FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Hi kindly help me with these

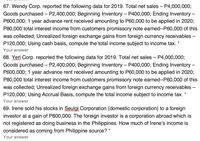

Transcribed Image Text:67. Wendy Corp. reported the following data for 2019. Total net sales – P4,000,000;

Goods purchased – P2,400,000; Beginning Inventory – P400,000; Ending Inventory –

P600,000; 1 year advance rent received amounting to P60,000 to be applied in 2020;

P80,000 total interest income from customers promissory note earned-P60,000 of this

was collected; Unrealized foreign exchange gains from foreign currency receivables –

P120,000; Using cash basis, compute the total income subject to income tax.

Your answer

68. Yeri Corp. reported the following data for 2019. Total net sales – P4,000,000;

Goods purchased – P2,400,000; Beginning Inventory – P400,000; Ending Inventory –

P600,000; 1 year advance rent received amounting to P60,000 to be applied in 2020;

P80,000 total interest income from customers promissory note earned--P60,000 of this

was collected; Unrealized foreign exchange gains from foreign currency receivables –

P120,000; Using Accrual Basis, compute the total income subject to income tax. *

Your answer

69. Irene sold his stocks in Seulgi Corporation (domestic corporation) to a foreign

investor at a gain of P800,000. The foreign investor is a corporation abroad which is

not registered as doing business in the Philippines. How much of Irene's income is

considered as coming from Philippine source? *

Your answer

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- It is talking about Hong Kong Tax, Special Business, Profit Tax Computation of Financial instituition, please explain what is DIPN 21 and its related two concepts, "Initiation" and "funding" with example.arrow_forwardUsing all the concepts discussed In this class, develop/create a tax system that can be used by a developed country to maximize its tax revenues. Why you believe this tax system is more appropriate than others?arrow_forwardDetermine if true or false.arrow_forward

- Calculation of Foreign Tax Credit (here is the answer for A&F. You need to complete Basket B&D and Basket Earrow_forward1. Internet users can go to http://www.irs.gov/ and: a.Use a search function to find forms and publications. b.Find links to other useful IRS pages. c.Download tax forms and publications. d.All of these choices are correct. 2. Electronically filed tax returns: a.Have error rates similar to paper returns. b.Offer faster refunds than paper returns. c.May not be transmitted from a taxpayer's home computer. d.Constitute less than 50 percent of the returns filed with the IRS. 3. John, age 25, is a full-time student at a state university. John lives with his unmarried sister, Ann, who provides over half of his support. His only income is $4,400 of wages from a part-time job at the college book store. What is Ann's filing status for 2021? a.Married, filing separately b.Head of household c.Qualifying widow(er) d.Single e.None of these choices are correct.arrow_forwardLevy means use authority to demand and collect a payment," especially a tax. Discuss four things taxes are levied on where you live.arrow_forward

- m1. Subject Accountingarrow_forwardAdvances in information technology and the development of programs like TurboTax, which guides people through their tax filing, have... Group of answer choices Raise the demand for tax preparers Lowered the demand for tax preparers Increase the wages for tax preparers Increased the supply of tax preparersarrow_forwardHow does scholarships received & gifts and inheritances work in taxation? Also, what is section 529 plans? Lastly, what is life insurance proceeds in accounting?arrow_forward

- Question Content AreaKrista is a CPA who helps her clients minimize their overall tax liability. What function is she performing? a. Tax evasion b. Tax planning c. Tax deferral d. Tax preparationarrow_forwardIf a person wins the state lottery, is it better to receive a lump sum payment or payments over time?arrow_forwardA tax preparer has a client tht recently asked him about the probability ofthe IRS detecting cash transactions not reported on tax return. What are some of the issues the tax preparer should discuss with this client?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education