FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

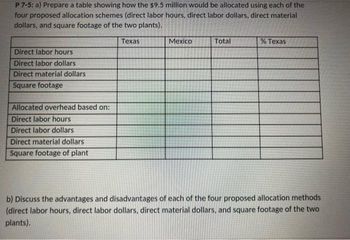

Transcribed Image Text:P 7-5: a) Prepare a table showing how the $9.5 million would be allocated using each of the

four proposed allocation schemes (direct labor hours, direct labor dollars, direct material

dollars, and square footage of the two plants).

Texas

Direct labor hours

Direct labor dollars

Direct material dollars

Square footage

Allocated overhead based on:

Direct labor hours

Direct labor dollars

Direct material dollars

Square footage of plant

Mexico

Total

% Texas

b) Discuss the advantages and disadvantages of each of the four proposed allocation methods

(direct labor hours, direct labor dollars, direct material dollars, and square footage of the two

plants).

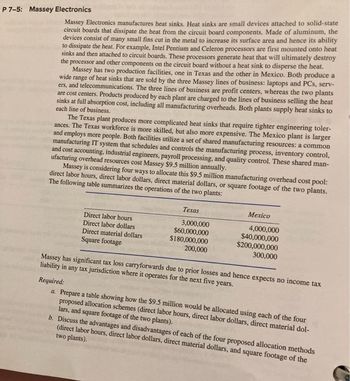

Transcribed Image Text:P 7-5: Massey Electronics

Massey Electronics manufactures heat sinks. Heat sinks are small devices attached to solid-state

circuit boards that dissipate the heat from the circuit board components. Made of aluminum, the

devices consist of many small fins cut in the metal to increase its surface area and hence its ability

to dissipate the heat. For example, Intel Pentium and Celeron processors are first mounted onto heat

sinks and then attached to circuit boards. These processors generate heat that will ultimately destroy

the processor and other components on the circuit board without a heat sink to disperse the heat.

Massey has two production facilities, one in Texas and the other in Mexico. Both produce a

wide range of heat sinks that are sold by the three Massey lines of business: laptops and PCs, serv-

ers, and telecommunications. The three lines of business are profit centers, whereas the two plants

are cost centers. Products produced by each plant are charged to the lines of business selling the heat

sinks at full absorption cost, including all manufacturing overheads. Both plants supply heat sinks to

each line of business.

The Texas plant produces more complicated heat sinks that require tighter engineering toler-

ances. The Texas workforce is more skilled, but also more expensive. The Mexico plant is larger

and employs more people. Both facilities utilize a set of shared manufacturing resources: a common

manufacturing IT system that schedules and controls the manufacturing process, inventory control,

and cost accounting, industrial engineers, payroll processing, and quality control. These shared man-

ufacturing overhead resources cost Massey $9.5 million annually.

Massey is considering four ways to allocate this $9.5 million manufacturing overhead cost pool:

direct labor hours, direct labor dollars, direct material dollars, or square footage of the two plants.

The following table summarizes the operations of the two plants:

Direct labor hours

Direct labor dollars

Direct material dollars

Square footage

Texas

3,000,000

$60,000,000

$180,000,000

200,000

Mexico

4,000,000

$40,000,000

$200,000,000

300,000

Massey has significant tax loss carryforwards due to prior losses and hence expects no income tax

liability in any tax jurisdiction where it operates for the next five years.

Required:

a. Prepare a table showing how the $9.5 million would be allocated using each of the four

proposed allocation schemes (direct labor hours, direct labor dollars, direct material dol-

lars, and square footage of the two plants).

b. Discuss the advantages and disadvantages of each of the four proposed allocation methods

(direct labor hours, direct labor dollars, direct material dollars, and square footage of the

two plants).

