Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

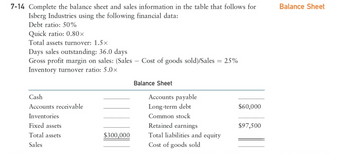

Transcribed Image Text:### Financial Data Completion Task

**Objective:**

Complete the balance sheet and sales information in the following table for Isberg Industries using the provided financial data.

**Provided Financial Data:**

- **Debt Ratio:** 50%

- **Quick Ratio:** 0.80×

- **Total Assets Turnover:** 1.5×

- **Days Sales Outstanding:** 36.0 days

- **Gross Profit Margin on Sales:** (Sales – Cost of Goods Sold)/Sales = 25%

- **Inventory Turnover Ratio:** 5.0×

---

### Balance Sheet

| **Assets** | **Amounts** | **Liabilities and Equity** | **Amounts** |

|------------------------------|-----------------|----------------------------------|--------------|

| Cash | _____________ | Accounts Payable | _____________|

| Accounts Receivable | _____________ | Long-Term Debt | $60,000 |

| Inventories | _____________ | Common Stock | _____________|

| Fixed Assets | _____________ | Retained Earnings | $97,500 |

| **Total Assets** | **$300,000** | **Total Liabilities and Equity** | _____________|

| Sales | _____________ | Cost of Goods Sold | _____________|

**Instructions:**

Utilize the given financial data to accurately complete the balances for various accounts. Make use of the provided ratios and financial metrics to solve for unknown variables.

**Notes on Ratios:**

- **Debt Ratio** is calculated as Total Debt divided by Total Assets.

- **Quick Ratio** measures a company’s ability to meet its short-term obligations with its most liquid assets.

- **Total Assets Turnover** is a measure of how efficiently a company uses its assets to generate sales.

- **Days Sales Outstanding (DSO)** is a measure of the average number of days that it takes a company to collect payment after a sale has been made.

- **Gross Profit Margin** reflects the percentage of sales that exceeds the cost of goods sold.

- **Inventory Turnover Ratio** indicates how many times inventory is sold and replaced over a period.

In completing this task, further calculations involving the manipulation of the above financial formulas will be necessary to derive accurate values for each entry.

**End of Task.**

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Selected XYZ financials (in dollars) 25,240,000 24,324,000 18,785,000 2,975,000 12,600,000 10,550,000 2,875,000 3,445,000 Gross income Total Sales Total Credit Sales, Net Income Cost of Goods Sold Total Assets Average Inventory Average Accounts receivable What is the inventory turover ratio for Firm XYZ. (round to 3 decimals)arrow_forwardRatio AnalysisPresented below are summary financial data from Porter’s annual report: Amounts in millions Balance Sheet Cash and Cash Equivalents $1,850 Marketable Securities 19,100 Accounts Receivable (net) 9,367 Total Current Assets 39,088 Total Assets 123,078 Current Liabilities 38,450 Long-Term Debt 7,279 Shareholders’ Equity 68,278 Income Statement Interest Expense 400 Net Income Before Taxes 14,007 Calculate the following ratios:(Round to 2 decimal points) a. Times-interest-earned ratio Answer b. Quick ratio Answer c. Current ratio Answerarrow_forwardCompare the Solvency, Liquidity and Profitability for the two companiesarrow_forward

