Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

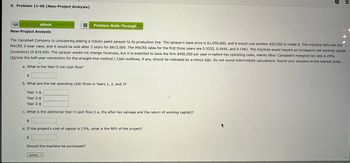

Transcribed Image Text:6. Problem 11-06 (New-Project Analysis)

eBook

New-Project Analysis

Problem Walk-Through

The Campbell Company is considering adding a robotic paint sprayer to its production line. The sprayer's base price is $1,050,000, and it would cost another $20,500 to install it. The machine falls into the

MACRS 3-year class, and it would be sold after 3 years for $613,000. The MACRS rates for the first three years are 0.3333, 0.4445, and 0.1481. The machine would require an increase in net working capital

(inventory) of $19,000. The sprayer would not change revenues, but it is expected to save the firm $400,000 per year in before-tax operating costs, mainly labor. Campbell's marginal tax rate is 25%.

(Ignore the half-year convention for the straight-line method.) Cash outflows, if any, should be indicated by a minus sign. Do not round intermediate calculations. Round your answers to the nearest dollar.

a. What is the Year-0 net cash flow?

b. What are the net operating cash flows in Years 1, 2, and 3?

Year 1:$

Year 2:$

Year 3:$

c. What is the additional Year-3 cash flow (i.e, the after-tax salvage and the return of working capital)?

$

d. If the project's cost of capital is 13%, what is the NPV of the project?

Should the machine be purchased?

-Select-

SAVE

AI-Generated Solution

info

AI-generated content may present inaccurate or offensive content that does not represent bartleby’s views.

Unlock instant AI solutions

Tap the button

to generate a solution

to generate a solution

Click the button to generate

a solution

a solution

Knowledge Booster

Similar questions

- Explansion Project: ABC is planning to buy a new heavy duty printing machine. You were hired to assist KFUPM on this decision. So you gathered the following information. The new machine has a life of 3 years. New Machine: Life of machine: 3 years The cost of the new machine is SAR 1,134 The machine will increase the gross profit every year by SAR 314 The market value of the machine when sold at the end of its life is SAR 191 If replaced, then the net working capital (NOWC) will increase every year by SAR 22 ABC will recover all investments in working capital at the end of the new machine's life (after 3 years). WACC is 9.49% Tax rate is 40% ABC uses straight-line Depreciation. Calculate the follwoing: Notes: 1. Use 2 Decimalsarrow_forward5arrow_forwardNew-Project Analysis The president of MorChuck Enterprises has asked you to evaluate the proposed acquisition of a new chromatograph for the firm’s R&D department. The equipment’s basic price is $70,000, and it would cost another $15,000 to modify it for special use by your firm. The chromatograph, which falls into the MACRS 3-year class, would be sold after 3 years for $30,000. The MACRS rates for the first three years are 0.3333, 0.4445, and 0.1481. Use of the equipment would require an increase in net working capital (spare parts inventory) of $4,000. The machine would have no effect on revenues, but it is expected to save the firm $25,000 per year in before-tax operating costs, mainly labor. The firm’s marginal federal-plus-state tax rate is 25%. a. What is the Year-0 cash flow? b. What are the project recurring cash flows in Years 1, 2, and 3? c. What is the additional (non operating) cash flow in Year 3? d. If the project’s cost of capital is 10%, should the…arrow_forward

- pm.3arrow_forwardNew-Project Analysis The Campbell Company is considering adding a robotic paint sprayer to its production line. The sprayer's base price is $850,000, and it would cost another $23,500 to install it. The machine falls into the MACRS 3-year class, and it would be sold after 3 years for $568,000. The MACRS rates for the first three years are 0.3333, 0.4445, and 0.1481. The machine would require an increase in networking capital (inventory) of $14,500. The sprayer would not change revenues, but it is expected to save the firm $368,000 per year in before-tax operating costs, mainly labor. Campbell's marginal tax rate is 25%. (Ignore the half-year convention for the straight-line method.) Cash outflows, if any, should be indicated by a minus sign. Do not round intermediate calculations. Round your answers to the nearest dollar. What is the Year-0 net cash flow? $ What are the net operating cash flows in Years 1, 2, and 3? Year 1: $ Year 2: $ Year 3: $ What is…arrow_forwardPlease dont provide solution image based thanxarrow_forward

- New-Project Analysis The president of your company, MorChuck Enterprises, has asked you to evaluate the proposed acquisition of a new chromatograph for the firm's R&D department. The equipment's basic price is $63,000, and it would cost another $19,500 to modify it for special use by your firm. The chromatograph, which falls into the MACRS 3-year class, would be sold after 3 years for $26,800. The MACRS rates for the first three years are 0.3333, 0.4445 and 0.1481. (Ignore the half-year convention for the straight-line method.) Use of the equipment would require an increase in net working capital (spare parts inventory) of $2,320. The machine would have no effect on revenues, but it is expected to save the firm $19,960 per year in before-tax operating costs, mainly labor. The firm's marginal federal-plus-state tax rate is 25%. Cash outflows and negative NPV value, if any, should be indicated by a minus sign. Do not round intermediate calculations. Round your answers to the nearest…arrow_forwardNew-Project Analysis The Campbell Company is considering adding a robotic paint sprayer to its production line. The sprayer's base price is $1,030,000, and it would cost another $18,500 to install it. The machine falls into the MACRS 3-year class, and it would be sold after 3 years for $537,000. The MACRS rates for the first three years are 0.3333, 0.4445, and 0.1481. The machine would require an increase in net working capital (inventory) of $20,000. The sprayer would not change revenues, but it is expected to save the firm $377,000 per year in before-tax operating costs, mainly labor. Campbell's marginal tax rate is 25%. (Ignore the half-year convention for the straight-line method.) Cash outflows, if any, should be indicated by a minus sign. Do not round intermediate calculations. Round your answers to the nearest dollar. What is the Year-0 net cash flow? $ What are the net operating cash flows in Years 1, 2, and 3? Year 1: $ Year 2: $ Year 3: $ What is…arrow_forwardshj.3arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education