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- please answer within the format by providing formula the detailed workingPlease provide answer in text (Without image)Please provide answer in text (Without image)Please provide answer in text (Without image)arrow_forwardCyberBest started to develop an anti-malware application on August 1, 20X1. It reached technological feasibility on March 1, 20X2, and the application was released on April 30, 20X2. Below are costs to develop the application. August 1 through December 31, 20X1 $5,000,000 January 1 through February 28, 20X2 1,600,000 March 1 through April 30, 20X2 1,800,000 Determine the amount of asset and the amount of R&D expenses relating to the development of this anti-malware application. $1,800,000 asset, and $6,600,000 R&D expenses $5,000,000 asset, and $3,400,000 R&D expenses $6,600,000 asset, and $1,800,000 R&D expenses $3,400,000 asset, and $5,000,000 R&D expensesarrow_forwardAnswer the following questions using the Answer Report and the Sensitivity Report Below. Support your answers with explanations and the work showed. You run a company that produces three electrical products – clocks, radios, and toasters. You are asked to figure out how many of each of these things should be produced. Here are the Questions Below That Needs To Be Answered 1.) How many of each of the electronic appliances should you make? (Make sure your answer makes sense.) 2.) Which of the constraints are binding? What does the slack for each non-binding constraint represent?arrow_forward

- One way of improving the efficiency of a power plant is by reheating the steam in between the stages of expansion. A high pressure (H.P.) and a low pressure (L.P.) turbine may be used together. A power plant that uses reheating operates on a steam cycle as shown in the diagram to generate electricity. The TS diagram represents the steam cycle in the system. Reheater Superheater. +(4) Boller +(3) +(5) H.P. Turbine LP. Turbine (6) Condensor- P₁ (2) (1) Feed pump P₁ P₂ kk III Pp 0 Rarrow_forwardGlassworks makes products for the sandblasting industry. One of the products they make is bags of high-grade sandblasting media that is made from a combination of quartz-sand and recycled ground-glass (cullet). Standard costs and quantities to produce one bag of sandblasting media are as follows: Quantity Cost Quartz-sand 20 kg $4.00 Cullet 5 kg $3.00 80,000 bags of sandblasting media were produced. Actual purchases and inventories were: Beginning Ending Purchases Purchases Inventory Inventory (in kg) ( in $) Quartz-sand 0 kg 0 kg 1,610,000 kg $322,161 Cullet 0 kg 120,000 kg 550,000 kg $286,000 Required: Calculate the following variances: a)Total direct material efficiency variance. b)Total direct material mix variance.…arrow_forwardPlease help me with show all calculation thankuarrow_forward

- Ashley Technology Inc. manufactures a scrambling device for cellular telephones. The device's main component is a delicate part, CT140. CT140 is easily damaged and requires careful handling. Once damaged, it must be discarded. The firm hires only skilled laborers to manufacture and install CT140; however, some are still damaged. Robotic instruments process all other parts. Ashley's operating data for 2 years are as follows: Units manufactured Number of CT140 used Number of direct labor hours spent Cost of CT140 per unit Direct labor wage rate per hour 2019 $ S 750,000 900,000 150,000 156 56 2018 1,000,000 1,050,000 200,000 $ 135 $ 62 Assume that fixed manufacturing costs are $50 million in both 2018 and 2019. Required: 1. Compute the total productivity ratios for 2018 and 2019.arrow_forwardCombat Fire, Inc. manufactures steel cylinders and nozzles for two models of fire extinguishers: (1) a home fire extinguisher and (2) a commercial fire extinguisher. The home model is a high-volume (54,000 units), half-gallon cylinder that holds 2 1/2 pounds of multi-purpose dry chemical at 480 PSI. The commercial model is a low-volume (10,200 units), two-gallon cylinder that holds 10 pounds of multi-purpose dry chemical at 390 PSI. Both products require 1.5 hours of direct labor for completion. Therefore, total annual direct labor hours are 96,300 or [1.5 hours × (54,000 + 10,200)]. Estimated annual manufacturing overhead is $ 1,585,316. Thus, the predetermined overhead rate is $ 16.46 or ($ 1,585,316 ÷ 96,300) per direct labor hour. The direct materials cost per unit is $18.50 for the home model and $26.50 for the commercial model. The direct labor cost is $19 per unit for both the home and the commercial models.The company’s managers identified six activity cost pools and related…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education