- Excerpts from Sydner Corporation's most recent balance sheet appear below: Current assets: Cash Accounts receivable, net Inventory Prepaid expenses Total current assets Total current liabilities Year 2 Year 1 $ 140 $ 160 210 230 240 200 10 10 $ 600 $ 600 $360 $ 330 Sales on account in Year 2 amounted to $1,390 and the cost of goods sold was $900. The accounts receivable turnover for Year 2 is closest to:arrow_forwardComplete the balance sheet and sales information using the following financial data: Balance sheet Cash ________ Current liabilities _________ Accounts Receivable ________ Long-term debt 120,000 Inventories ________ Common stock _________ Total assets $600,000 Retained earnings 195,000 Total liabilities and equity _________ Sales ________ Cost of good sold ____40%sales__ Current ratio: 2.o X…arrow_forwardThe following ratios are available for agricultural chemical competitors Potash Corporation of Saskatchewan(PotashCorp) and Agrium from a recent year PotashCorp Agrium Liquidity Current Ratio 1.1:1 2.1:1 Acid-test 0.8:1 1.2:1 Receivables turnover 10.7 times 8.3 times Inventory turnover 6.8 times 4.1 times Oeprating cycle 88 days 133 days Solvency Debt to total assets 36.6% 26.9% Interest coverage 18.3 times 63.1 times Profitability Gross profit margin 49.20% 28.00% Profit margin 35.40% 9.80% Asset turnover 0.6 times 1.2 times Return on assets 19.40% 11.60% Return on equity 42.40% 25.90% a) Which company is more liquid? Explain your answer. b) Which company is more solvent? Explain your answer. c) Which company is…arrow_forward

- am.101.arrow_forwardComparative Balance SheetsConsider the following balance sheet data for Great Buy Co., Inc., an electronics and major appliance retailer (amounts in thousands): Current Year Previous Year Cash and Cash Equivalents $113,756 $12,848 Accounts Receivables 100,593 68,342 Merchandise Inventories 1,212,105 449,983 Other Current Assets 26,303 17,692 Total Current Assets 1,452,757 548,865 Property and Equipment (net) 328,175 227,596 Other Assets 28,804 13,993 Total Assets $1,809,736 $790,454 Current Liabilities $763,853 $334,809 Long-Term liabilities 454,141 127,537 Total Liabilities 1,217,994 462,346 Common Stock 3,965 2,068 Additional Paid-in-Capital 425,768 246,871 Retained Earnings 162,009 79,169 Total Stockholders' Equity 591,742 328,108 Total Liabilities and Stockholders' Equity $1,809,736 $790,454 Prepare a comparative balance sheet, showing increases in dollars and percentages. Note: Round "Percent Change" answers to one decimal place (ex:…arrow_forwardEMM, Inc. has the following balance sheet: EMM, Incorporated Balance Sheet as of 12/31/X0 Assets Liabilities and Equity Cash $ 1,200 Accounts payable $ 4,900 Accounts receivable 8,900 Bank note payable 7,700 Inventory 6,100 Long-term assets 4,400 Equity 8,000 $ 20,600 $ 20,600 It has estimated the following relationships between sales and the various assets and liabilities that vary with the level of sales: Accounts receivable = $3,560 + 0.35 Sales, Inventory = $2,356 + 0.28 Sales, Accounts payable = $1,449 + 0.20 Sales. If the firm expects sales of $27,000, what are the forecasted levels of the balance sheet items above? Round your answers to the nearest dollar. Accounts receivable: $ Inventory: $ Accounts payable: $ Will the expansion in accounts payable cover the expansion in inventory and accounts receivable? Round your answers to the nearest dollar. The expansion in accounts payable of $ the total…arrow_forward

- Vishnuarrow_forwardSelected data from the financial statements of Rags to Riches are provided below: Current Year Prior Year Accounts Receivable $120,000 $ 76,000 Inventory 24,000 32,000 Total Assets 900,000 760,000 Net Sales 760,000 540,000 Cost of Goods Sold 320,000 420,000 Which of the following would result from vertical analysis of the company's income statement? a. The accounts receivable turnover ratio is 7.76 in the current year. b. Gross profit is 57.9% of net sales for the current year. c. Net sales are 84.4% of total assets for the current year. d. Cost of goods sold decreased by $50,000 or 23.8% duringarrow_forwardFind the below: Cash ratio Inventory turnover EPS Total asset turnover Debt ratio Debt-to-equity ratio Times interest earned ROI Net profit margin ROE Market price/Book value P/E BALANCE SHEET ASSETS LIABILITIES & STOCKHOLDERS EQUITY Cash $ 1,500 Accounts payable $12,500 Marketable securities 2,500 Notes payable 12,500 Accounts receivable 15,000 Total current liabilities $25,000 Inventory 33,000 Long-term debt 22,000 Total current assets…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education