Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

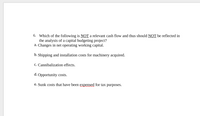

Transcribed Image Text:6. Which of the following is NOT a relevant cash flow and thus should NOT be reflected in

the analysis of a capital budgeting project?

a. Changes in net operating working capital.

b. Shipping and installation costs for machinery acquired.

c. Cannibalization effects.

d. Opportunity costs.

e. Sunk costs that have been expensed for tax purposes.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- A decrease in accounts payable constitutes a/an _________ in net working capital and is considered a/an __________ to a project. Select one: a. increase; cash inflow b. increase; cash outflow c. decrease; cash inflow d. decrease; cash outflow e. increase; opportunity costarrow_forwardWhich of the following best describes the process of capital budgeting? a Forecasting revenues and expenses hmiting funds for capital improvements without considering the profitability of proposed prot determining a companys short term goals d. determinung the amount to spend on fixed assets and which fixed assets to purchasearrow_forwardIdentify “relevant” cash flows that should and should not be included in a capital budgeting analysis.arrow_forward

- Which of the following statements is FALSE? A. When evaluating a capital budgeting decision, we generally include interest expense. B. Only include as incremental expenses in your capital budgeting analysis the additional overhead expenses that arise because of the decision to take on the project. C. Many projects use a resource that the company already owns. O D. As a practical matter, to derive the forecasted cash flows of a project, financial managers often begin by forecasting earnings.arrow_forwardThe weighted average cost of capital is used to determine whether or not a project should be done. true falsearrow_forwardIn capital budgeting decisions, are there reasons a company might choose to take a project that was NPV negative? Explain.arrow_forward

- Nonearrow_forwardHi, number 3 still appears to be unanswered for this problem. How do you determine relevant cash flow (after-tax) at project disposal (termination)?arrow_forward13.Concerning incremental project cash flow, this is a cost one would never count as a cash flow of the project. A. taxes paid B. financing costs C. initial investment D. operating expenses of the projectarrow_forward

- Why is it important to consider the cost of long-term capital expenditures when they reside on the balance sheet?arrow_forwardUse an example to explain to show why capital budgeting relies on cash flows rather than net income?arrow_forwardWhat are three variables that the firm does not control when it seeks to raise funds; indicate the impact of the costs.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education