCo TarMart CostGet Receivable $1,775 5,966 589 Net Sales $318,427 63,878 64,963 Required: 1. Calculate the receivables turnover ratio and the average collection period for WalCo, TarMart and CostGet. 2. Which company appears most efficient in collecting cash from sales?arrow_forwardA company reports the following: Sales $1,057,770 Average accounts receivable (net) 83,950 Determine the (a) accounts receivable turnover, and (b) number of days' sales in receivables. When required, round your answers to one decimal place. Assume a 365-day year. a. Accounts receivable turnover b. Number of days' sales in receivables daysarrow_forwardThe year-end financial statements of Prize Inc. include the accounts receivable footnote:Total accounts and other receivables at December 31 consisted of the following: (in millions) Year 2 Year 1 Total accounts and other receivables $444.4 $476.6 Allowance for doubtful accounts (6.0) (8.4) Total accounts and other receivables, net $438.4 $468.2 The balance sheet reports total assets of $2,984.1 million at December 31, Year 2.The common-size amount for gross accounts and other receivables are: Select one: a. $444.4 million b. None of these are correct. c. 14.7% d. 14.9% e. $438.4 millionarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education