FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

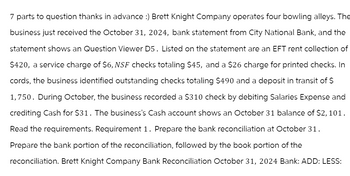

Transcribed Image Text:7 parts to question thanks in advance :) Brett Knight Company operates four bowling alleys. The

business just received the October 31, 2024, bank statement from City National Bank, and the

statement shows an Question Viewer D5. Listed on the statement are an EFT rent collection of

$420, a service charge of $6, NSF checks totaling $45, and a $26 charge for printed checks. In

cords, the business identified outstanding checks totaling $490 and a deposit in transit of $

1,750. During October, the business recorded a $310 check by debiting Salaries Expense and

crediting Cash for $31. The business's Cash account shows an October 31 balance of $2,101.

Read the requirements. Requirement 1. Prepare the bank reconciliation at October 31.

Prepare the bank portion of the reconciliation, followed by the book portion of the

reconciliation. Brett Knight Company Bank Reconciliation October 31, 2024 Bank: ADD: LESS:

Transcribed Image Text:Brett Knight Company operates four bowling alleys. The business just received the October 31, 2024, bank statement from City National Bank, and the statement shows an

05. Listed on the statement are an EFT rent collection of $420, a service charge of $6, NSF checks totaling $45, and a $26 charge for printed checks. In

Question Viewer

cords, the business identified outstanding checks totaling $490 and a deposit in transit of $1,750. During October, the business recorded a $310 check by

debiting Salaries Expense and crediting Cash for $31. The business's Cash account shows an October 31 balance of $2,101.

Read the requirements.

Requirement 1. Prepare the bank reconciliation at October 31.

Prepare the bank portion of the reconciliation, followed by the book portion of the reconciliation.

Brett Knight Company

Bank Reconciliation

October 31, 2024

Bank:

ADD:

LESS:

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- I need help with problemarrow_forwardIf a company accepts credit cards, they must record the expense on their books. Please prepare the journal entries for the following scenario: Company A sells $480,000 on credit card sales. The credit card charges a 4.5% fee for the use of the card. The card company also deposits the cash into the company’s bank account the same night as the credit cards are accepted.arrow_forwardRequired information Use the following information for the Exercises 12-13 below. (Algo) [The following information applies to the questions displayed below.] Del Gato Clinic's cash account shows an $16,473 debit balance and its bank statement shows $15,762 on deposit at the close of business on June 30. a. Outstanding checks as of June 30 total $2,180. b. The June 30 bank statement lists a $70 bank service charge. c. Check No. 919, listed with the canceled checks, was correctly drawn for $489 in payment of a utility bill on June 15. Del Gato Clinic mistakenly recorded it with a debit to Utilities Expense and a credit to Cash in the amount of $498. d. The June 30 cash receipts of $2,830 were placed in the bank's night depository after banking hours and were not recorded on the June 30 bank statement. Exercise 6-12 (Algo) Bank reconciliation LO P3 Prepare its bank reconciliation using the above information. Bank statement balance Add: Deduct: Adjusted bank balance DEL GATO CLINIC Bank…arrow_forward

- Need Answer please provide with Perfect Calculationarrow_forwardTimmins Company of Emporia, Kansas, spreads herbicides and applies liquid fertilizer for local farmers. On May 31, 2022, the company's Cash account per its general ledger showed a balance of $6,738.90. The bank statement from Emporia State Bank on that date showed the following balance. EMPORIA STATE BANK Checks and Debits Deposits and Credits Daily Balance XXX XXX 5-31 6,968.00 A comparison of the details on the bank statement with the details in the Cash account revealed the following facts. 1. The statement included a debit memo of $40.00 for the printing of additional company checks. Cash sales of $883.15 on May 12 were deposited in the bank. The cash receipts journal entry and the deposit slip were incorrectly made for $933.15. The bank credited Timmins Company for the correct amount. 2. 3. Outstanding checks at May 31 totaled $276.25, and deposits in transit were $1,880.15. On May 18, the company issued check No. 1181 for $685.00 to H. Moses, on account. The check, which cleared…arrow_forwardJul 13 The owner, Jen Beck, withdrew $2,000 cash for personal use, Check No. 78. Memorize the transaction for payments every two weeks. Next payment is July 27, 2022. Just tell me in quickbooks where do i record this transaction? bill (enter bills window) credit (enter bills window) bill pmt - check (pay bills window) check (write checks window) invoice (create invoices window) payment (receive payments window) sales receipt (enter sales receipts window) deposit (make deposit window) general journal (make general journal entries window) inventory adjust (adjust quantity/value on hand window) sales tax payment (pay sales tax window) paycheck (pay employees window) liability check (pay payroll liabilities window) transfer (transfer funds between accounts window) credit card charge (enter credit card charges window) credit memo (create credit memos/refunds window) discounts (receive payments window)arrow_forward

