FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

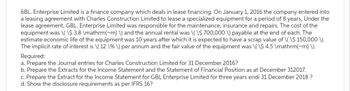

Transcribed Image Text:6BL. Enterprise Limited is a finance company which deals in lease financing. On January 1, 2016 the company entered into

a leasing agreement with Charles Construction Limited to lease a specialized equipment for a period of 8 years, Under the

lease agreement, GBL. Enterprise Limited was responsible for the maintenance, insurance and repairs. The cost of the

equipment was \(\$ 3.8 \mathrm{~m) \) and the annual rental was \(\$ 700,000 \) payable at the end of each. The

estimate economic life of the equipment was 10 years after which it is expected to have a scrap value of \(\$ 150,000 \).

The implicit rate of interest is \( 12 \%\) per annum and the fair value of the equipment was \(\$ 4.5 \mathrm{m} \).

Required:

a. Prepare the Journal entries for Charles Construction Limited for 31 December 2016?

b. Prepare the Extracts for the Income Statement and the Statement of Financial Position as at December 312017.

c. Prepare the Extract for the Income Statement for GBL Enterprise Limited for three years endi 31 December 2018 ?

d. Show the disclosure requirements as per IFRS 16?

SAVE

AI-Generated Solution

info

AI-generated content may present inaccurate or offensive content that does not represent bartleby’s views.

Unlock instant AI solutions

Tap the button

to generate a solution

to generate a solution

Click the button to generate

a solution

a solution

Knowledge Booster

Similar questions

- J4. Accountarrow_forwardBerkeley Inc. is engaged in manufacturing. For the procurement of machines, Berkeley Inc. uses the leasing method. On May 1, 2016, Berkeley Inc. entered into a lease contract with Mindy Corp. on a printing machine that costs Rp180,000,000 with the following agreement:- The lease period is 3 years, payments are made semi-annually with the first payment is November 1, 2016.- The lease payment per 6 months is Rp35,000,000,-.- Berkeley Inc. has the option to purchase the production machine at a price of Rp1,500,000,- at the end of the lease period- The economic life of the production machine is 5 years- The incremental borrowing rate is 15%- Mindy Corp's implicit interest rate is 12%, known to Berkeley Inc. Prepare the schedule of lease payment! (Use the following format)arrow_forwardUniversal Leasing leases electronic equipment to a variety of businesses. The company's primary service is providing alternate financing by acquiring equipment and leasing it to customers under long-term sales-type leases. ⚫ Universal earns interest under these arrangements at a 10% annual rate. • The company leased an electronic typesetting machine it purchased for $36,900 to a local publisher, Desktop Incorporated, on December 31, 2023. The lease contract specified annual payments of $8,353 beginning January 1, 2024, the beginning of the lease, and each December 31 through 2025 (three-year lease term). ⚫ The publisher had the option to purchase the machine on December 30, 2026, the end of the lease term, for $18,700 when it was expected to have a residual value of $22,700, a sufficient difference that exercise seems reasonably certain. Note: Use tables, Excel, or a financial calculator. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) Required: 1. Show how…arrow_forward

- me.1arrow_forwardFRM Ltd acquired an item of equipment and enters into a non -cancellable lease agreement with FEN Equipment LTd on 1January 2015. The lease consists of the following: Date of inception. 1/1/15 Duration of Lease 4 years Life of Leased asset. 5 years Lease payments (annual) $550000(annual) which includes $80000 for Maintenance and insurance costs per annum Guaranteed residual value (Added to final payment). $190000 Interest rate. 7% Formula for PV of $1/(1+k)n Formula for present value of annuity of $1 per period for n periods= 1-1/(1+k)n /k Where k is the discount rate expressed in decimal Required 1. Determine the PV of minimum lease rental payment. 2. Prepare the journal entries for FRM Ltd (The lessee) using the Net method for the following a) Transfer of control b) Payment of annual payments for 2015 and 2016.arrow_forwardChad Ltd negotiated a lease on the following terms: the term of the lease was 5 years; the estimated useful life of theleased equipment was 10 years; the purchase price was R60 000; and the annual lease payment was R5 000. This leaseshould be classified as_____.Select one:a.a financial leaseb.An operating leasec.neither operating nor finance leased.A finance leasearrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education