FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:6:20 1

8 expert.chegg.com/qna/aut

Chegg Home Expert Q&A

Student question

My solutions

Time Left: 01:56:48

Vo #5G

LTE

158%

Guide Me

8

Notifications

Tag the question Step-by-step Final solution

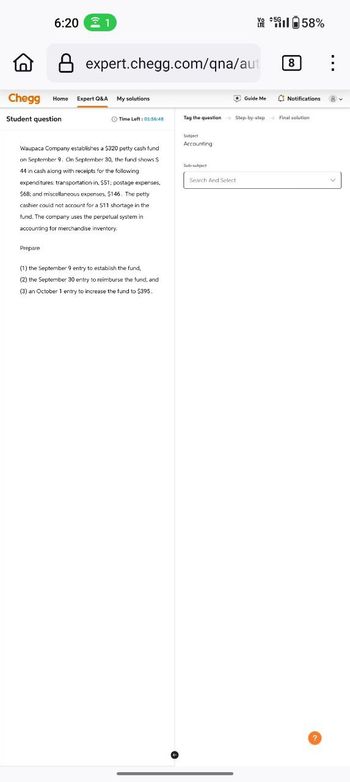

Waupaca Company establishes a $320 petty cash fund

on September 9. On September 30, the fund shows $

44 in cash along with receipts for the following

expenditures: transportation-in, $51; postage expenses,

$68; and miscellaneous expenses, $146. The petty

cashier could not account for a $11 shortage in the

fund. The company uses the perpetual system in

accounting for merchandise inventory.

Prepare

(1) the September 9 entry to establish the fund,

(2) the September 30 entry to reimburse the fund, and

(3) an October 1 entry to increase the fund to $395.

Subject

Accounting

Sub-subject

Search And Select

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- C Record the following transactions. Mar 5 Established a Petty Cash Fund amounting to P4,000 Mar 6-25 Paid for the following Mar Food for the visitors Flowers for Gen Manager Parking Fees and Toll gate fees IOU of employee Office supplies 26 Replenished Petty Cash P Cash on hand totalled P150.00 27 Increased PCF by P2,250 Mar Mar 28-31 Paid for the following Maynilad Office supplies 1,199.00 750.00 201.50 1,000.00 723.00 850.00 425.00 April 1-22 Paid for the following Office supplies Repair of equipment IOU of employee April 2,122.00 1,250.00 1,500.00 23 Replenished petty cash fund Cash on hand totalled P100.00arrow_forwardPetty Cash Record and Journal Entries On May 1, a petty cash fund was established for $200.00. The following vouchers were issued during May: Date Voucher No. Purpose Amount May 1 Postage due 2$ 2.90 Office supplies 11.00 5 Auto repair (miscellaneous) 43.00 4. Drawing (Joy Adams) 22.00 11 Donation (Red Cross) 11.00 15 6. Travel expenses 26.00 22 Postage stamps 3.40 26 8. Phone call 3.00 30 9. Donation (Boy Scouts) 21.00 Required: 1. Prepare the journal entry to establish the petty cash fund. Page: DOC. POST. DATE ACCOUNT TITLE DEBIT CREDIT NO. REF. 38 1 20-- May 1 21 Establish petty cash fund 4.arrow_forwardPROBLEM 1. 4111 Company had the following items in its "Cash and cash equivalents" account as of December 31, 2022: Cash on hand P125,000Bank time deposit (acquired 12/30/2022; due in 2/28/2023) 150,000Petty cash fund - including P2,550 unreplenished vouchers dated December 27-30, 2022; and P1,200 dated January 4, 2023 10,000Cash in foreign bank - unrestricted ($5,000; average rate - P50; closing rate - P52) 250,000Cash restricted for additions to plant (to be disbursed in 2025) 1,200,000Cash in bank - to be used for payment of 2023 dividends and taxes 1,380,000 How much should be reported as cash and cash equivalents as of December 31, 2022? a. P1,875,450 b. P1,922,450 c. P1,921,250 d. P1,944,250 PROBLEM 2. The following data were taken from the accounting records of 423, Inc Balance at January 1, 2022 5,000 balls @ P20Purchases:…arrow_forward

