FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

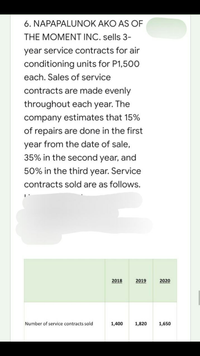

Transcribed Image Text:6. NAPAPALUNOK AKO AS OF

THE MOMENT INC. sells 3-

year service contracts for air

conditioning units for P1,500

each. Sales of service

contracts are made evenly

throughout each year. The

company estimates that 15%

of repairs are done in the first

year from the date of sale,

35% in the second year, and

50% in the third year. Service

contracts sold are as follows.

2018

2019

2020

Number of service contracts sold

1,400

1,820

1,650

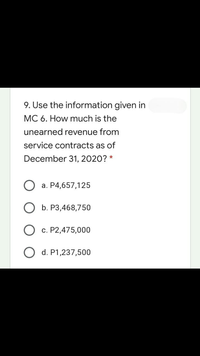

Transcribed Image Text:9. Use the information given in

MC 6. How much is the

unearned revenue from

service contracts as of

December 31, 2020? *

a. P4,657,125

b. P3,468,750

c. P2,475,000

O d. P1,237,500

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- A company enters into a contract with a customer to build a building, with a performance bonus of $33,500 if the building is completed by September 30, 2021. The bonus is reduced by $5,000 each week that completion is delayed. The company commonly includes these completion bonuses in its contracts and, based on prior experience, estimates the following completion outcomes: Completed by ProbabilitySeptember 30, 2021 70%October 7, 2021 15%October 14, 2021 10%October 21, 2021 5%The amount of revenue the company should recognize related to this bonus is $_______________.arrow_forward57arrow_forwardAllocating Transaction Price to Performance Obligations and Recording Sales Value Dealership Inc. markets and sells the vehicles to retail customers. Along with a new vehicle purchase, a customer will receive a free annual maintenance contract for one year from the date of purchase. The standalone selling price of a vehicle is $30,000 and the standalone selling price for the annual maintenance contract is $400. During October 2020, Value Dealership Inc. sold 30 vehicles for $30,250 per vehicle, each with a free annual maintenance contract. When answering the following questions: Round each allocated transaction price to the nearest dollar. If a journal entry (or a line of the journal entry) isn't required for the transaction, select "N/A" as the account name and leave the Dr. and Cr. answers blank (zero). a. Ignoring the cost entries, record the journal entry in October 2020 for Value Dealership’s sale of vehicles with the associated maintenance contracts to customers.…arrow_forward

- 4. Bonita.com sells 6800 units of its product for $460 each. The selling price includes a one- year warranty on parts. It is expected that 3% of the units will be defective and that repair costs will average $40 per unit. In the year of sale, warranty contracts are honored on 120 units for a total cost of $4800. What amount should Bonita.com accrue on December 31 for estimated warranty costs? Select answer from the options below a. $8160 b. $32640 c. $ 4800 d. $3360arrow_forwardProblem 9. At December 31, 2021, Cactus Co. had 10,000 gift certificates outstanding which had been sold to customers during 2021 for P100 each. Cactus operates on a gross margin of 60% of its sales. What amount of revenue pertaining to the 10,000 outstanding gift certificates should be deferred at December 31, 2021?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education