- Rick Rambis operates a ski lodge center at Bull Mountain in Alaska. He has just received the monthly bank statement at October 31 from Bull National Bank. The bank statement shows an ending balance at October 31 of $750. The following items are listed on the statement:1. The bank collected rent revenue for Rick in the amount of $330.2. Service charge of $10.3. Two NSF checks from customers totaling $110.4. Printing check charge of $11.In reviewing his cash records and the bank statement, Rick identifies the following:1. Outstanding checks totaling $603.2. Deposit in transit on October 31 of $1,770.3. An error made by Rick: Rick recorded a salary check for $31 but it cleared the bank at $310.Rick’s cash records show a balance on October 31 of $1,997.Requireda) Reconcile the bank account.b) Prepare journal entries that should be made as a result of the bank reconciliation.c) What should the balance in Rick’s Cash account be after the reconciliation?d) What total amount of cash should the…arrow_forwardsaarrow_forwardHello I want the Correct answer about the Questionarrow_forward

- st .fm K The following information is needed to reconcile the cash balance for Gourmet Catering Services, *A deposit of $5,800 is in transit. * Outstanding checks total $1,100. *The book balance is $6,000 at February 28, 2025. The bookkeeper recorded a $1,500 check as $17,400 in payment of the current month's rent The bank balance at February 28, 2025 was $15,430. A deposit of $200 was credited by the bank for $2,000. A customer's check for $3,500 was returned for nonsufficient funds The bank service charge is $70. What was the adjusted book balance? OA. $15,500 OB. $18,400 OC. $18,330 OD. $18,470 This question; posarrow_forwardOscar's Red Carpet Store maintains a checking account with Academy Bank. Oscar's sells carpet each day but makes bank deposits only once per week. The following provides information from the company's cash ledger for the month ending February 28, 2021. Date Amount No. Date Amount $ 2,000 Checks: 1,600 2,500 Deposits: 2/4 321 2/2 $4,000 2/11 322 2/8 450 2/18 323 2/12 1,800 2/25 3,400 324 2/19 1,500 Cash receipts: 2/26-2/28 900 325 2/27 250 $10,400 326 2/28 750 327 2/28 1,200 Balance on February 1 $ 6,100 $9,950 Receipts 10,400 Disbursements (9,950) Balance on February 28 $ 6,550 Information from February's bank statement and company records reveals the following additional information: a. The ending cash balance recorded in the bank statement is $9,610. b. Cash receipts of $900 from 2/26-2/28 are outstanding. c. Checks 325 and 327 are outstanding. d. The deposit on 2/11 includes a customer's check for $250 that did not clear the bank (NSF check). e. Check 323 was written for $2,500 for…arrow_forwardAsap Use the following information for the Exercises 12-13 below. (Algo)Skip to question [The following information applies to the questions displayed below.] Del Gato Clinic's cash account shows an $16,657 debit balance and its bank statement shows $15,640 on deposit at the close of business on June 30. Outstanding checks as of June 30 total $1,844.The June 30 bank statement lists a $90 bank service charge.Check No. 919, listed with the canceled checks, was correctly drawn for $689 in payment of a utility bill on June 15. Del Gato Clinic mistakenly recorded it with a debit to Utilities Expense and a credit to Cash in the amount of $698.The June 30 cash receipts of $2,780 were placed in the bank’s night depository after banking hours and were not recorded on the June 30 bank statement. Exercise 6-13 (Algo) Entries from bank reconciliation LO P3Prepare any necessary journal entries that Del Gato Clinic must record as a result of preparing the bank reconciliation. (If no entry is…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education