- saarrow_forwardQuestion attached to screenshot thanks for the help appreciated z zfdfd w3t22arrow_forward← Lorena's Dance Studio created a $270 imprest petty cash fund. During the month, the fund custodian authorized and signed petty cash tickets as follows: (Click the icon to view the petty cash tickets.) Data table Petty Cash Ticket No. Ticket No. 1 Ticket No. 2 Ticket No. 3 Ticket No. 4 Ticket No. 5 Account Debited Delivery of programs to customers Delivery Expense Mail package Postage Expense Printing Expense Miscellaneous Expense Office Supplies Item Newsletter Key to closet Copier paper Amount $ 30 15 35 50 75 Requirements 1. Make the general journal entry to create the petty cash fund. Include an explanation. 2. Make the general journal entry to record the petty cash fund replenishment. Cash in the fund totals $50. Include an explanation. 3. Assume that Lorena's Dance Studio decides to decrease the petty cash fund to $130. Make the general journal entry to record this decrease.arrow_forward

- Petty Cash Fund Chart of Accounts: Cash 11 Petty Cash Fund Accounts Payable Sue Bird, Capital Sue Bird, Drawing Ashley Robinson, Capital Ashley Robinson, Drawing Income from Services 112 Exercise 1 221 311 312 313 314 On May 1 of this year, Start With Urself Clinic established a Petty Cash Fund. The following petty cash transactions took place during the month: 411 Office Supplies Expense Delivery Expense Miscellaneous Expense 511 512 513 Directions: 1. Record the disbursements of petty cash in the petty cash payments record, starting with page 6. Cashed check no. 8784 for $150.00 to establish petty cash fund and put the $150.00 in a locked drawer in the office. 20XX 1 May Bought postage stamps $13.60, voucher #5 (Miscellaneous Expense) 4 Issued voucher for taxi fare $25.50, voucher #6 Issued voucher 7 for delivery of props to WNBA Delivery Service, $13.50. 9. S. Bird withdrew $30.00 for personal use, voucher #8. 11 Bought balloons for show $15.75, voucher #9 (Office Supplies) 14…arrow_forwardOn March 20 whispering winds petty cash funds of $113 is replenished with the fine contains $10 in cash and receipts for postage $50 supplies $14 in travel Smith $39 prepare the injury to record the replenishment of the petty cash fundarrow_forwardPlease answer this accounting question correctlyarrow_forward

- Please solve the project 5 question .arrow_forwardurrent Attempt in Progress Nancy's Cabinet Design established a petty cash fund on April 1, 2024, to facilitate the payment of small items. The following petty cash transactions were noted by the petty cash custodian during the month of April 2024: Apr. 1 10 15 Received cash of $205 to establish the petty cash fund. The petty cash fund was replenished when there was $80 on hand and the following receipts: a) $32 for supplies b) $52 for freight in charges c) $27 for postage The petty cash fund was increased to $246arrow_forwardRequired information Problem 6-24A (Algo) Petty cash fund LO 6-4 [The following information applies to the questions displayed below.) Austin Company established a petty cash fund by issuing a check for $286 and appointing Steve Mack as petty cash custodian. Mack had vouchers for the following petty cash payments during the month. Stamps Miscellaneous items Employee supper money Taxi fare Window-washing service $50 24 65 45 81 There was $20 of currency in the petty cash box at the time it was replenished. The four distinct accounting events affecting the petty cash fund for the period were (1) establishment of the fund, (2) reimbursements made to employees, (3) recognition of expenses, and (4) replenishment of the fund. Assume the company uses a traditional approach to petty cash expense recognition and replenishment.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education